The ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA) is a smart beta ETF that, despite only holding 21 securities, is more diversified than the broader Nasdaq-100, according to Todd Rosenbluth, Head of ETF and Mutual Fund Research for CFRA.

The Nasdaq-100 Index tracks the largest domestic and international non-financial mega-cap growth stocks of the tech-heavy Nasdaq. It serves as the benchmark for the Invesco QQQ Trust (QQQ), one of the most widely traded ETFs in the world.

QQQA, meanwhile, utilizes a momentum strategy to select top-performers within the Nasdaq-100 Index.

To build the portfolio, Dorsey Wright, a leader in momentum investing, uses a “relative strength” signal to select the top 21 companies within the Nasdaq-100 based on their highest price momentum at the time of rebalance.

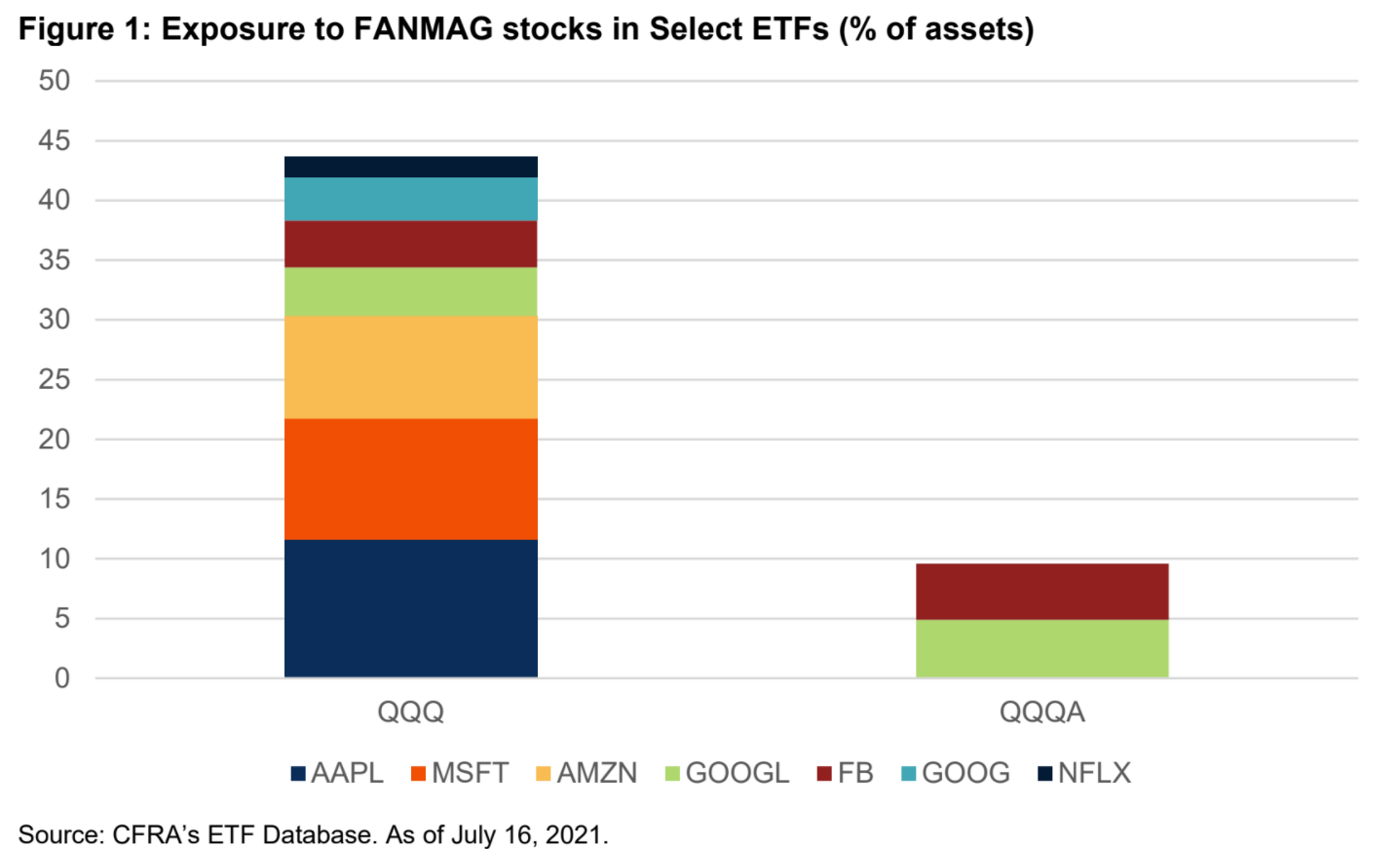

Unlike the cap-weighted QQQ, QQQA is equal-weighted, and that makes all the difference. As of its most recent quarterly rebalance, QQQA’s contains only part of the FANMAG companies: tts positions in Facebook (FB) and Alphabet (GOOGL) together total 9.6% of the assets within the fund.

In comparison, QQQ contains all six of the major FANMAG players, which compromise 44% of that fund’s holdings.

As of its July rebalance, QQQA had a more diversified spread across sectors than QQQ and other ETFs like the iShares MSCI USA Momentum Factor ETF (MTUM).

“By fishing within the Nasdaq-100 universe, QQQA’s maintained a hefty stake in information technology,” Rosenbluth stated.

Whereas MTUM rebalanced in May and reduced its allocation to information technology stocks, QQQA maintained its focus on growth companies. Currently, the fund has a 42% allocation in information technology.

In addition, by adding positions in Biogen (BIIB), Illumina (ILMN), and Moderna (MRNA), the fund now holds a 25% allocation in healthcare – ideal timing as it happens, as fears of Delta and other Covid variants have investors once again looking for opportunities in the sector.

QQQA has an expense ratio of 0.58%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.