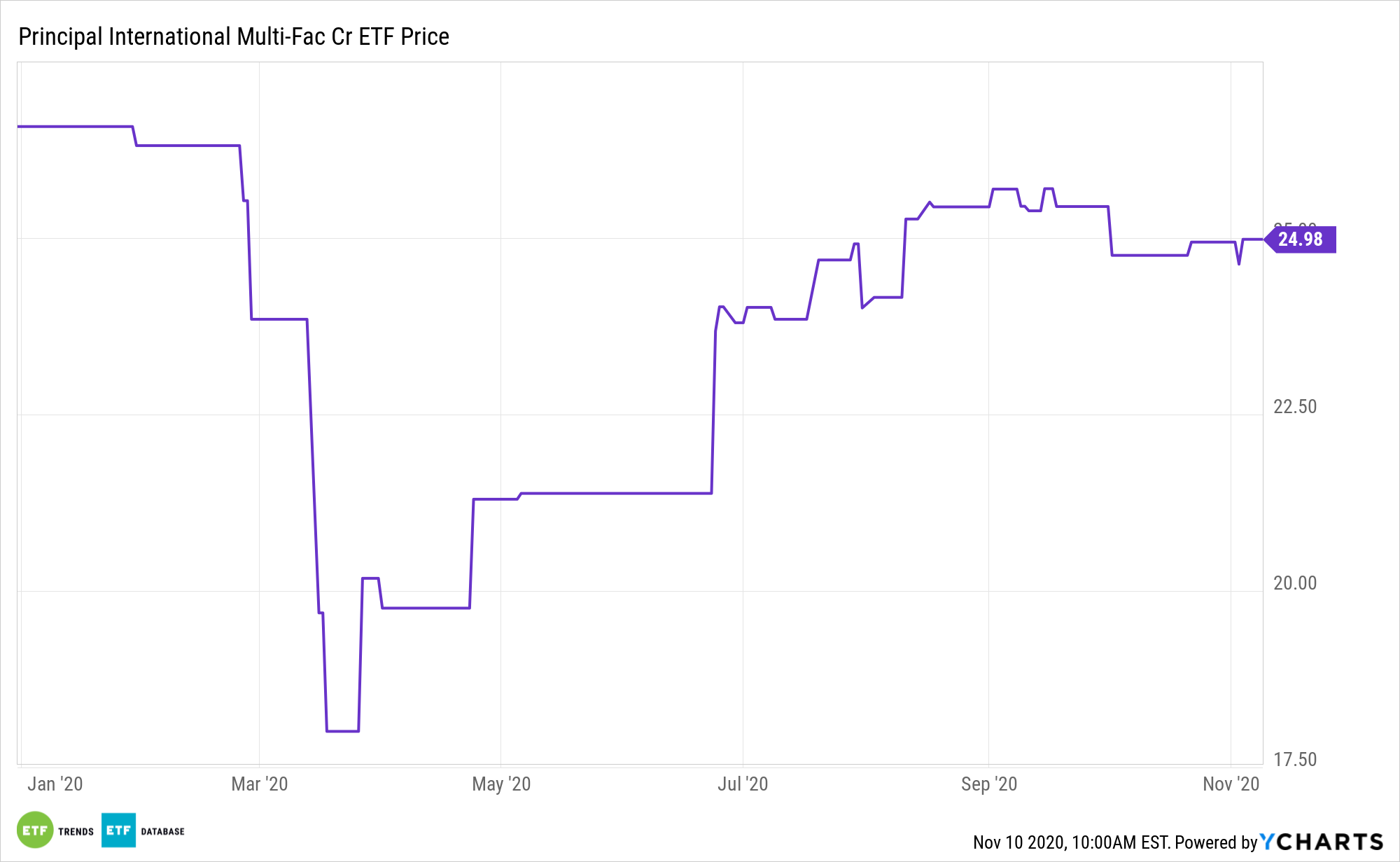

With regime change coming in the nation’s capital, a more congenial tone toward countries outside the U.S. could be on the table, which could provide a spark for ex-US assets, including the Principal International Multi-Factor Core Index ETF (PDEV).

PDEV is designed to provide broad index-aware developed international equity exposure while incorporating a multi-factor model and modified the weighting process to potentially enhance the risk/return profile. The multi-factor model seeks to identify equity securities of companies in the Nasdaq Developed Market Ex-US Ex-Korea Large Mid Cap IndexSM that exhibit potential for high degrees of sustainable shareholder yield (value), pricing power (quality growth), and strong momentum. The fund’s objective is to track the Nasdaq Developed Select Leaders Core Index.

Underscoring the notion that a Biden Administration could be favorable for international equities, the MSCI EAFE Index is higher by almost 8% over the past week.

“A Biden win likely signifies a return to more predictable trade and foreign policy. We believe emerging market (EM) assets should perform on improved trade sentiment, especially in Asia ex-Japan,” according to BlackRock research.

PDEV for a More Global Portfolio

Owing to the Federal Reserve’s move to take interest rates to record lows, the U.S. dollar is sagging this year. Yet greenback weakness doesn’t spell trouble for investors considering international equities.

PDEV can potentially provide investors efficient access to international developed stocks with relatively low tracking error to the international developed market. Its innovative factor definitions and combinations may enhance the risk/return profile without significantly differing from the targeted index holdings. Finally, its index-aware design may make PDEV an attractive replacement for passive, cap-weighted, and active strategies.

“We also see an increased focus on sustainability under a divided government through regulatory actions, rather than via tax policy or spending on green infrastructure, and a rejoining of the Paris Agreement to combat climate change,” according to BlackRock.

There are near- to medium-term catalysts for PDEV.

“The bottom line: A Biden divided government would bring significant changes in foreign policy and regulation – both in substance and tone. Yet the legislative agenda would be constrained, taking off the table the more transformative scenarios being contemplated ahead of the election. The likely implication: continuity in the market environment,” notes BlackRock.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.