Although 10-year Treasury yields have steadied a bit in recent weeks, the prior rise by those yields has hindered technology stocks.

The tech-heavy Nasdaq-100 Index (NDX) is in the green on a year-to-date basis – an impressive feat when considering tech was the sector most inversely correlated to 10-year yields in the first quarter.

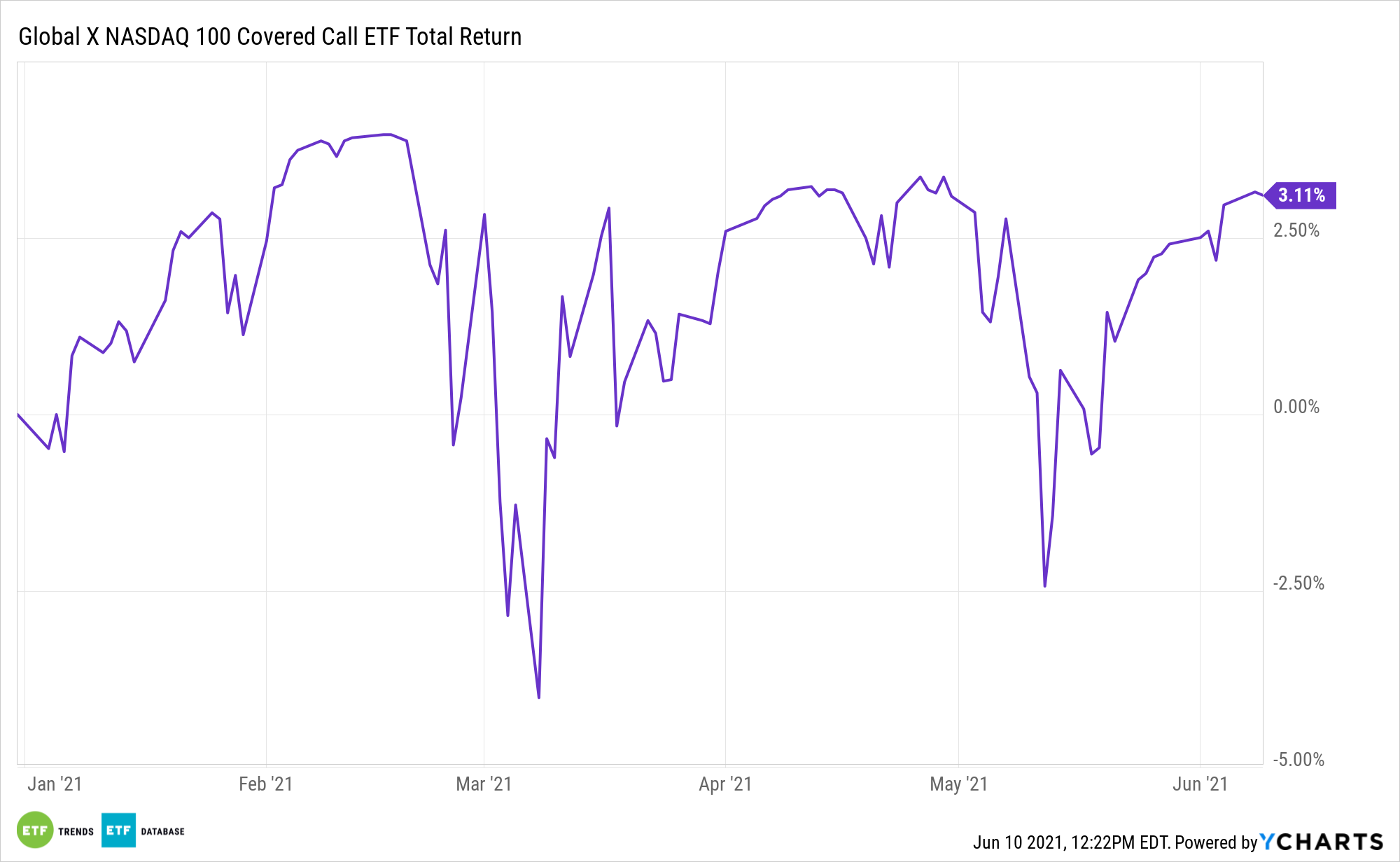

In more upbeat news, investors can still extract healthy levels of income from the Nasdaq-100 via the Global X Nasdaq 100 Covered Call ETF (QYLD). The $3 billion QYLD, which turns eight years old in December, tracks the CBOE Nasdaq-100 BuyWrite V2 Index.

On its own, the Nasdaq-100 isn’t an income paradise, but QYLD enhances that proposition by writing covered calls on that index. Also known as a “buy write” strategy, covered calls involve selling call options on an underlying asset in which the investor holds a long position. The idea is to generate income while guarding against a downturn in that asset, not to just participate in the upside of the options.

The Search for Yield

Writing covered calls on all the NDX components is expensive and time-consuming for individual investors. QYLD eliminates that burden, but the Global X exchange trade fund offers other benefits.

“While covered call strategies can be implemented on a variety of indexes or underlying assets, selling calls on the Nasdaq 100 offers a couple of distinctive features,” notes Global X analyst Rohan Reddy. “First, historically the NDX has consistently exhibited higher volatility than the S&P 500, which can fuel greater income from selling options. NDX volatility averaged 21.71% over the last five years, compared to 18.11% for the S&P 500.”

That confirms QYLD has credibility as a volatility mitigation tool, but investors typically turn to covered calls for income. The fund delivers there too. QYLD has a jaw-dropping trailing 12-month yield of 12.57%, according to issuer data. Plus, it provides a steady stream of income, having delivered a monthly distribution for the entirety of its seven-plus years on the market.

QYLD also merits consideration at a time when value stocks are shining. That’s a drag on NDX, which is growth-heavy, but there’s another issue to mull. Some high dividend stocks that are also value names may not be able to sustain those rich payouts, potentially subjecting investors to negative dividend action. With a covered call strategy like QYLD, dividend cuts or suspensions aren’t an issue.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.