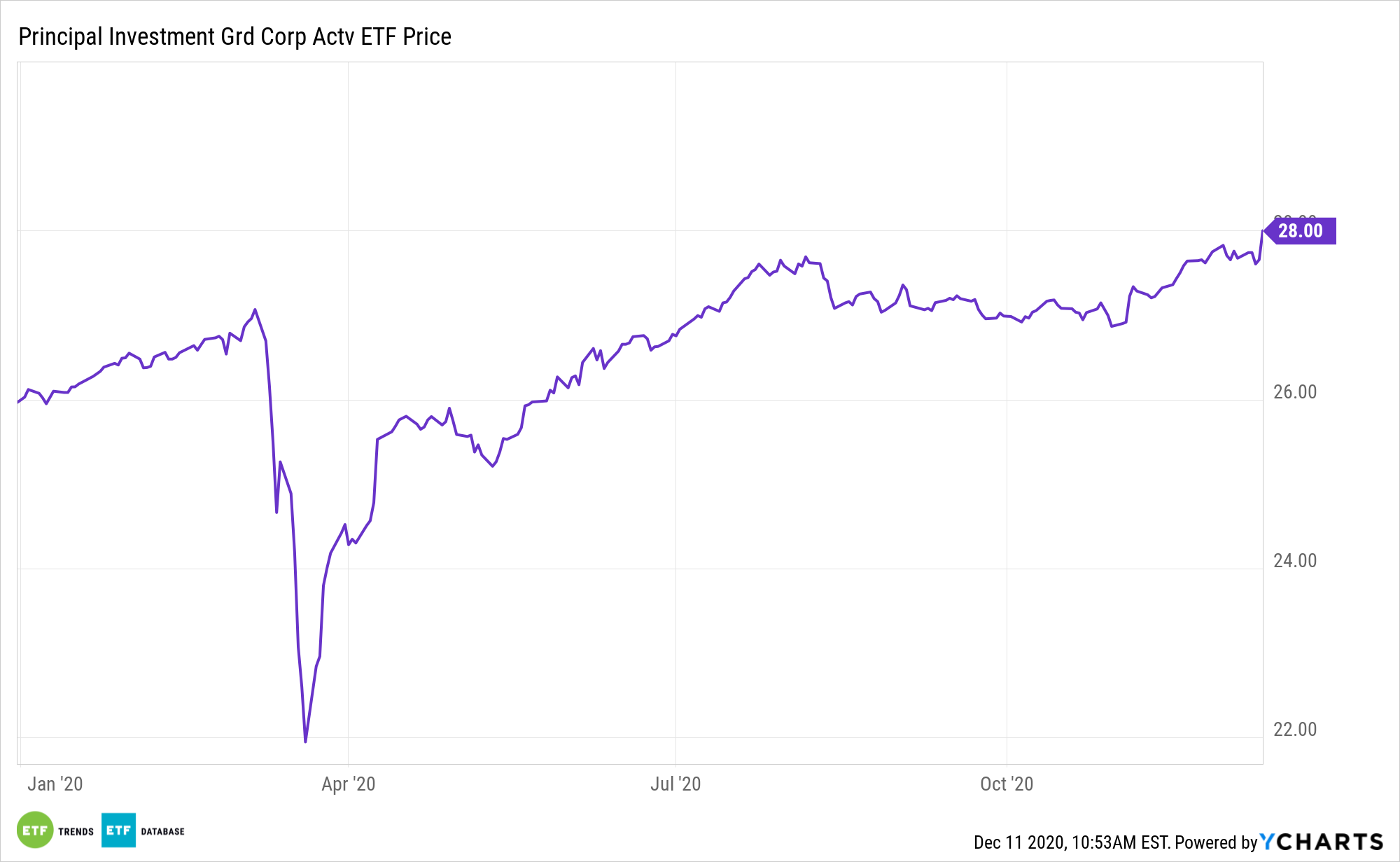

Some investment-grade corporate bond strategies are proving steady amid another spike in coronavirus case counts across the U.S. The Principal Investment Grade Corporate Active ETF (NYSEArca: IG) is certainly one of them.

IG is an actively managed fund, a potentially beneficial trait at a time when demographic shifts could disrupt traditional corporate bond investing. IG tries to provide current income and capital appreciation by investing in investment-grade corporate bonds rated BBB- or higher by S&P Global Ratings or Baa3 or higher by Moody’s Investors Service.

IG is positioned to benefit as a vaccine comes to market and investors price the resilience of riskier assets, even as COVID-19 remains a major issue for the world’s largest economy.

“Hospitalizations related to resurgent COVID-19 have been setting new record highs, but so has the market value of U.S. common equity,” writes Moody’s Chief Economist John Lonski. “Forward-looking financial markets have discounted the unfolding near term loss of business activity to resurgent COVID-19 and, instead, have focused on the faster normalization of economic activity that will occur after a vaccine has been sufficiently distributed. Not only do markets sense that the U.S. will better cope with the latest upsurge by COVID-19 compared with what occurred during March and April of this year, they also believe that when push comes to shove Congress will be quick to compensate those suffering unduly from the virus.”

The IG ETF Methodology

IG combines bottom-up independent credit research with top-down strategy, seeking alpha through credit selection, industry rotation, curve positioning, and a forward-looking, iterative process. This mechanism seeks credits exhibiting a stable-to-improving credit rating trajectory that may benefit from spread compression and income premiums, an approach that’s relevant in today’s corporate credit climate.

“Recent rallies in corporate debt and equities have largely stemmed from widespread expectations of a material expansion by corporate earnings in 2021 and 2022. Today’s relatively thin credit spreads and richly valued equity market warn of harsh corrections if fears of a contraction by corporate earnings take hold,” notes Lonski.

Although IG is an investment-grade fund, there are encouraging signs from the high-yield market.

“Despite resurgent COVID-19, the credit rating revisions of U.S. high-yield issuers show fewer downgrades than upgrades thus far in 2020’s final quarter. An improved outlook for operating profits, the lengthening of maturities and reduction of interest expense brought on by debt refinancings, as well as credit-quality-enhancing mergers and acquisitions help to explain the arrival of negative net high-yield downgrades,” adds Lonski.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.