Investors getting exposure to the U.S. market via cap-weighted funds may be facing greater concentration risk than they realize.

Broad U.S. indexes like the S&P 500 and Russell 1000 are very top heavy, effectively providing meaningful exposure only to the largest names. Investors in cap-weighted funds are currently facing high levels of concentration risk at both the company and sector levels.

Being overly concentrated at the company level introduces significant idiosyncratic company risk to a portfolio. Currently, in cap-weighted funds, there is an overrepresentation of mega-caps, while persistently under-representing large caps deeper within the universe.

“In the first half of 2023, the market was highly concentrated and led by a handful of securities,” Todd Rosenbluth, head of research at VettaFi, said. “However, many advisors want a more diversified approach with exposure to mid sized companies.”

See more: “Cap-Weighted ETFs Can Introduce Unintended Risks to Portfolios”

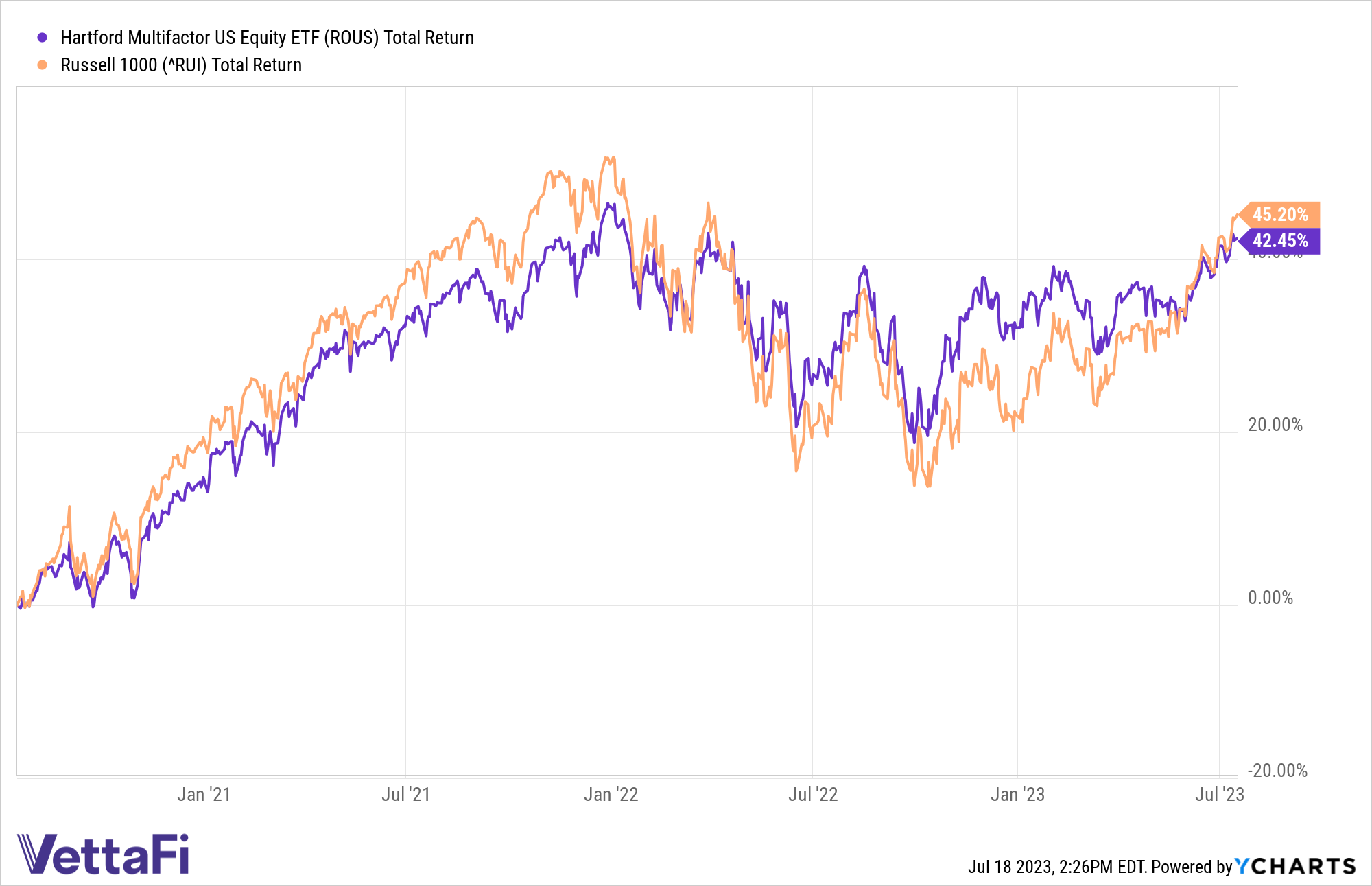

The Hartford Multifactor US Equity ETF (ROUS) is designed to provide equity exposure to the U.S. market with potentially less volatility over a complete market cycle than traditional cap-weighted indexes.

ROUS seeks to improve diversification versus a cap-weighted benchmark by reducing concentration risk. The fund focuses on reducing concentration at the sector, market cap, and individual company levels. 35% of the fund by weight is in companies with a market cap greater than $100 billion, compared to 59% of the Russell 1000.

Furthermore, 46% of ROUS by weight is in companies with a market cap between $10 billion and $100 billion. In comparison, 35% of the benchmark by weight is in companies with a market cap between $10 and $100 billion.

Finally, 18% of the fund is in companies with a $2 billion to $10 billion market cap, compared to just 5% for the benchmark.

How ROUS Compares to the Benchmark

ROUS diversifies exposure across sectors and explicitly avoids unintended sector concentrations. Compared to the benchmark, ROUS overweights the health care, consumer staples, and utilities sectors as of June 30. Conversely, the fund underweights the information technology, consumer discretionary, and real estate sectors.

See more: “Small Caps Positioned for Rebound in Second Half”

While both ROUS and the benchmark-tracking iShares Russell 1000 ETF (IWB) offer exposure to the broad U.S. market, there is only a 42% overlap by weight between the two portfolios. This amounts to around 316 overlapping holdings.

Relative to the benchmark, ROUS is underweight mega cap giants including Apple, Microsoft, Amazon, and Nvidia. Instead, ROUS offers more diversified access to the full U.S. market.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.