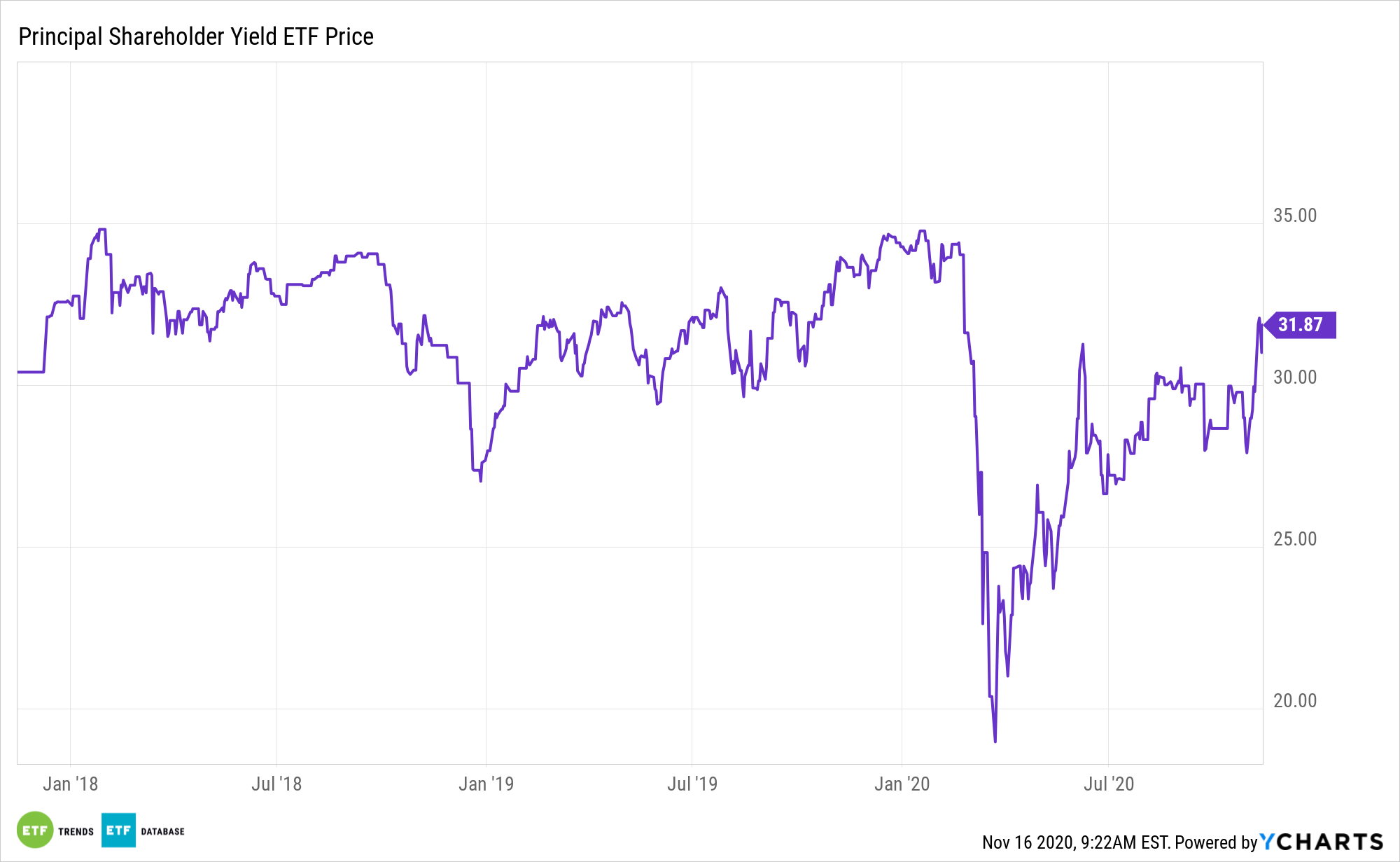

Momentum is building for value stock resurgence, but investors looking to capitalize may want to go beyond prosaic exchange traded funds. Enter the Principal Value ETF (PY).

PY features an emphasis on shareholder yield, an increasingly important concept in today’s low-yield environment.

PY seeks to provide investment results that closely correspond to the performance of the Nasdaq US Shareholder Yield Index. The index uses a quantitative model designed to identify equity securities (including value stock) of mid- to large-capitalization companies in the Nasdaq US Large Mid Cap Index (the “parent index”) that exhibit high degrees of sustainable, shareholder yield.

“Value stocks have consistently lagged behind growth stocks over the past five years and especially during the pandemic, with growth stocks overperforming value stocks by more than 44%,” writes Morningstar analyst Dave Sekera. “However, that trend appears to have changed course over the past few weeks. The market rotation thus far in the fourth quarter is indicative of investors seeing a path toward economic normalization in 2021.”

Play PY for Value Resurgence

The three components of shareholder yield are good measures for shareholder friendliness. The trifecta helps investors target companies with a history of dividend growth, low debt, and the ability to support equity prices through share buybacks.

Growth stocks can be seen as exorbitant and overvalued, causing some investors to favor value stocks, considered undervalued by the market. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors.

Increasing the allure of PY is that some value sector are poised to rebound as a coronavirus vaccine becomes readily available in 2021.

“As the vaccine is broadly distributed over the first half of 2021, in our economic outlook we incorporate our expectation that the consumer services sectors that have been hard-hit will recover meaningfully and normalize in the second half of the year,” according to Morningstar.

Value fans believe this time may be different for value stocks, pointing to improving measures of investment sentiment, abating fears of a recession, rebounding corporate profits, and lessening trade tensions between the U.S. and China. Furthermore, value stocks are now trading at some of their most attractive prices in years as the growth/value gap is as wide as it’s been in decades.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.