Marriott International Inc. recently released its yearly ESG report, the 2021 Serve 360 Report, which details and catalogues efforts made in 2020 towards environmentalism, social engagement, and governance policies that support diversity from within.

2020 was a difficult year with the pandemic forcing most companies to have to pivot policies and practices in a rapidly changing economy. The travel industry was hit particularly hard, with hotels often having to shutter their business or drastically reduce operations.

Despite the adversity it faced, Marriott was not only able to continue along the sustainability goals it had already laid out, but it also responded to the pandemic in a way that highlighted the importance of social engagement to the company.

“Around the world, our hotels donated food, cleaning supplies, and other essential items to frontline workers and local families and community groups in need,” said CEO Anthony Capuano in the report. “On the corporate level, together with American Express and JPMorgan Chase, Marriott committed to provide $10 million worth of free hotel stays to frontline healthcare workers.”

Additionally, Marriott donated event space to the American Red Cross and held almost 500 blood drives, contributing 14,000 units of blood, and was a top corporate blood drive sponsor.

“It is true that we are a global company – but we should never lose sight of the fact that each of our more than 7,600 properties and the amazing associates who execute our service culture are a part of their local communities and, each and every day, they are doing their part to serve our world,” said Capuano.

QQQA Invests in Top Performers, Including Marriott

Despite unprecedented challenges and difficulties, Marriott continues to forge a way forward in the midst of the pandemic, demonstrating strong social engagement and defined ESG leadership that allowed for continuing success for the company on all fronts.

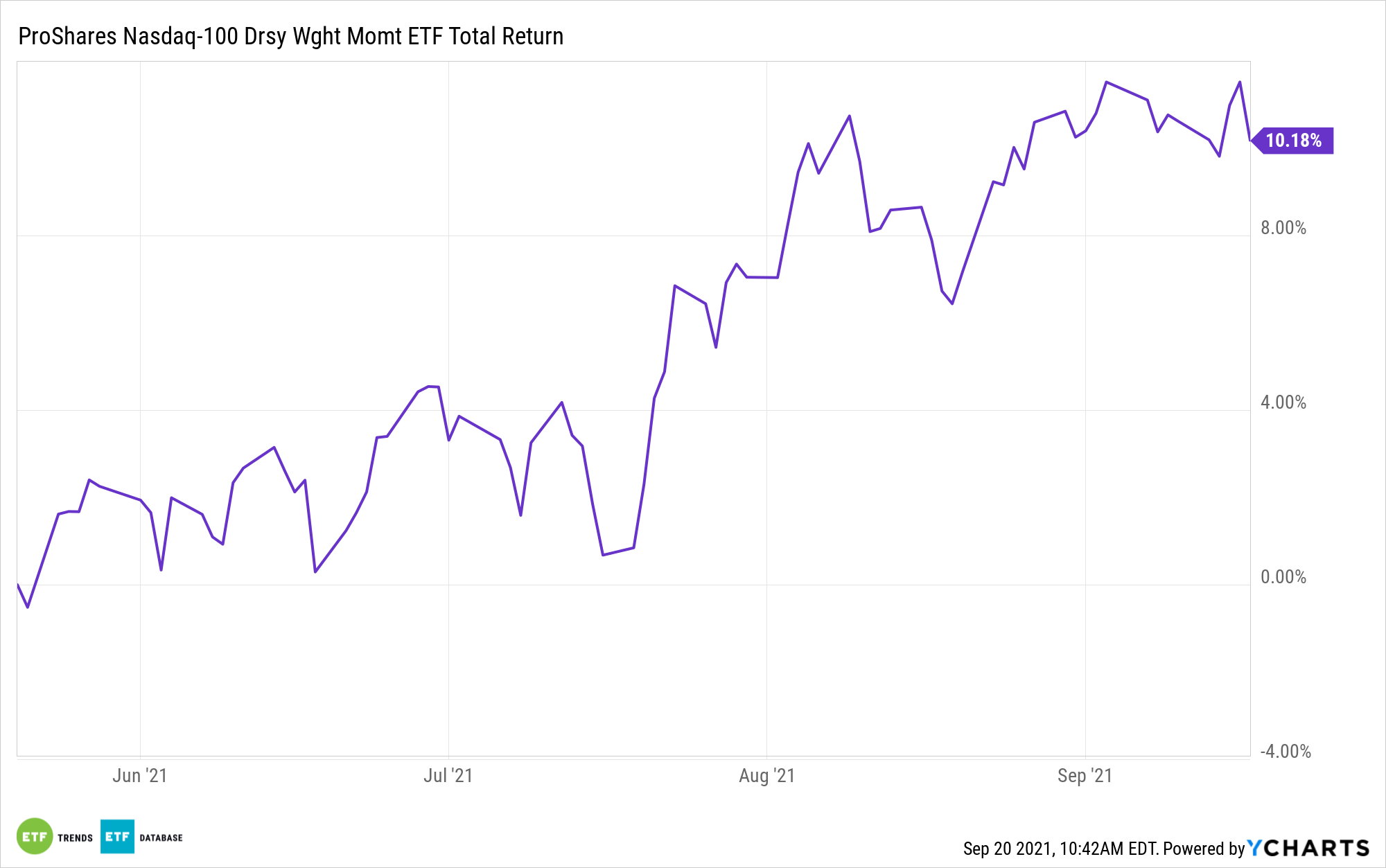

The ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA) is a smart beta ETF that, despite only holding 21 securities, is more diversified than the broader Nasdaq-100, according to Todd Rosenbluth, head of ETF and Mutual Fund Research for CFRA.

The Nasdaq-100 Index tracks the largest domestic and international non-financial mega-cap growth stocks of the tech-heavy Nasdaq. It serves as the benchmark for the Invesco QQQ Trust (QQQ), one of the most widely traded ETFs in the world.

QQQA, meanwhile, utilizes a momentum strategy to select top performers within the Nasdaq-100 Index.

To build the portfolio, Dorsey Wright, a leader in momentum investing, uses a “relative strength” signal to select the top 21 companies within the Nasdaq-100 based on their highest price momentum at the time of rebalance.

Unlike the cap-weighted QQQ, QQQA is equal-weighted. Collectively, the fund now has a 42.58% allocation to information technology, a 25.54% allocation to healthcare, and a 14.18% allocation to communication services.

Marriott International, Inc. (MAR) has a 4.45% weighting in QQQA.

QQQA has an expense ratio of 0.58% and carries 21 holdings.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.