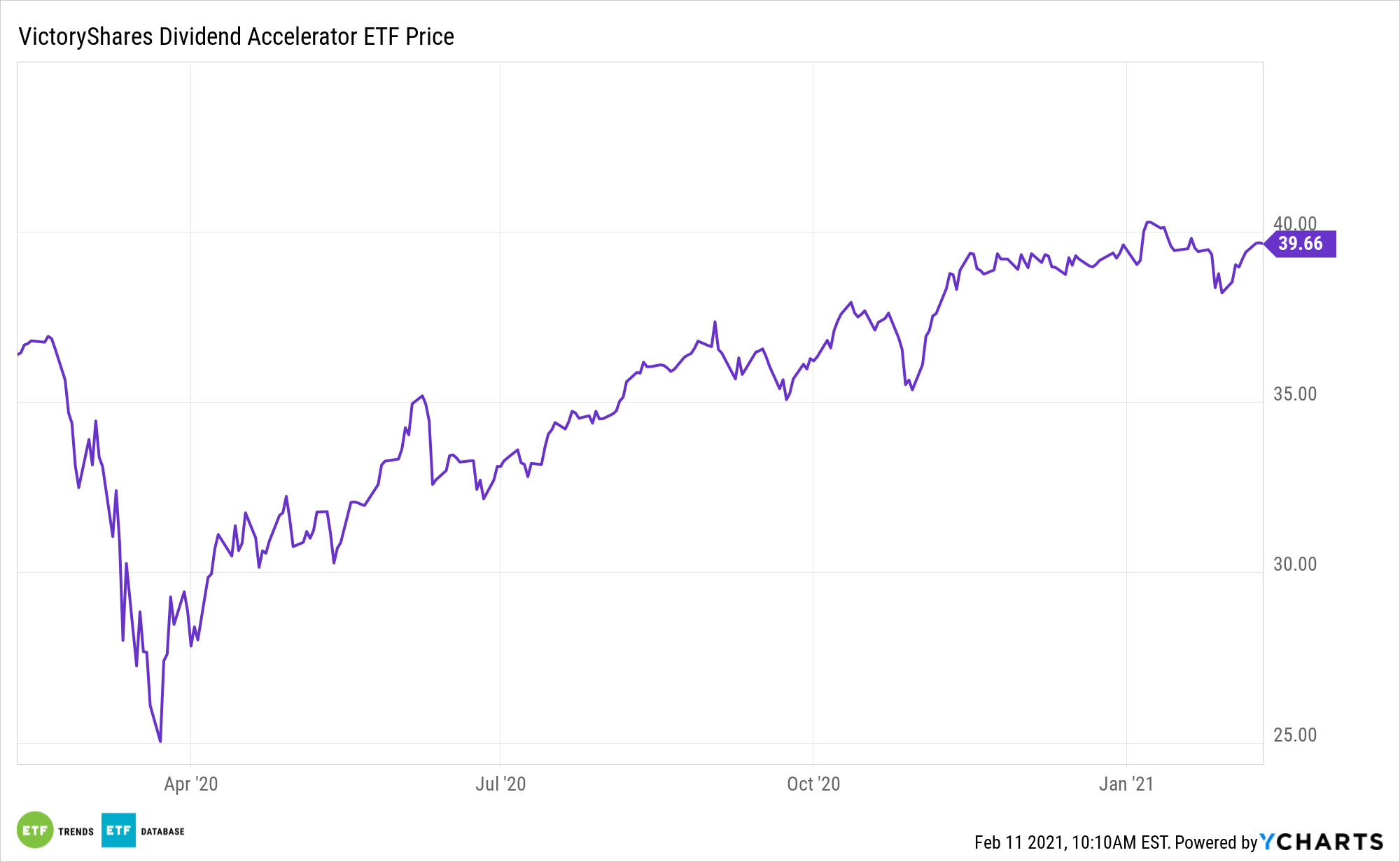

Dividend growth is showing signs of perking up. Investors can add some fuel to the fire with the VictoryShares Dividend Accelerator ETF (VSDA).

The VictoryShares Dividend Accelerator ETF debuted in April 2017 and follows the Nasdaq Victory Dividend Accelerator Index (NQVDIV), which Victory Capital developed in partnership with Nasdaq. What makes VSDA unique is that it focuses on more than a company’s previous dividend track record.

And there’s more good news: VSDA is a valid near-term consideration for income-starved investors.

Dividends are in demand as fixed income investors face a lower-for-longer interest rate environment. The Federal Reserve is expected to maintain its near-zero interest rate policy to help push inflation up, bolster the economy, and lower the unemployment rate. The Fed has already stated it was willing to let inflation run higher to offset years inflation fell below its 2% target.

Companies are increasingly confident in growing dividends again, even as another surge in Covid-19 cases threatens earnings. According to FactSet estimates, S&P 500 per-share earnings are expected to bounce 22% in 2021—to above 2019 levels.

Will VSDA Come Out Victorious in 2021?

As a result, companies are feeling better about returning more of their capital to shareholders. S&P 500 dividends are expected to grow 3% in 2021 from 2020, according to FactSet. The payout ratio—the percent of earnings companies use to pay dividends — is expected to fall to about 35% from 42%, but the pure growth in dividend dollars still provides an attractive yield opportunity at current prices.

Investors should consider quality dividend growth stocks that typically exhibit stable earnings, solid fundamentals, strong histories of profit and growth, commitment to shareholders, and management team conviction in their businesses.

Dividend growth as a means of trumping inflation could and arguably should serve to highlight the advantages of ETFs like VSDA. The group is comprised of well-established ETFs that emphasize dividend increase streaks. This new breed of funds looks for sectors chock full of dividend growth potential.

VSDA features companies with “not only a history of increasing dividends, but which also possess the highest probability of future dividend growth. It seeks to provide exposure to dividend growth, rather than yielding, offering a potential diversification benefit to high dividend yielding alternatives,” according to VictoryShares.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.