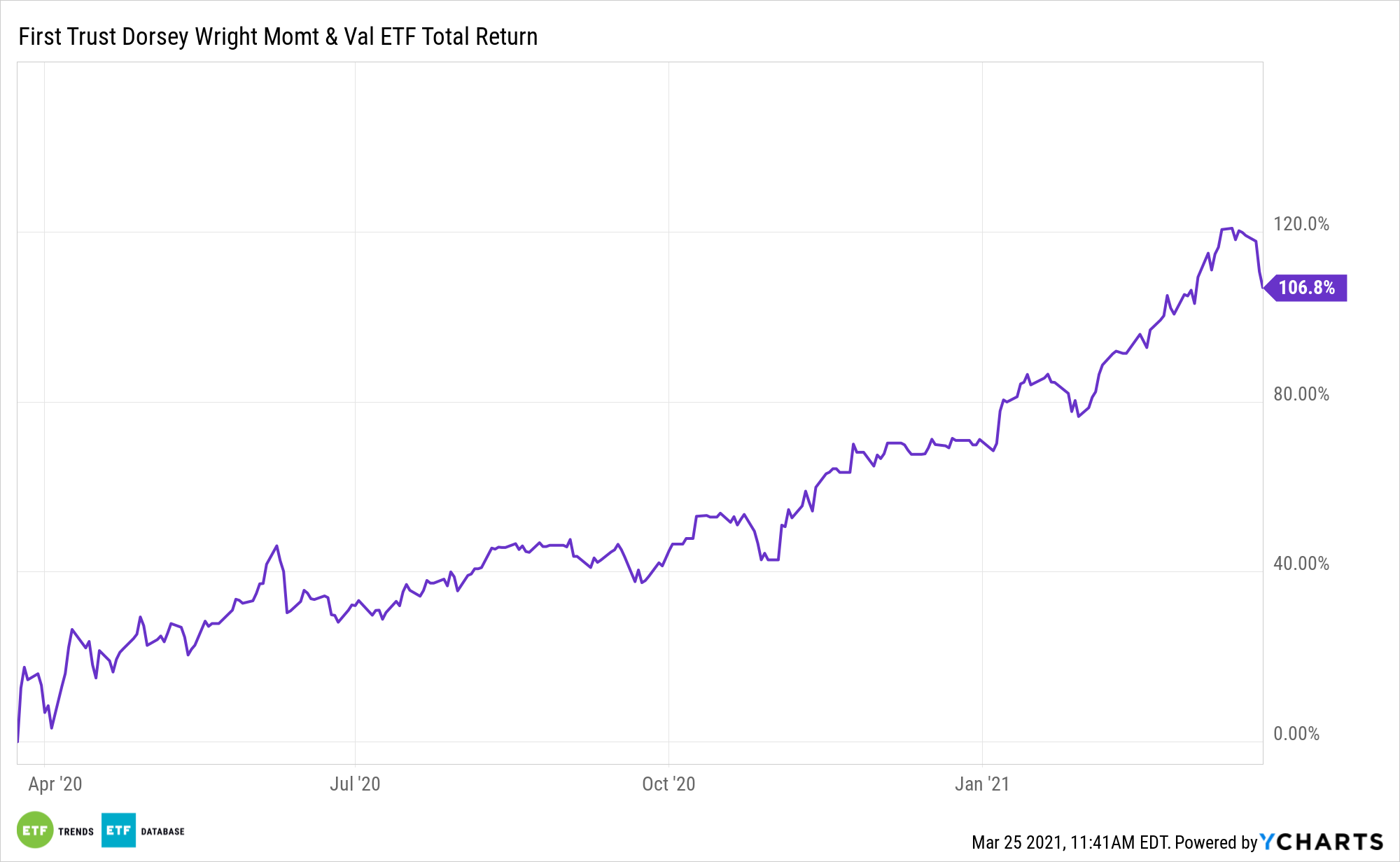

Momentum and value are two distinct investment factors, and they’re rarely married under a single ETF umbrella. The First Trust Dorsey Wright Momentum & Value ETF (DVLU) is changing the conversation.

DVLU seeks investment results that correspond generally to the price and yield of an index called the Dorsey Wright Momentum Plus Value Index. The fund uses an indexing investment approach to replicate the performance of the Index.

Relative strength tries to measure a security’s price momentum relative to its peers. By combining relative strength with a factor-based investing strategy, investors may home in on desirable characteristics of a stock, such as value, low volatility, or dividends, and combine it with the potential for more attractive excess returns through the momentum tilt.

Momentum tends to be negatively correlated to factors like size and value since momentum identifies securities that are trending upwards. These stocks tend to reflect successful companies with positive trends that become bigger and bigger. Consequently, investors can also enjoy the diversification benefits of adding momentum strategies to small cap and value-heavy portfolios.

Conversely, value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

Drilling Down on ‘DVLU’

Each DVLU component is assigned a relative strength score based on its forward price momentum compared to the momentum of a broad market benchmark index. Securities that exhibit a minimum level of relative strength are eligible for inclusion in the index.

Momentum investing is rooted in the notion that securities that are on torrid paces will continue acting that way over the near-term, while laggards will continue slumping. Long-term data for the momentum factor are compelling, but the factor can be volatile.

Momentum—once it picks up, it can be difficult to stop and while the debate in the capital markets is whether value can sustain its lead overgrowth, investors can’t forget about the momentum factor, especially if events like a coronavirus easing stir a rally for riskier assets.

DVLU’s underlying index ranks companies on four “value” metrics, including price-to-sales ratio, price-to-book ratio, price-to-earnings ratio, and price-to-cash flow ratio. Securities with higher value scores are assigned correspondingly higher weights.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.