A multifactor ETF has the potential to generate attractive returns and reduce volatility compared to traditional cap-weighted funds.

The Hartford Multifactor US Equity ETF (ROUS) is designed to provide equity exposure to the U.S. market with potentially less volatility over a complete market cycle. While multifactor strategy ROUS contains many of the same securities as the vanilla iShares Russell 1000 ETF (IWB), the composition of the two funds looks very different.

The two funds share 349 securities, but the portfolio overlap by weight is just 42%. While IWB tracks the Russell 1000, a cap-weighted collection of U.S. companies based on size, ROUS takes a more methodical approach to providing U.S. equity exposure.

ROUS selects companies that have a favorable combination of low valuation, high momentum, and high-quality investment factors. The Hartford Funds ETF seeks to enhance diversification by reducing concentration at the sector, market cap, and individual company levels.

“Many advisors are concerned the broader market has climbed too far too fast being driven by lower quality companies in 2023,” Todd Rosenbluth, head of research at VettaFi, said. “A multifactor ETF like ROUS could be the right alternative as it takes valuation and quality into account.”

See more: “Help Clients Stomach Small-Cap Volatility With ROSC”

Multifactor ROUS Has Outperformed Benchmark Tracking IWB

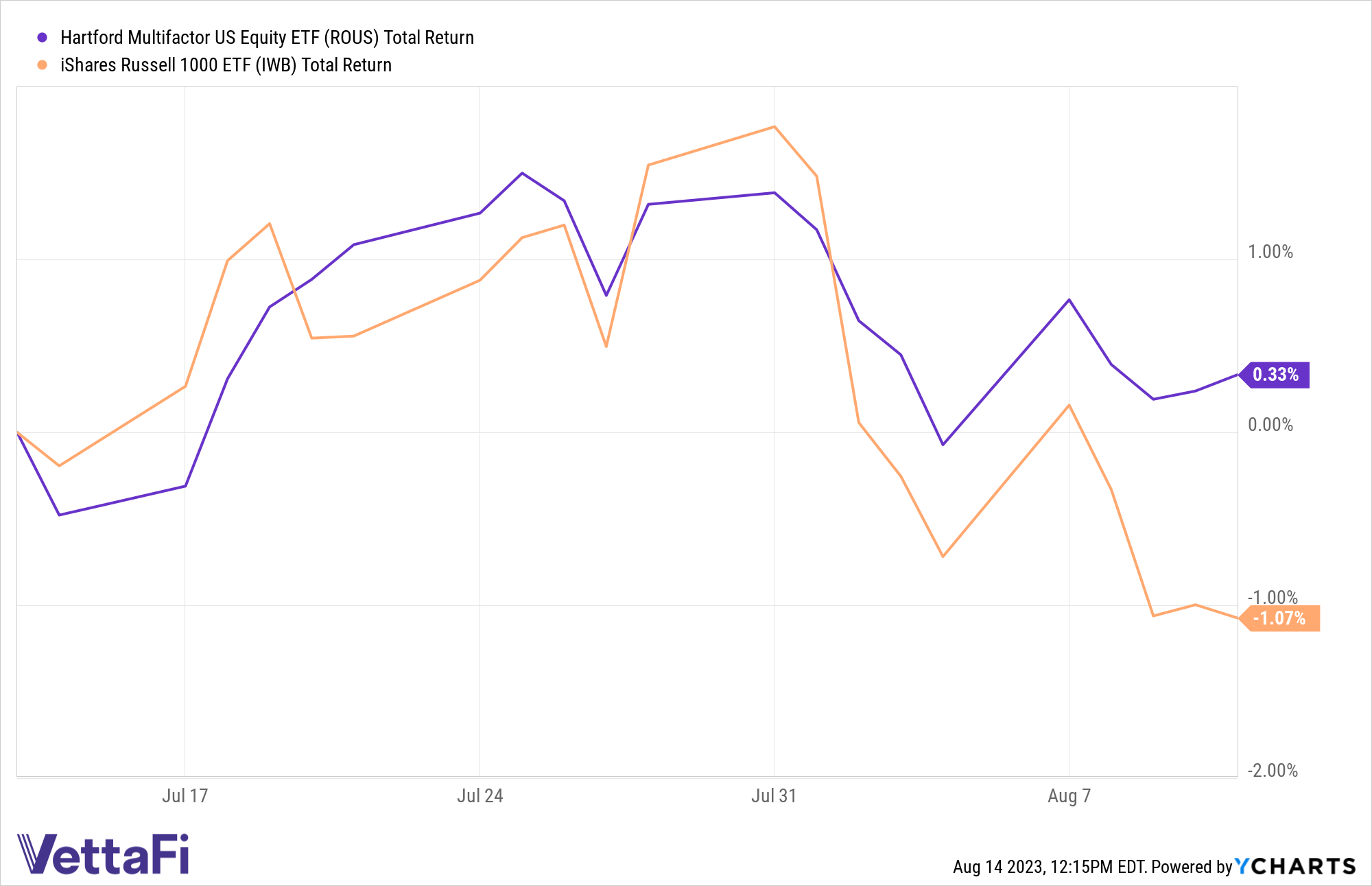

Notably, in the past month, ROUS has held steady while the broader market has declined. ROUS is up 0.3% over one month ending August 10, while IWB has lost 1.1%.

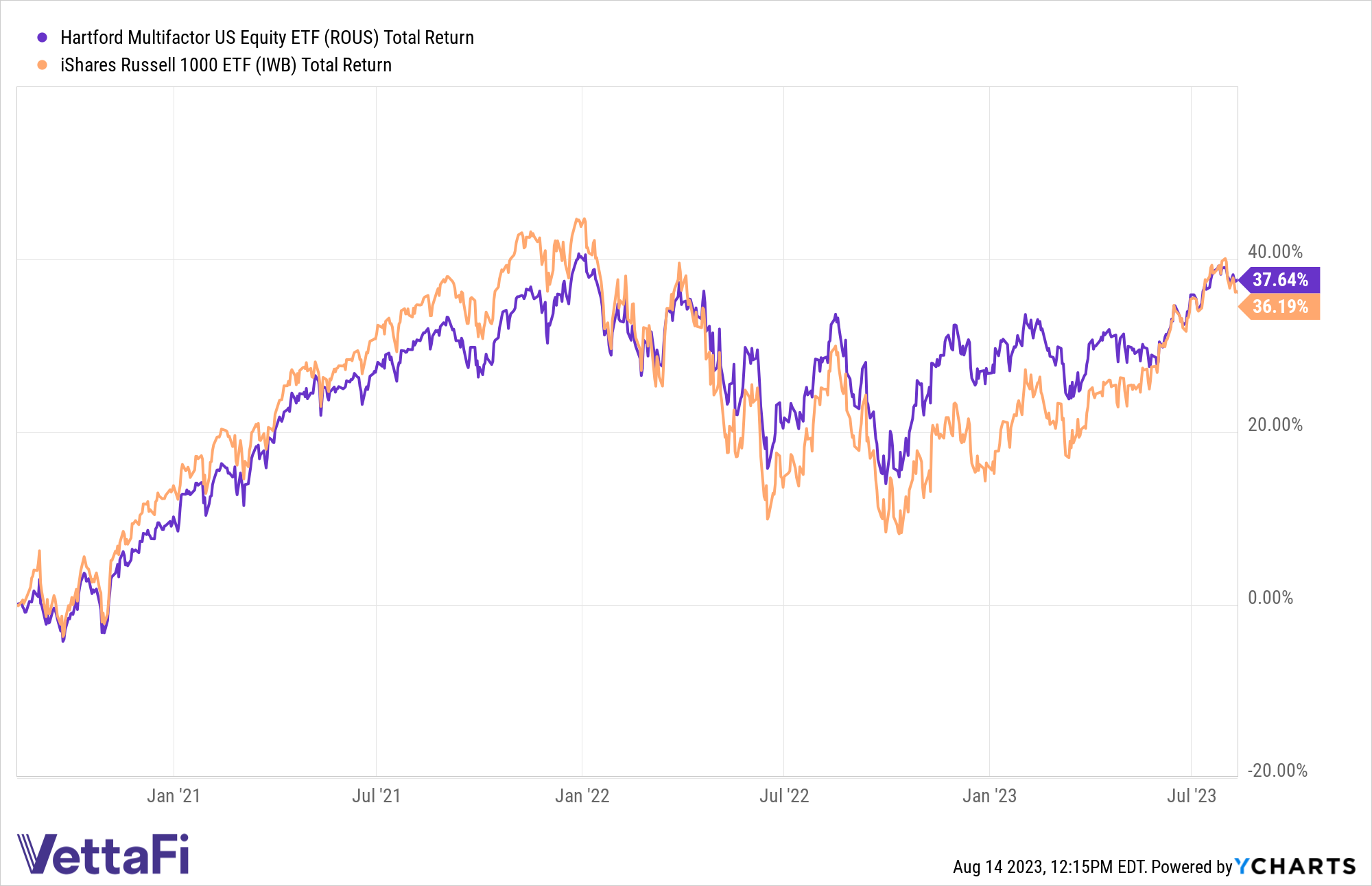

Over three years, ROUS and IWB’s returns are relatively similar. However, investors in ROUS have avoided much of the volatility. ROUS is up 37.6%, while IWB has climbed 36.2% over three years.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.