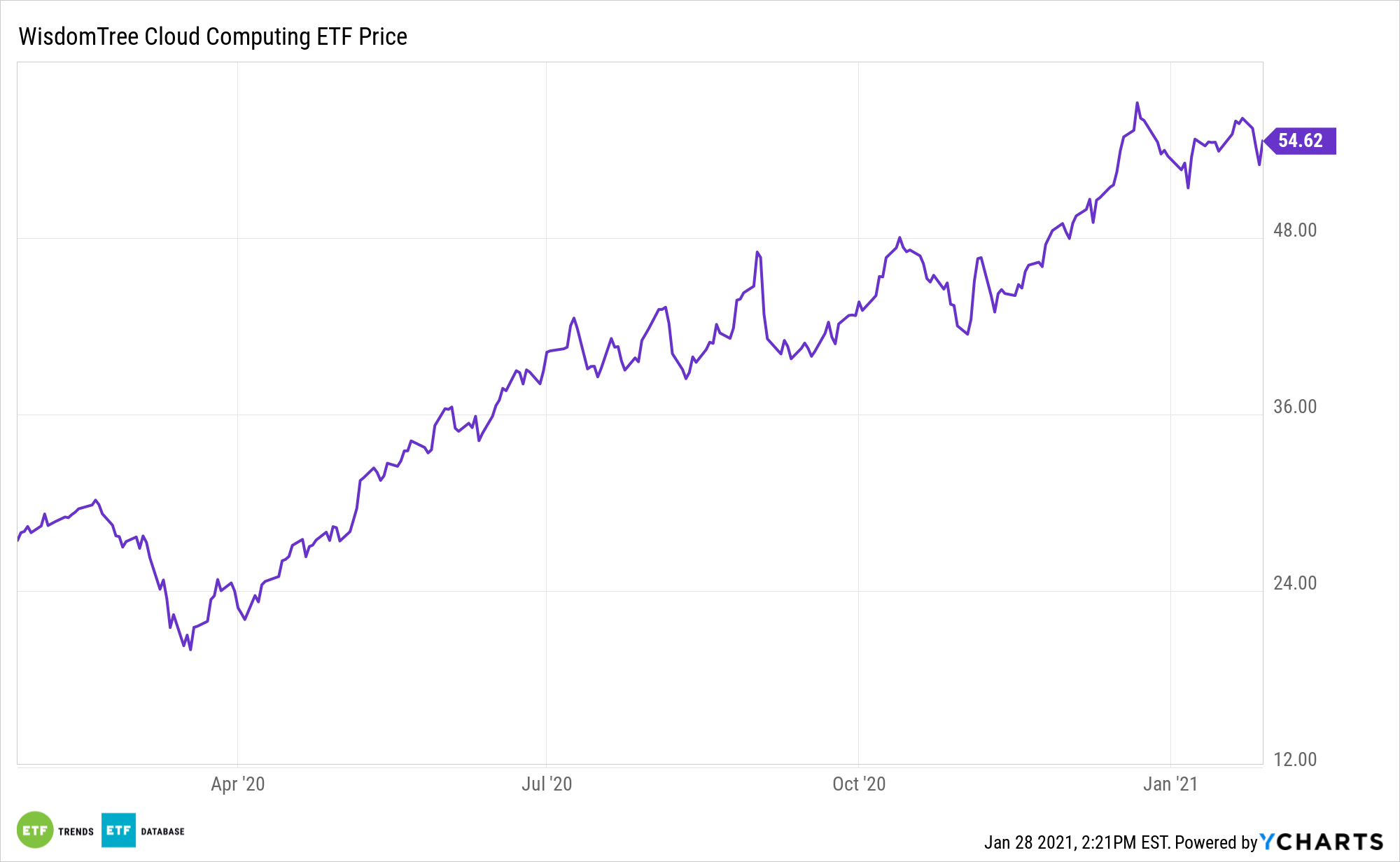

The WisdomTree Cloud Computing ETF (WCLD) was the star of cloud computing exchange traded funds last year. It has more to give in 2021.

The WisdomTree Cloud Computing Fund seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

Public cloud revenue is one of the many catalysts that can spark more upside for WCLD this year.

“According to data presented by Finaria, public cloud revenues jumped by 25% year-over-year amid the COVID-19 crisis and hit $271.9bn in 2020. The increasing trend is set to continue this year, with revenues growing by another 25% YoY to $338b,” notes Finaria.

WCLD and the Cloud Computing Boon

The cloud computing industry refers to companies that (i) license and deliver software over the internet on a subscription basis (SaaS), (ii) provide a platform for creating software applications which are delivered over the internet (PaaS), (iii) provide virtualized computing infrastructure over the internet (IaaS), (iv) own and manage facilities customers use to store data and servers, including data center Real Estate Investment Trusts (REITs), and/or (v) manufacture or distribute infrastructure and/or hardware components used in cloud and edge computing activities.

As more business models look to technology amid social distancing, cloud computing will only grow to greater heights. Prior to the pandemic, businesses were already transitioning to the cloud to streamline their processes.

“Today, billions of people use cloud storage to manage and store private data. However, its ability to provide access to computing power that would otherwise be extremely expensive has seen cloud computing technology spread widely in the business sector, also,” notes Finaria. “Examples of cloud computing use can be found practically everywhere, from messaging apps, social networking, and streaming services to business processes, office tools, lending platforms, or chatbots.”

Cloud computing has been a boon for companies that have been able to capitalize on the increased work-from-home labor force.

“The COVID-19 and the shift to remote work and video conferencing accelerated moves to the cloud in 2020, with annual revenues rising by more than $55bn. Statista data indicate the global public cloud market is expected to hit a $500 billion benchmark in the next two years and continue rising to $679.5bn value by 2025,” concludes Finaria.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.