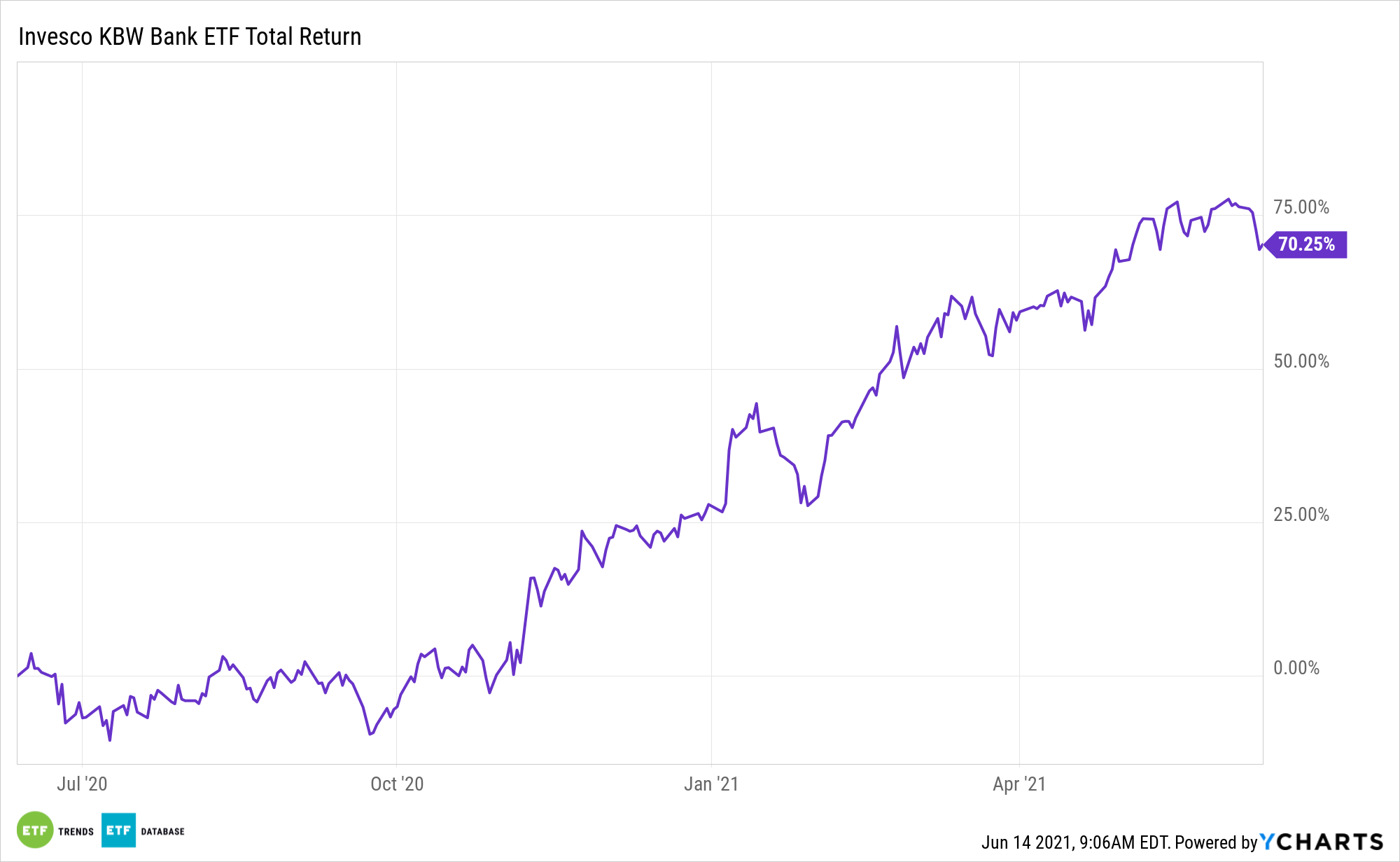

The bank stock story is well-documented this year. Amid a rally in value stocks and a spike by 10-year Treasury yields, bank stocks and exchange traded funds, including the Invesco KBW Bank ETF (NASDAQ: KBWB), are back with a vengeance.

KBWB, which tracks the KBW Nasdaq Bank Index, is higher by 32.45% year-to-date. A big move like that in less than six months may imply upside from here is limited, but that may not be the case.

Results of the Federal Reserve’s annual stress tests on the largest U.S. banks are due out on June 24 and expectations are that the Fed will sign off on banks boosting dividends and restarting share repurchase programs.

“Analysts are optimistic about the industry’s performance in this year’s stress tests and the prospects for banks to pay capital back to shareholders,” reports Carleton English for Barron’s. “The total capital return for banks could hit $200 billion over the next four quarters, according to Barclay’s analyst Jason Goldberg. He expects that the total yield for the sector will be roughly 8.5% with 2.6% from dividends and 5.8% from buybacks.”

A Positive Turnabout for KBWB

As of June 11, KBWB sported a dividend yield of 1.96%. If the Barclays forecast is accurate and bank dividend yields grow by way of increased payouts, there’s some potential upside on that metric for KBWB.

That’s a potentially positive reversal from 2020 when the Fed prevented banks from raising dividends while forcing them to halt buyback plans amid the coronavirus pandemic. The central bank also forced financial institutions to set aside massive amounts of cash to cover sour loans on expectations that the pandemic would create a deeper recession, leading to a wave of consumer defaults.

Ultimately, that scenario didn’t arrive, and with the benefit of hindsight, investors now know that plenty of KBWB holdings could have boosted dividends last year if the Fed would have allowed it. It remains to be seen if banks will play dividend catch-up this year, but it’s clear there’s room to boost payouts.

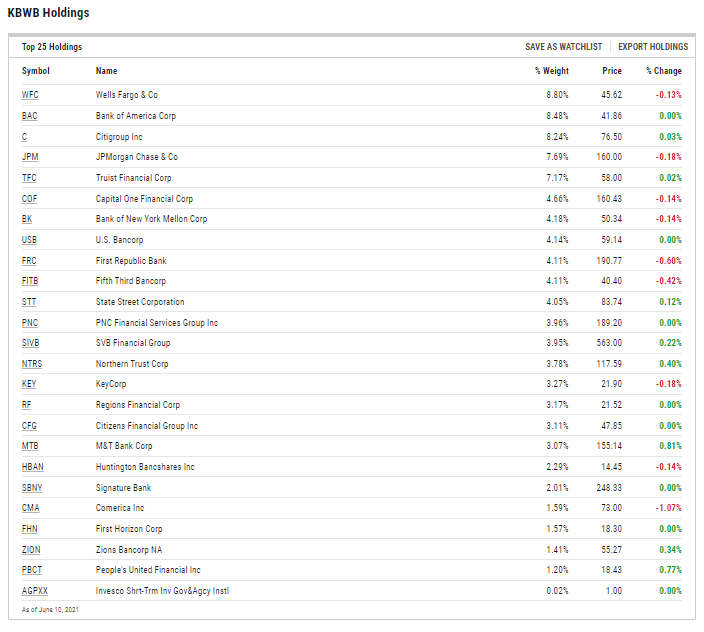

“Based solely on their comparatively low payout ratios in 2019 as well as in a challenging 2020, the following banks may have the most room to lift their dividends this year: Bank of America (ticker: BAC), Citigroup (C), Fifth Third (FITB), JPMorgan Chase (JPM), M&T Bank (MTB), and Zions Bancorporation (ZIONS),” according to Barron’s.

Those stocks combine for about 30% of KBWB’s weight. Investors have added $748 million in new capital to the fund year-to-date.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.