Looking to a multifactor ETF for small-cap exposure can help add value to client portfolios.

Multifactor ETFs seek to outperform tradition cap-weighted indexes while providing exposure to desired factors. Additionally, a multifactor strategy that aims to reduce risk could be particularly important in the inherently more volatile small-cap space, helping investors maintain their targeted exposure through periods of market turbulence.

“Given the market volatility, advisors should be looking to higher-quality small-cap strategies that are built based on fundamental metrics,” Todd Rosenbluth, head of research at VettaFi, said.

The Hartford Multifactor Small Cap ETF (ROSC) aims to outperform cap-weighted indexes over a complete market cycle with up to 15% less volatility. ROSC invests in companies in the U.S. small-cap universe that exhibit strong and balanced exposure to the value, momentum, and quality factors.

A multifactor approach can lead to a drastically different portfolio than cap-weighted peers, potentially adding value for investors. ROSC looks very different than the iShares Russell 2000 ETF (IWM), which tracks the benchmark Russell 2000.

While both funds offer exposure to small-cap equities, there is only a 16% overlap by weight between the two portfolios. This amounts to around 301 overlapping holdings.

Compared to IWM, ROSC provides more exposure to the information technology, consumer discretionary, and consumer staples sectors. Conversely, ROSC tilts away from the energy, utilities, and financials sectors.

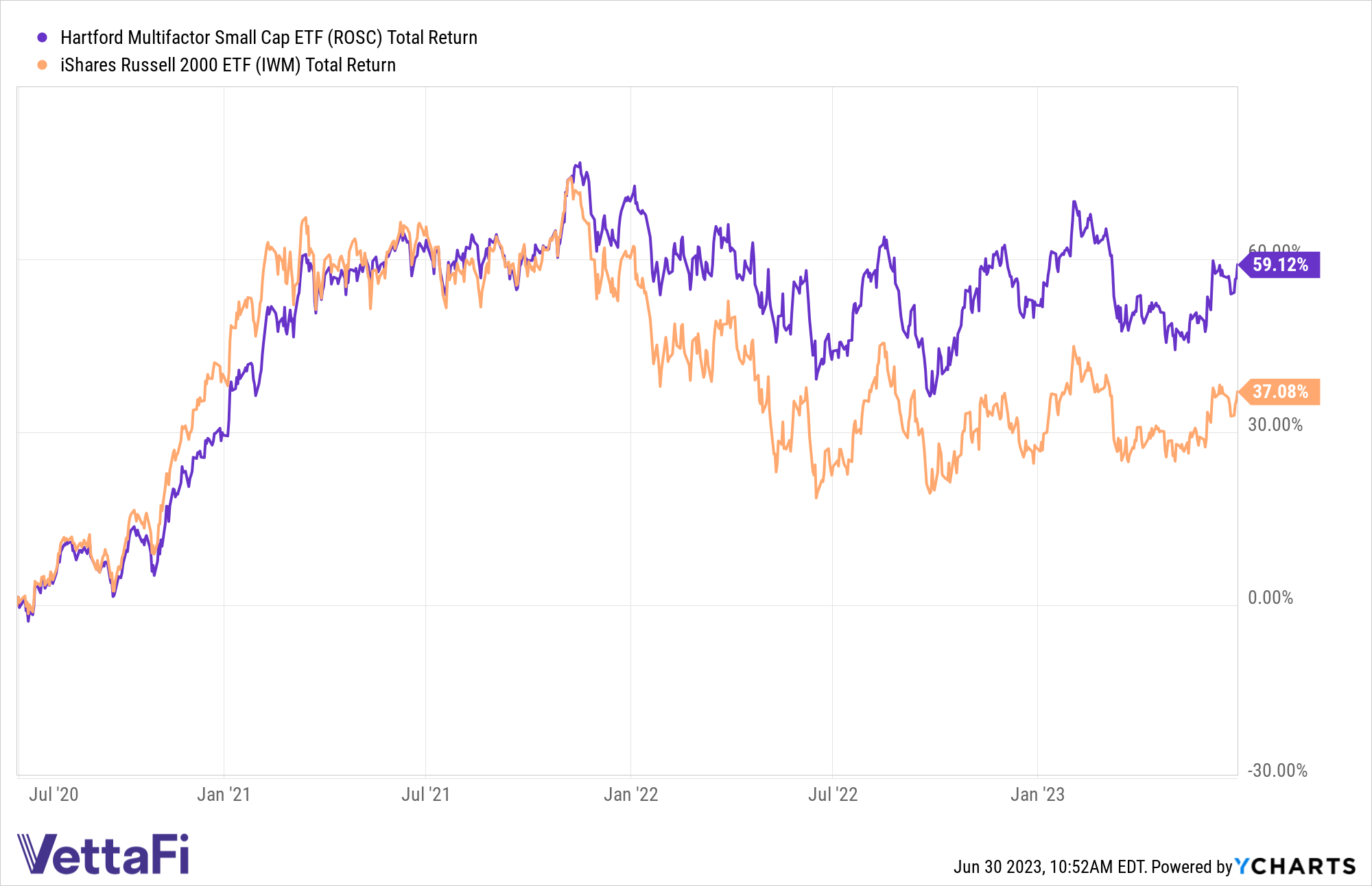

Performance of multifactor ETF ROSC and IWM

ROSC’s multifactor approach has added significant value to portfolios over various periods. Over a one-year period, ROSC and IWM have each climbed 11%. However, the return gap is significant over a three-year period, as ROSC has gained 59.1% and IWM has climbed 37.1% (nonannualized).

Notably, since ROSC’s inception in March 2015, the fund has outpaced IWM by nearly 1,100 basis points.

Under the Hood of a Multifactor Approach

ROSC utilizes an integrated approach to portfolio construction. In other words, the fund selects securities that fit a number of desired factor characteristics rather than dividing its portfolio into different sleeves.

See more: “Multifactor Emerging Markets ETF ‘ROAM’ Handily Outpaces Benchmark YTD”

In an integrated scoring approach to factor implementation, a single composite score comprises the factor scores at the company level. The integrated scoring approach aims to improve the strength and balance of overall factor exposure within a portfolio.

An integrated factor scoring approach generally results in higher factor expression and higher average monthly spread returns than an isolated approach, according to Hartford Funds.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.