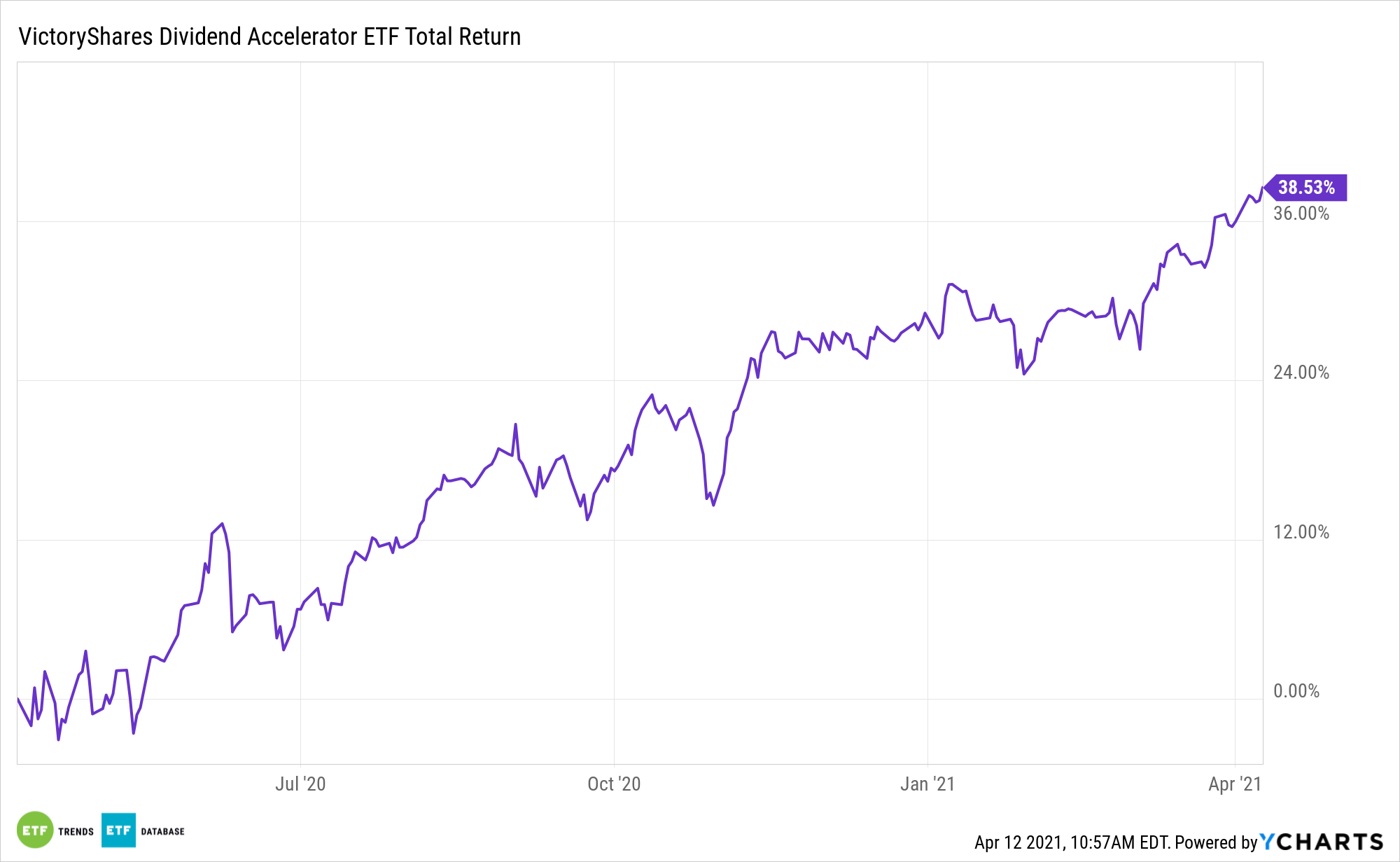

Dividend growth is once again on an impressive trajectory. That’s the good news, but it also means advisors should be selective with their payout growth strategies. The VictoryShares Dividend Accelerator ETF (VSDA) is one way of embracing a higher level of dividend selectivity.

VSDA launched in April 2017 and follows the Nasdaq Victory Dividend Accelerator Index (NQVDIV), which Victory Capital developed in partnership with Nasdaq. What makes VSDA unique is that it focuses on more than a company’s previous dividend track record.

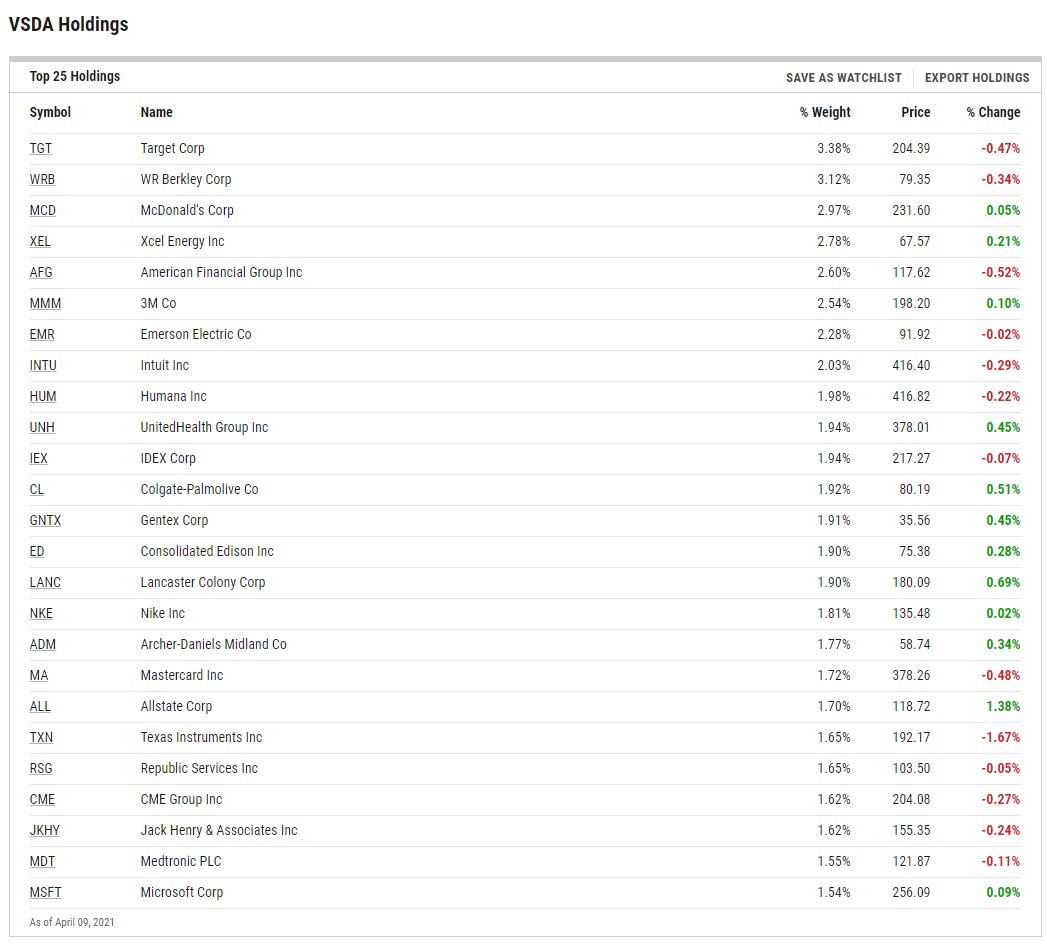

“The Nasdaq Victory Dividend Accelerator Index seeks to create a diversified portfolio of securities which are forecasted to grow dividends. The Index selects 75 securities from the Nasdaq US Large Mid Cap Index based on factors such as dividend growth, liquidity and other financial metrics,” according to Nasdaq.

Dividend Growth as an Inflation-Fighting Tool

Dividend growth not only fosters added income and returns, but can also act as an inflation-fighting tool. Since the early 1970s, when inflation ran as high as 11% per year, aggregate annual dividends of the S&P 500 have grown.

Dividend growth as a means of trumping inflation could and arguably should serve to highlight the advantages of the ETFs that focus on dividend growth stocks. That group is comprised of well-established ETFs that emphasize dividend increase streaks as well as unique funds that look for sectors chock-full of stocks that have the potential to be future sources of dividend growth.

“By nature, dividend investing is a long-term concept. To that end, growth is paramount and it’s vital to both younger investors looking to harness the power of compounding and older investors nearing or in retirement that are looking to avoid negative dividend action that damages income streams,” according to Nasdaq. “On a related note, many of last year’s dividend offenders are resuming payouts – another sign of growth that supports the case for VSDA.”

Another perk of VSDA is its compelling sector composition.

“The VictoryShares fund allocates just 5.40% of its combined weight to utilities, energy and real estate names – the latter of two of which were egregious payout offenders in 2020,” notes Nasdaq. “On the other hand, VSDA’s second-largest sector allocation is 16.32% to financial services – a sector poised for significant payout growth in the back half of this year as the Federal Reserve removes dividend handcuffs from banks.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.