Emerging markets (EM) have headwinds dialed up a notch higher given the confluence of rising global inflation and a stronger dollar. However, in the case of certain regions like Latin America, they can provide investors with the right growth opportunity should certain economic conditions fall in line.

For Latin America, one of the key drivers of economic success will be its ability to provide an efficient near-shoring strategy. Near shoring involves having the ability to be close to a specific client, or geographic region, in the case of Latin America providing goods to the United States, by building the necessary facilities to conduct such business.

“A key component for being bullish on Latin America is based on near-shoring, the idea that multinationals will build more factories in the region to bring their output closer to its final destination in the US market,” a Bloomberg article explained. “The days of the span-the-globe supply chains died in the pandemic, the theory goes, and shorter is now inherently better.”

A Discerning ETF With Latin America Exposure

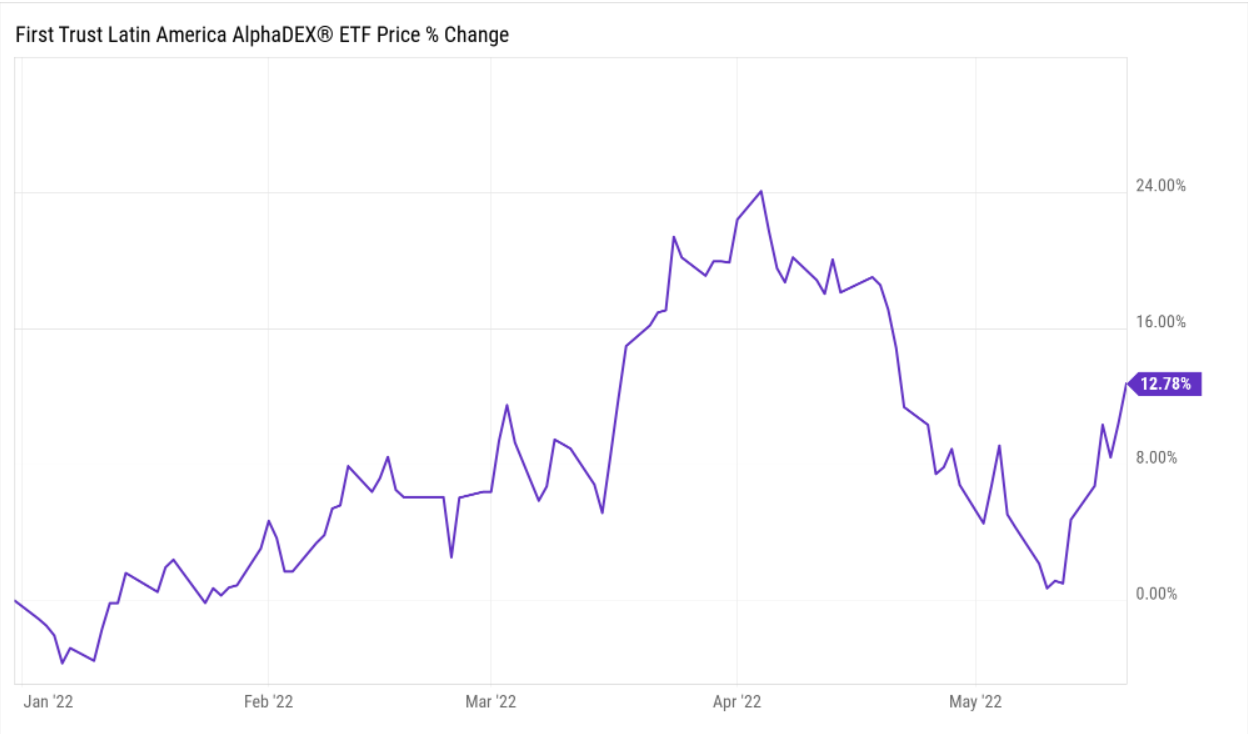

If investors are willing to take on the risk of EM or in this specific case, Latin America, one exchange traded fund (ETF) to look at is the First Trust Latin America AlphaDEX Fund (FLN). The fund seeks investment results that correspond generally to the price and yield, before the fund’s fees and expenses, of an equity index called the Nasdaq AlphaDEX® Latin America Index.

- The Index is an “enhanced” index created and administered by Nasdaq, Inc. (“Nasdaq”) which employs the AlphaDEX® stock selection methodology to select stocks from the NASDAQ Latin America Index that meet certain criteria.

- To construct the Index, Nasdaq ranks the eligible stocks on growth factors including 3-, 6- and 12- month price appreciation, sales to price, and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors. A stock must have data for all growth and/or value factors to receive a rank for that style.

For more news, information, and strategy, visit the Nasdaq Investment Intelligence Channel.