By eVestment, a Nasdaq Company

Net institutional flow for non-cash strategies was positive in the first quarter of 2021, ending a nearly three year stretch of net outflows, according to the latest Nasdaq Institutional Intelligence Quarterly Report.

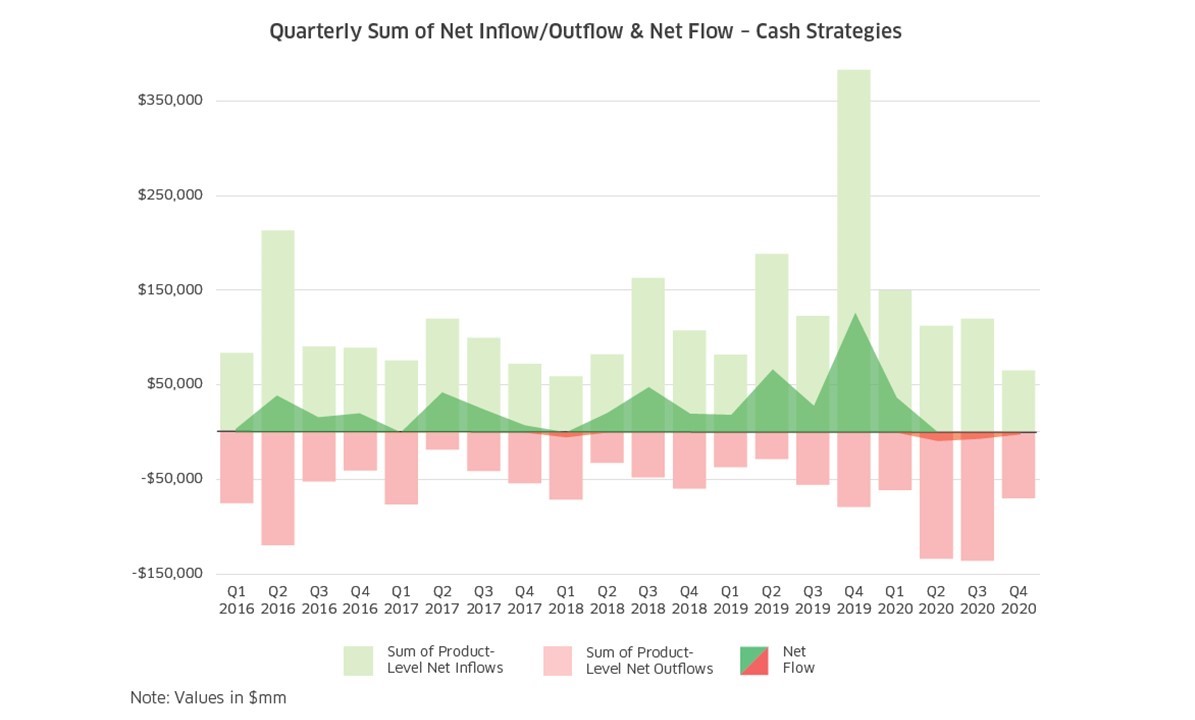

Assets appeared to be coming out of cash management strategies (net), a reversal of a significant medium-term theme. Net flows for cash management strategies were negative in Q1, for the third consecutive quarter.

The net institutional flow of assets for traditional strategies had been trending in a favorable direction prior to Q1 2021, becoming increasingly less negative over the three quarters prior to Q1 2021.

Given the trend in the data, it isn’t a surprise to see net inflows across traditional non-cash strategies in Q1, but it is still significant. Not only was it the first net inflow since Q1 2018, it is also the largest net inflow of institutional assets into non-cash strategies since at least 2005.

With institutional investors like pension funds, endowments, foundations, and sovereign wealth funds collectively making billion- and trillion-dollar investments that can move markets, knowing the investments these big investors and their consultants are reviewing can be insightful for financial advisors. While there are no guarantees in investing, knowing that institutional investment trends often precede retail investment trends can provide early insight that could be invaluable to advisors.

The Nasdaq Institutional Intelligence Quarterly Report, based on data from Nasdaq’s institutional investment and intelligence platform eVestment, can provide that early insight. The report delivers a global and regional look at the drivers of institutional investment trends in the asset management community, based on data provided by thousands of asset managers around the world, reporting on more than 26,000 active institutional investment strategies and representing more than $39 trillion in institutional investor assets.

Other highlights from the new report include:

- There was a rebound of interest in US Passive Equity in Q1 2021 and strong net demand for US Core and Short Duration Fixed Income, active and passive approaches for both categories. Net outflows were concentrated in US Large Cap Equity, but also appeared in Global Core Equity and in a few US and Global Fixed Income segments.

- Consultants around the world, primarily outside the US, showed large or highly increased interest in Global Core and Emerging Markets Core Equity strategies, while asset owners in the US and Canada showed large and increased interest to Global EM All Cap Equity strategies.

- While asset owners in EMEA and APAC shared similar interests in Global Large and All Cap Equity strategies, there were large amounts of interest in Global EM Fixed Income from within Germany, Saudi Arabia, and Singapore.

- There were three Emerging Markets universes among the five most positively trending in Q1 2021, with two of them being EM Fixed Income strategies. The largest influences for these products appear to be coming from the Middle East.

The Nasdaq Institutional Intelligence Quarterly Report highlights these and many more trends in easy-to-understand graphs, charts, and bullets and offers financial advisors a look today into trends that will could shape the investment landscape tomorrow.

To download a copy of the report, please click here. To watch the Nasdaq/eVestment quarterly trends briefing that also highlights some of these trends, please click here.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.