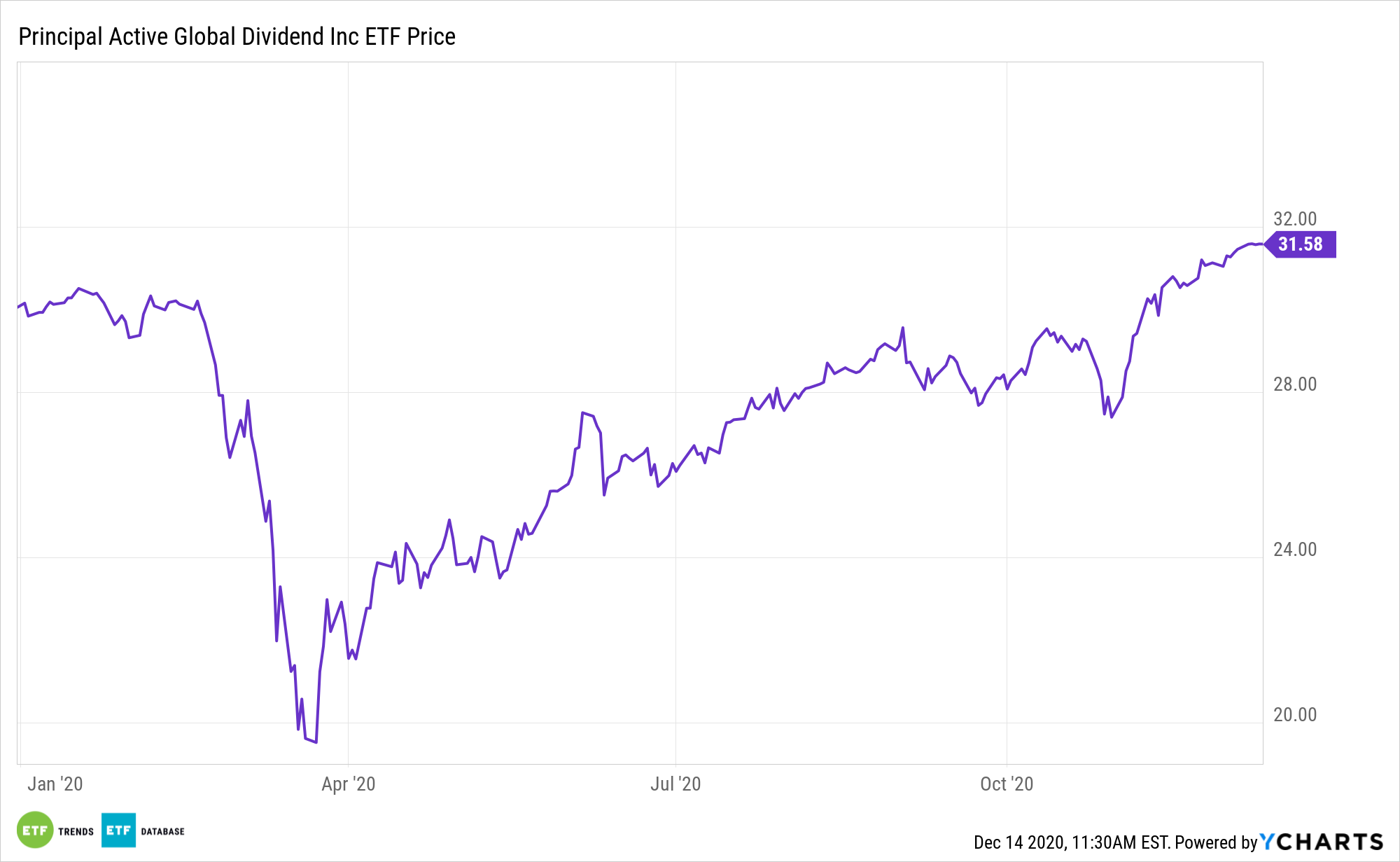

It’s been a tricky year for dividend stocks the world over, but that situation is improving, bringing opportunity with exchange traded funds like the Principal Active Global Dividend Income ETF (CBOE: GDVD).

GDVD will try to generate current income and long-term growth of income and capital by investing in dividend-paying equity securities. The advisors will utilize quantitative screens and research on an industry and company level to identify and monitor companies it believes have the commitment and capacity to pay dividends.

Global dividends are poised to decline this year, but GDVD, which is actively managed, could be in for a brighter 2021.

“Although the prediction by investment firm Janus Henderson represents a smaller dividend drop than some had feared at the outset of the COVID-19 pandemic, it will be the biggest since at least 2009 in the wake of the global financial crisis,” reports Reuters. “Dividends are a major source of income for both public and private pension funds, but companies trying to cope with the coronavirus cut them by $55 billion, or 11.4%, in the third quarter after a $108 billion 22% plunge between April and June when uncertainty over the course of the pandemic peaked.”

GDVD Ready for a Rebound

For income-starved investors, GDVD is a consideration today as the dividend outlook improves. Low bond yields only bolster the case for Principal’s actively managed GDVD.

GDVD holds small-, medium- and large-cap companies in both growth and value styles, along with real estate investment trusts, or REITs. The fund will also hold international companies, with at least 40% of net assets in foreign and emerging market securities. GDVD will typically hold investments tied economically to at least three countries outside the U.S.

“Next year’s rebound could be as high as 12% depending on the path of the pandemic and whether Europe’s banks are allowed to restart dividends again, the report estimated, although in a ‘worst-case scenario’ they might flatline,” Reuters reports, citing Janus Henderson.

The need for global income is more readily apparent as U.S. companies are slashing their dividends in order to preserve cash thanks to the coronavirus pandemic. As more companies are looking to stymie the effects of the pandemic by cutting dividends, investors can look to global yield opportunities. Seeking fixed income opportunities around the globe could help yield-hungry investors satiate their appetites while sectors like manufacturing return to normal.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.