Many investors look to emerging markets for diversification benefits.

While emerging markets can serve as a portfolio diversifier, investors shouldn’t overlook concentration, however. Concentration risk is just as prevalent overseas as it is in the U.S. Just as the U.S. equity market has reached record levels of concentration, emerging markets benchmarks have seen a similar spike in concentration.

The top 10 names in the top-heavy S&P 500 comprise 30.6% of the index by weight. Meanwhile, despite having over 1,400 names, the top 10 constituents make up 23.3% of the MSCI Emerging Markets index by weight.

Historically, markets normalize after periods of high concentration. Notably, during these periods, cap-weighted indexes often lag smart beta strategies that use an alternate weighting methodology. As concentration is poised to recede, investors in emerging markets should seek to better diversify their exposure.

Solutions for Concentration in Emerging Markets

In a market that carries similar concentration risk as the U.S., the Hartford Multifactor Emerging Markets ETF (ROAM) offers some of the best country and company diversification compared to category peers.

While the top 10 names comprise 23.3% of the MSCI Emerging Markets index by weight, the top 10 holdings in ROAM make up just 11% of the fund by weight.

ROAM underweights mega-cap tech and China compared to category peers and the benchmark MSCI Emerging Markets index.

See more: “Diversify Emerging Markets Exposure Away From Xi’s Control With ROAM”

Investors may understandably worry that increasing diversification, effectively shifting exposure down the cap spectrum, could enhance volatility. However, since the end of 2019, ROAM had offered volatility that is often in the lowest decile of the peer group. ROAM targets a 15% in volatility over a full market cycle.

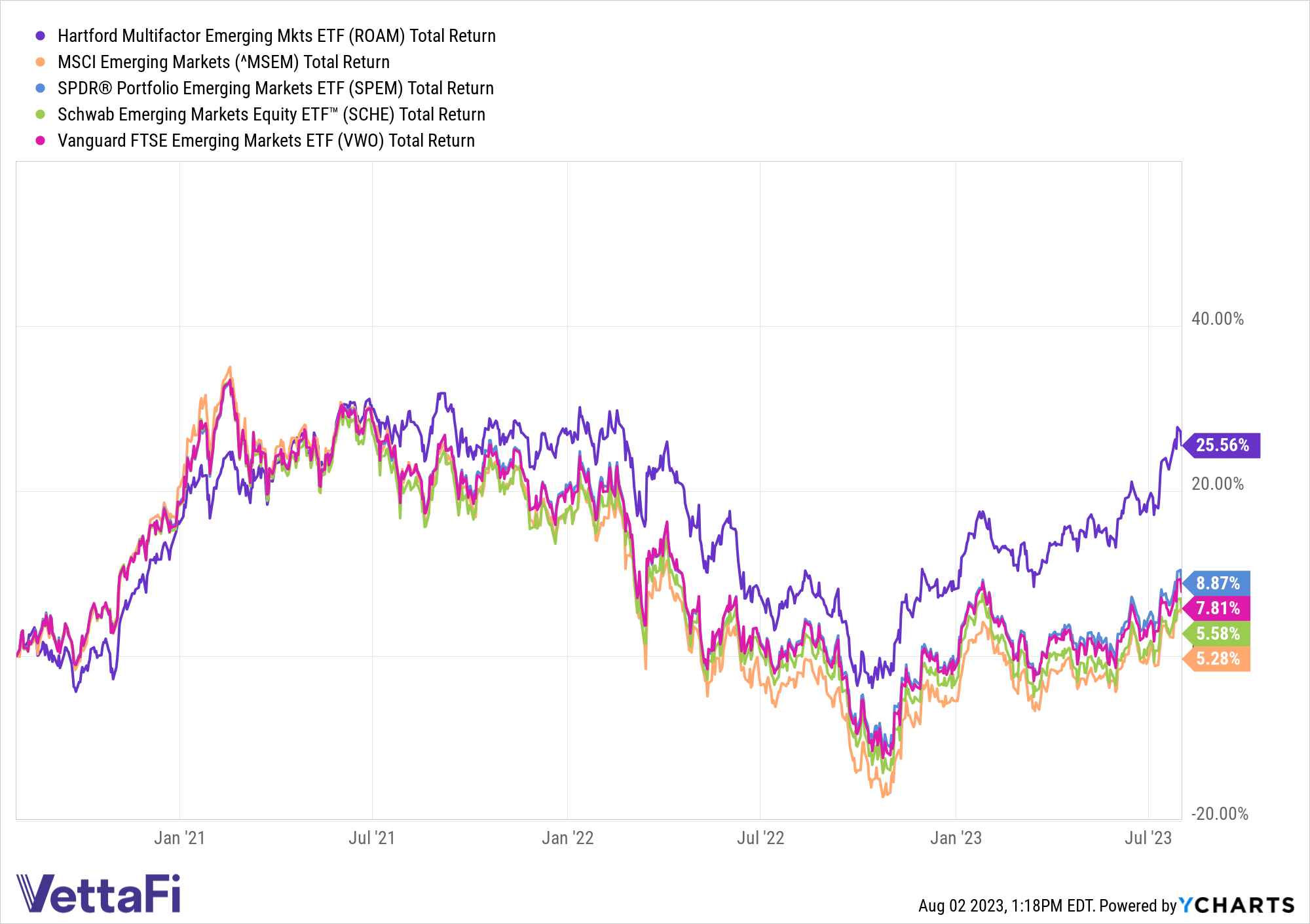

Due to the fund’s volatility reduction and enhanced diversification, ROAM has attractive risk-adjusted returns over the past three years. ROAM has handily outpaced some of the most popular ETFs in the category and the benchmark by notable margins.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.