The recent market rally ended with a six-day winning streak for the Dow Jones Industrial Average as optimism floods in on the U.S. economy slowly re-opening and easing lockdown measures. Equities can thank bonds for the recent rally, especially after the Federal Reserve’s commitment to shoring up the bond market with exchange-traded fund (ETF) purchases.

However, the rally isn’t one based on investors decoupling their capital from the safe haven of bonds and into riskier stocks.

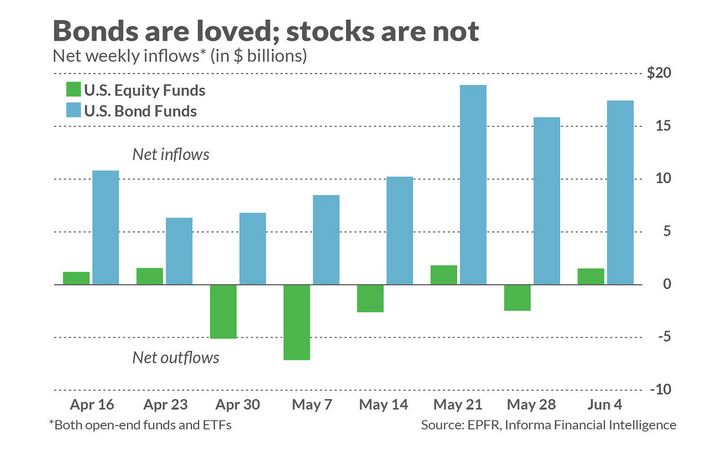

“The stock market’s incredible rally over the past couple of months has not been fueled by transfers out of bond funds and into stocks,” a MarketWatch report noted. “On the contrary, according to data from EPFR, a division of Informa Financial Intelligence, fund flows over the past eight weeks have gone in the opposite direction. U.S. equity funds (both open-end funds and ETFs) have experienced total net outflows of $11 billion, while U.S. bond funds have seen net inflows of $95 billion. (See chart, below.)”

This would appear confounding since stocks and bonds are typically seen as uncorrelated assets. However, it’s important to view the inflow/outflow data with a contrarian mindset—the outflows portend only to short-term movements and subsequent flood of inflows would result.

“This comes as a surprise to many since conventional wisdom teaches us that rallies are propelled higher when money on the sidelines is seduced back into the market,” the report added. “But the conventional wisdom is wrong, according to researchers: fund flows actually are a contrarian indicator. So while fund inflows are associated with an immediate boost to funding prices, that boost typically only lasts a few days. Over the subsequent several months, it usually reverses.”

An Active, Investment-Grade ETF Option

ETF investors looking for an active fund option for bonds can opt for an investment-grade option like the Principal Investment Grade Corporate Active ETF (IG). IG seeks to provide current income and, as a secondary objective, capital appreciation.

Additionally, the fund is an actively managed ETF that seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets, plus any borrowings for investment purposes, in investment grade corporate bonds and other fixed income securities at the time of purchase. “Investment grade” securities are rated BBB- or higher by S&P Global Ratings (“S&P Global”) or Baa3 or higher by Moody’s Investors Service, Inc. (“Moody’s”) or, if unrated, of comparable quality in the opinion of those selecting such investments.

For more market trends, visit ETF Trends.