Earnings season has kicked off with extremely strong growth and the expectations of positive numbers from most companies, reports CNBC.

Earnings are showing their strongest rate of growth since 2009 and the post-Great Recession recovery. On average, companies have managed to beat their analysts’ estimates of earnings by 3-5%, but for the last four quarters, they have done so by a minimum of 12%.

So far, it looks as though markets are on track to continue the trend.

While it is important to note that Q2 earnings are being compared to the height of the COVID-19-related economic shut-down, overall hopes are high for still-impressive numbers.

Christine Short of Wall Street Horizon explained that it’s a better read to compare this year’s Q2 numbers to 2019.

“For example, Q2 2021 growth is only 8.3% when compared to Q2 2019, which seems like a more realistic picture of the current rebound phase and growth trajectory we’re on,” she told CNBC.

She went on to say that “8.3% is still a great growth rate in any quarter, well above the 5-year average earnings growth rate of 4.1%.”

Large Numbers with Large Cap Investments: The CFA ETF

With earnings reports pending for many of the largest companies, VictoryShares offers several ETFs primed to capitalize on increased growth.

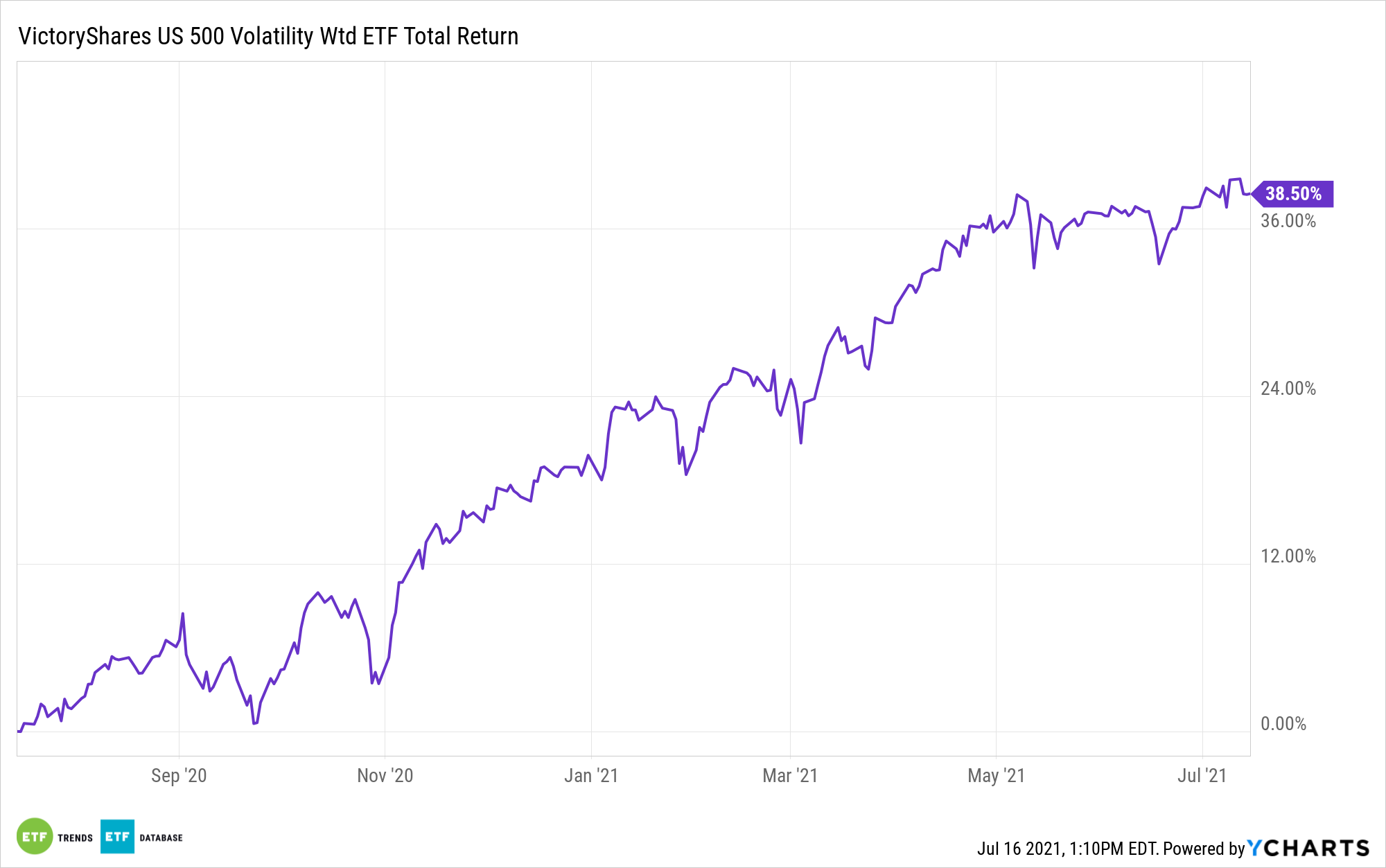

One such fund is the VictoryShares US 500 Volatility Wtd ETF (CFA), which allows investors to gain balanced exposure to large cap U.S. equities with a unique volatility-weighted approach.

CFA tracks the Nasdaq Victory US Large Cap 500 Volatility Weighted Index. The benchmark screens all publicly traded U.S. stocks and only includes those with positive earnings in the most recent 4 quarters.

From there, the benchmark takes the top 500 stocks by market cap and weights them based on the volatility of their price changes over the previous 180 days. Those with lowest volatility get the highest weighting, while those with highest volatility have the lowest weighting.

CFA’s sector breakdown includes a 17.63% allocation to industrials, a 16.03% allocation to information technology, 15.97% to financials, 14.27% to healthcare, 9.97% in consumer discretionary, and various smaller allocations.

The fund has an expense ratio of 0.35%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.