Cloudflare’s co-founder Michelle Zatlyn became the newest billionaire in the technology sector last week when the company’s shares hit a new high, as reported by Forbes.

By Tuesday, Cloudflare (NET) shares had more than doubled their value year over year, shooting Zatlyn into the billionaire category.

Cloudflare is a web infrastructure and security firm that protects over 4 million customers’ websites from cybersecurity threats. It reports blocking over 70 billion cyber threats daily, from attacks like distributed denial of service (DDoS).

Zatlyn is the company’s president and COO as well as its co-founder. Fellow co-founder and CEO Matthew Prince became a billionaire last May and, as of the record high last week, was worth $4 billion.

Cloudfare’s IPO in September of 2019 debuted shares at $18. Current share value has shown 500% growth in price when compared to the original IPO pricing. Revenues in 2020 hit $431 million, as compared to $287 million the previous year.

During last year’s presidential election, Cloudflare provided free service to election websites, as well as to distributors of the Covid-19 vaccine, allowing them to create digital queues for vaccination appointments.

Capturing Cloud Computing Advantages with WCLD

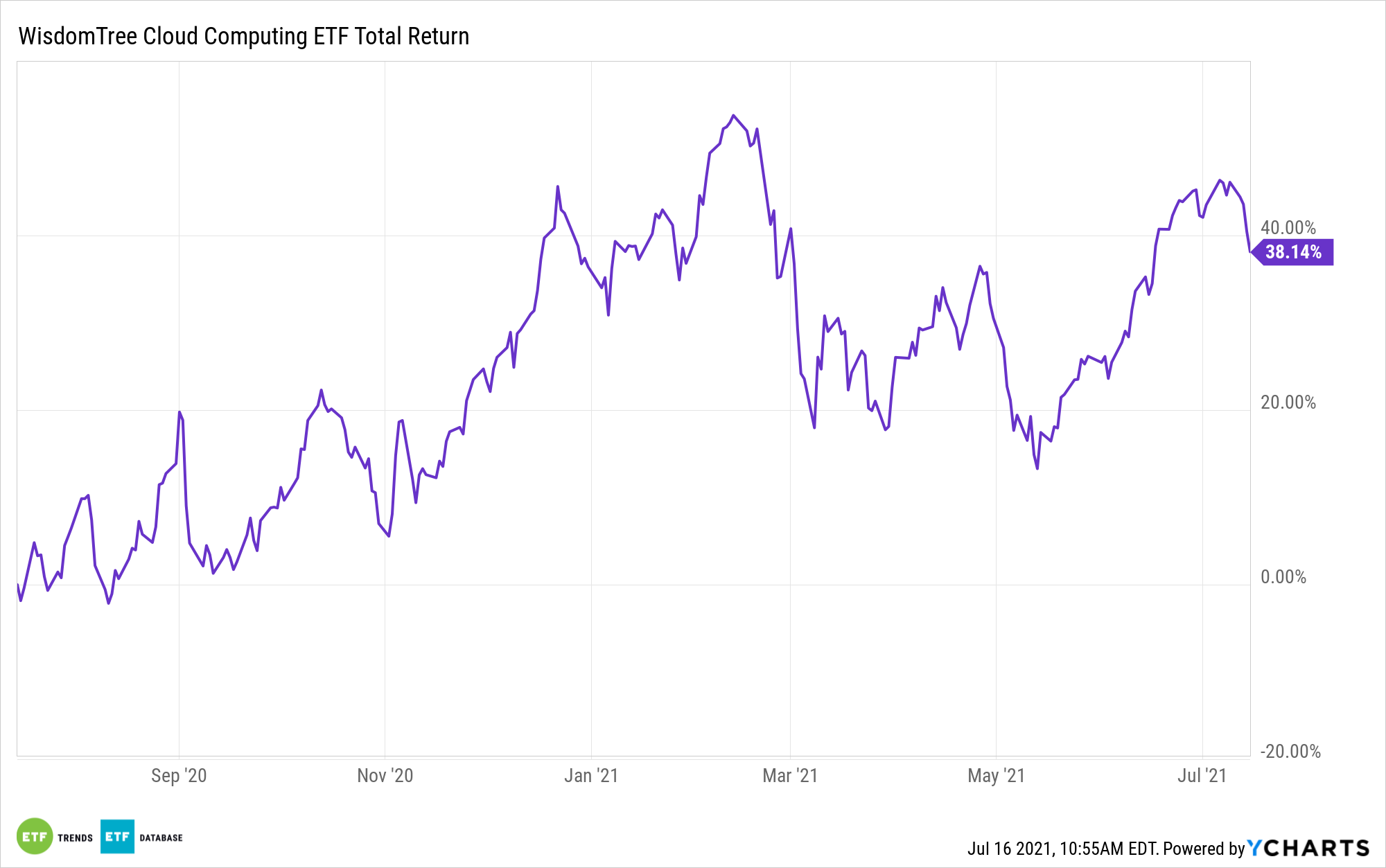

Cloudflare is one of a number of cloud computing companies that has thrived during the Covid-19 pandemic. The WisdomTree Cloud Computing Fund (WCLD) provides investors pure-play exposure to companies that provide cloud-based software, such as CloudFlare.

WCLD tracks the BVP Nasdaq Emerging Cloud Index, an equally-weighted index comprised of companies that derive the majority of their revenue from software provided via the cloud. That could mean remote delivery, or a cloud-based business model that is subscription-, transaction-, or volume-based.

WCLD offers multi-cap exposure to emerging, fast-growing companies within cloud software and services. Holdings include Asana (ASAN) at 3.05%, Dropbox Inc (DBX) at 2.45%, Box Inc (BOX) at 2.42%, Adobe Inc. (ADBE) at 2.40%, and Cloudflare at 2.39%.

WCLD has an expense ratio of 0.45%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.