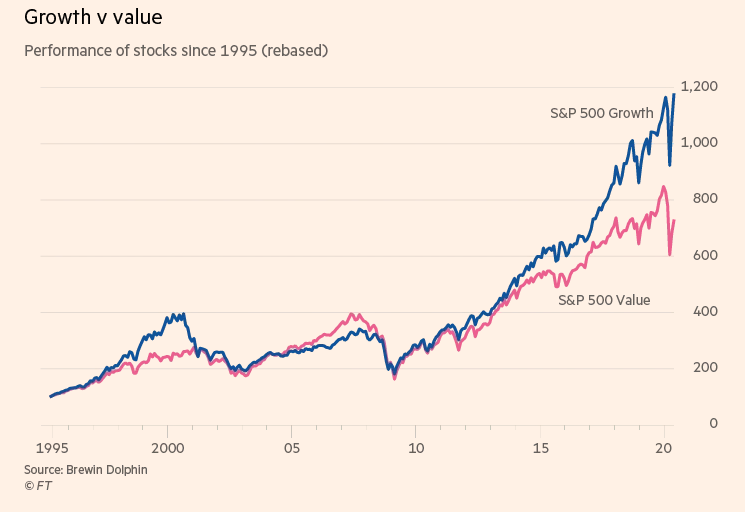

A recent Financial Times report underscored the widening gap between value and growth. As the bifurcation between the two popular investing factors increases, it’s already reached a 25-year high in terms of historical performance.

“Value investing continues to underperform growth investing, with a gap in returns that has expanded to its widest point in at least 25 years,” the FT article noted. “Value funds have returned 624 percent since 1995, while growth funds have returned 1,072 percent over the same period, according to data from wealth management firm Brewin Dolphin and Thomson Financial Datastream.”

Enter the coronavirus pandemic and that helped to widen the gap between the two factors—both commonly pitted against each other as a common debate within the factor investing faithfully. When

“The coronavirus pandemic has only exacerbated the disparity, as growth stocks such as the large US tech companies have outperformed, catching value investors out,” the report added.

However, that’s not to say value doesn’t belong in an investor’s portfolio—while the case for growth and momentum is building given that global economies are reopening and riding a wave of optimism, value-tilted issues could eponymously be a good value.

“Yet some analysts say value stocks are now so inexpensive and undervalued that it could be the opportunity to pick up shares before the investment style returns to favor,” the FT article said, “Others are skeptical, pointing to the widening performance gap.”

However, for the value faithful Investors looking towards ETFs, they can opt for funds like the American Century STOXX U.S. Quality Value ETF (VALQ). VALQ seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the iSTOXX® American Century USA Quality Value Index (the underlying index). Under normal market conditions, the fund invests at least 80% of its assets in the component securities of the underlying index. The underlying index is designed to select securities of large- and mid-capitalization companies that are undervalued or have a sustainable income.

One more value-titled fund to consider is the Invesco Dynamic Large Cap Value ETF (PWV). PWVseeks to track the investment results (before fees and expenses) of the Dynamic Large Cap Value IntellidexSM Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying intellidex. The underlying intellidex is composed of large-capitalization U.S. value stocks that the Intellidex Provider includes principally on the basis of their capital appreciation potential.

For more market trends, visit ETF Trends.