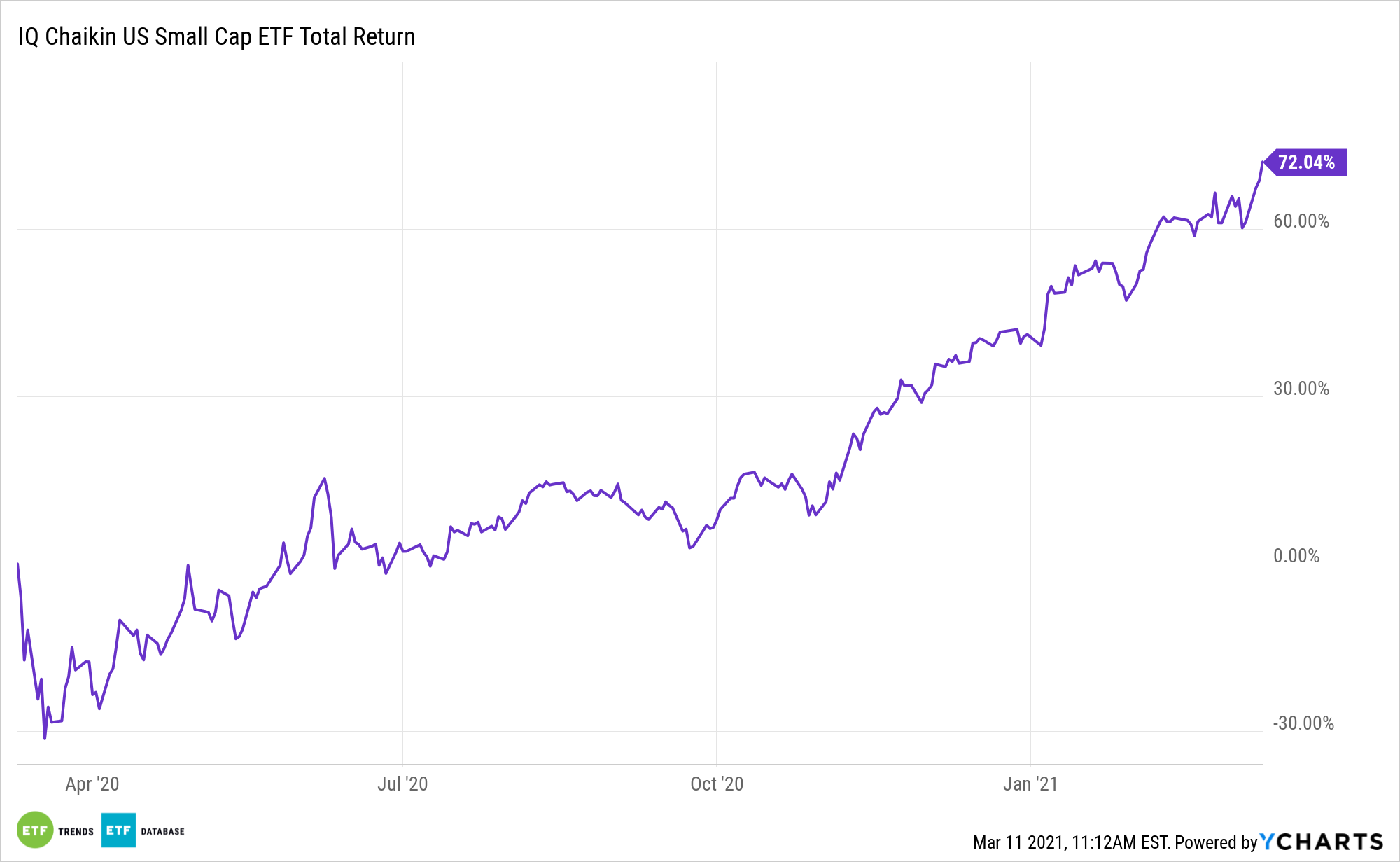

Investors may want to look toward small cap stocks and the IQ Chaikin U.S. Small Cap ETF (NasdaqGM: CSML). CSML brings a layered factor approach to tapping small caps.

Through the Chaikin Power Gauge stock rating tool, potential investors can look up the various holdings and dive deeper down into the four main factors to find out the sub-metrics that help define the Power Gauge’s rating system.

The value factor includes screens like LT debt to equity ratio, price to book value, return on equity, price to sales ratio, and free cash flow. Technical factors cover price trend, price trend rate of change, relative strength vs. market, and volume trend. Growth factors include earnings growth, earnings surprise, earnings trend, projected P/E ratio, and earnings consistency. Lastly, the sentiment factor screens for earnings estimate trend, short interest, insider activity, analyst ratings, and industry relative strength.

“The year-to-date return for small-caps through the end of February was a remarkable 25 percentage points greater than that of large-caps (as measured by the 20% of stocks with the smallest market caps vs. the comparative quintile of the largest),” reports Mark Hulbert for the Wall Street Journal. “While it isn’t unexpected for small-cap portfolios to beat large-caps over time—a long-term tendency that Wall Street analysts refer to as the ‘size effect’—what is unusual is the magnitude of the outperformance. It has averaged just 0.9 percentage point over all two-month periods since 1926, according to data from Dartmouth professor Ken French.”

CSML’s Secret Sauce

CSML tracks the results of the Nasdaq Chaikin Power US Small Cap Index utilizing multi-factor model known as The Chaikin Power Gauge. This proprietary tool uses four factors–value, growth, technical, and sentiment.

Given the heightened market volatility, it may be prudent to incorporate a smart beta or factor-based investment strategy that implements academically proven strategies in a efficient and easy-to-use ETF wrapper. A factor can be thought of as any characteristic relating to a group of securities that can help explain their risk and return. Some of the most common factors that have been identified historically are size, value, quality, momentum, and volatility.

“Indeed, according to several researchers, small-caps’ recent strength may actually be something else in disguise—that is, it may have to do with factors other than just size, such as the battle between growth and value stocks,” according to the Journal.

CSML offers investors plenty of perks not found in cap-weighted small cap funds. Single factors exhibit a highly cyclical nature from year to year, which renders market timing harder to predict. Consequently, investors may combine the various factors to create a more diversified solution to enhance returns over time.

Other potential benefits with CSML include small caps’ historical outperformance to their large brethren, and the ability to recover faster from market downturns. Furthermore, small caps have also outperformed large caps during periods of rising rates since higher rates typically accompany periods of higher growth. Lastly, small caps can rise faster because they grow from a smaller initial base.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.