The Federal Reserve released its post-meeting notes today in a press release, announcing that it would be scaling back on the bond purchases it began at the onset of the COVID-19 pandemic. To many investors’ relief, the Fed also reinforced its stance that the inflation being experienced is a transitory one, and markets responded in kind.

The S&P 500 was up 0.5% in a new intraday record, with the Nasdaq Composite rising 0.8% in its own intraday high and the Dow Jones Industrial Average gaining 85 points in an intraday record, reported CNBC.

The Fed’s analysis regarding inflation is that it has been exacerbated by pandemic-related complications, such as supply chain issues and the supply and demand created because of the pandemic specifically. These factors have caused inflation to be felt overwhelmingly in some sectors, but the Fed believes the overall economy to be supported. As long as vaccinations continue and there is policy support, it anticipates that these issues will subside.

“Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors,” the Fed wrote in the press release.

The Fed acknowledged that there is still economic risk and that it will be keeping a close eye on inflation and the factors feeding into it.

“Our decision today to begin tapering our asset purchases does not imply any direct signal regarding our interest rate policy. We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate,” Federal Reserve Chairman Jerome Powell said in a news conference on Wednesday afternoon.

Investing for Potential Volatility With CFA

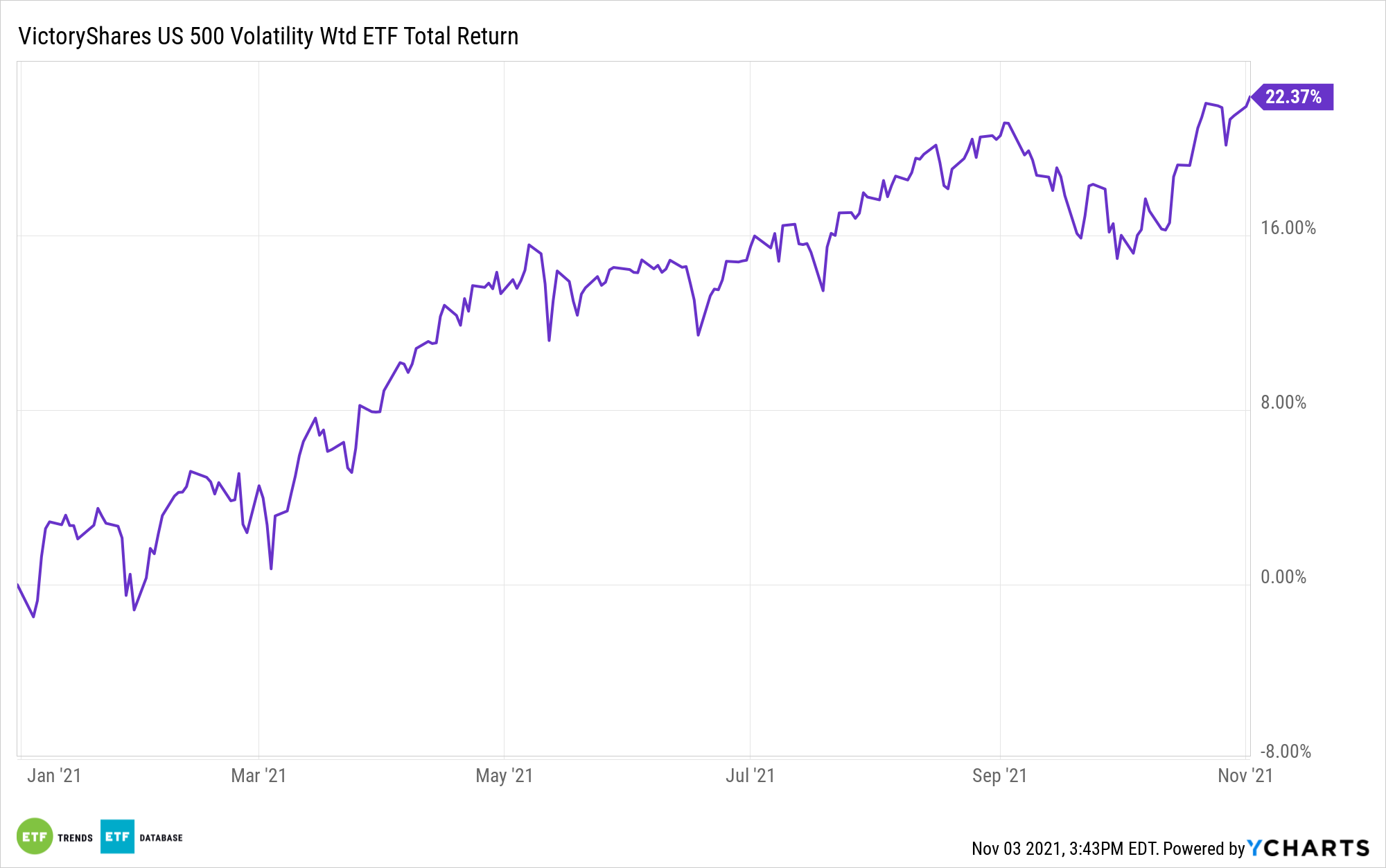

For cautious investors who are looking to capitalize on growth while keeping an eye towards potential inflation-driven volatility, the VictoryShares US 500 Volatility Wtd ETF (CFA) is a solid option. The fund allows investors to gain balanced exposure to large-cap U.S. equities with a unique volatility-weighted approach.

CFA tracks the Nasdaq Victory US Large Cap 500 Volatility Weighted Index. The benchmark screens all publicly traded U.S. stocks and only includes those with positive earnings in the most recent four quarters.

From there, the benchmark takes the top 500 stocks by market cap and weights them based on the volatility of their price changes over the previous 180 days. Those with the lowest volatility get the highest weighting, while those with the highest volatility have the lowest weighting.

CFA’s sector breakdown as of the end of September includes a 16.37% allocation to industrials, 15.76% to financials, 15.11% to information technology, 14.04% to healthcare, 9.99% to consumer discretionary, and various smaller allocations.

The fund has an expense ratio of 0.35%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.