Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon discuss the case for and against multifactor ETFs.

Elle Caruso, staff writer, VettaFi: Hey, Karrie! Looking forward to discussing the investment case for multifactor ETFs.

The way I see it, multifactor ETFs allow investors to take smarter risks. Especially in the current environment, characterized by a lot of uncertainty, a low volatility overlay can help investors maintain target exposure and stay invested through choppy markets.

Karrie Gordon, staff writer, VettaFi: Hi, Elle! I’m looking forward to diving into multifactor and factor investing with you. Arguments for multifactor investing don’t hold up against the enhanced risk inherent in factor investing, in my opinion. Factor drawdowns are pronounced and significant, and I just don’t think most advisors and investors have the stomach for these strategies long-term for a number of reasons.

A Game of Risk in Equities

Caruso: Many investors are unaware that cap-weighted ETFs can introduce unintended risks to portfolios. This includes concentration risk, valuation risk, and volatility risk. Multifactor ETFs seek to target desired return-enhancing factors and reduce exposure to unrewarded risk exposures.

Particularly in the U.S. large-cap space, many investors look to top-heavy, growth-tilted indexes such as the S&P 500. However, being overly concentrated at the company level introduces significant idiosyncratic company risk to a portfolio. Multifactor ETFs seek to avoid concentration at the market cap, sector, and individual company levels.

Additionally, investors can avoid single-factor risks by investing in an integrated multifactor ETF instead of an isolated/sleeve approach. An integrated approach selects securities that fit a number of desired factor characteristics. This approach aims to improve the strength and balance of overall factor exposure within a portfolio. An integrated factor scoring approach typically results in higher factor expression and greater monthly spread returns than an isolated approach.

Multifactor ETFs Aren’t Without Risk

Gordon: Investing in factors rose to prominence in the last decade, though factor investing has been popular for much longer. Factor investing is cyclical, which makes factor investing highly susceptible to abrupt trend changes — and sentiment changes — as well as market inflection points. In short, factor investing largely generates more volatile and unpredictable returns.

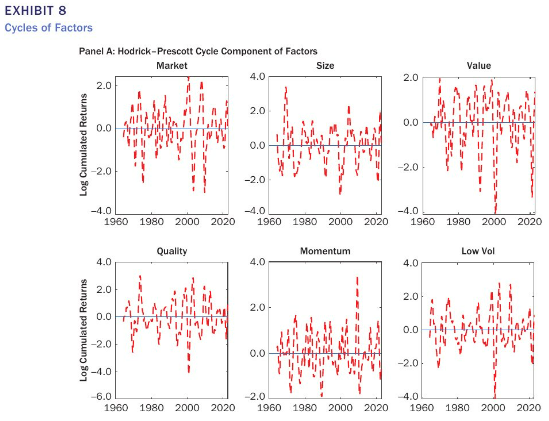

BlackRock published a great lookback on factor strategies of the last century using Hodrick-Prescott filters to smooth trends and calculate cumulated returns for various factors. The results unequivocally demonstrate the enhanced risk involved in factor investing.

Image source: BlackRock. Click to enlarge.

You need look no further than the popular momentum factor to find a long history of spectacular crashes, dubbed momentum crashes. In April 2009, the momentum trade yielded returns of -36%. In fact, in the three months including April 2009, momentum dropped more than 73%. Between 1999–2019, momentum lost more in its crashes than it made up for in its bull runs.

This performance profile isn’t unique to just momentum. Indeed, each factor carries its own specific risk profile with potential for this caliber of drawdown. The argument for combining factors into a singular strategy is that of diversification, but when market inflection points happen, non-correlated asset classes will often move in tandem. (I’m looking at you, 2022.)

This means that sometimes you inadvertently stack all the crash potential of individual factors into one strategy. When the S&P 500 dropped 30.4% on a total returns basis between February 1, 2020, and March 23, 2020, the Vanguard U.S. Multifactor ETF (VFMF) dropped 38.24% over the same period.

While the longer-term returns level out, I don’t know many investors that are willing to stomach the periods of underperformance, given the magnitude of factor drawdowns.

Risk-Adjusted Return Opportunities

Caruso: Multifactor ETFs have the potential to enhance risk-adjusted returns. The Hartford Multifactor US Equity ETF (ROUS) and the iShares Russell 1000 ETF (IWB) have very similar total returns over a three-year period; however, ROUS looks a lot better on a risk-adjusted basis.

ROUS is a multifactor U.S. equity ETF designed to offer 15% less volatility than traditional cap-weighted indexes over a full market cycle. Notably, about 75% of ROUS’s holdings demonstrate lower volatility than IWB’s underlying index, the Russell 1000 Index. Since 2019, ROUS has had a beta of 0.86, as of March 31.

Relative to the IWB, ROUS is underweight on mega-cap giants including Apple, Microsoft, Amazon, and Nvidia. Instead, ROUS offers more balanced, diversified access to the full U.S. market, reducing concentration risk.

Notably, there is only a 42% overlap by weight between the two portfolios, as of July 17.

Complexity and Concentration Risk

Gordon: Enhancing risk-adjusted returns in current markets is particularly important this year, but I still remain leery that factors are the answer here. Multifactor ETFS may be enticing, but the methodology used in multifactor strategies is often complex and convoluted.

Factor investing requires an extreme level of due diligence and carries a great educational burden. Advisors and investors not only need to understand the importance of looking beyond average returns, but also how the factors are defined and classified in each individual strategy.

Factor investing is convoluted on a fundamental level. Not only is there an ever-increasing variety of factor investing buckets — there are over 400 factors published in academia as of 2019 — but there is also no real agreement on how even the largest factors are defined. Take value, for instance, which is one of the longest-established types of factor investing.

Many value strategies look at the book-to-market ratio as a core data point to indicate value. It’s a measurement that increasingly doesn’t hold up in modern markets, however, particularly within the technology sector. Many of today’s tech companies hold little in terms of tangible assets; most of their value is tied up in intangibles.

Some value factor strategies include intangibles, and some don’t. Some strategies weight heavily into less-expensive sectors while shorting expensive industries as a way to capture value. (This particular value factor methodology hasn’t proven to enhance returns on any level.)

Many factor-based funds also end up with heavy concentrations to specific sectors, such as low volatility’s concentration in utilities and real estate between 1991–2018. Multifactor ETFs sometimes mitigate this concentration risk. However, they also have the potential to enhance it, depending on what factors are tracked.

Understanding how factors are defined, what metrics are utilized, and how they’re measured is incredibly important when it comes to this type of investing. Transparency of fund methodology and holdings is critical in factor and particularly multifactor ETF investing.

Taking Multifactor ETFs Global

Caruso: I’ve largely focused on using multifactor ETFs for U.S. large-cap exposure; however, these funds can be even more powerful in the small-cap and international equity space.

U.S. small-caps and international markets are both inherently more volatile than U.S. large-caps. This is where low volatility and value factor expressions can be particularly impactful and lead to outperformance.

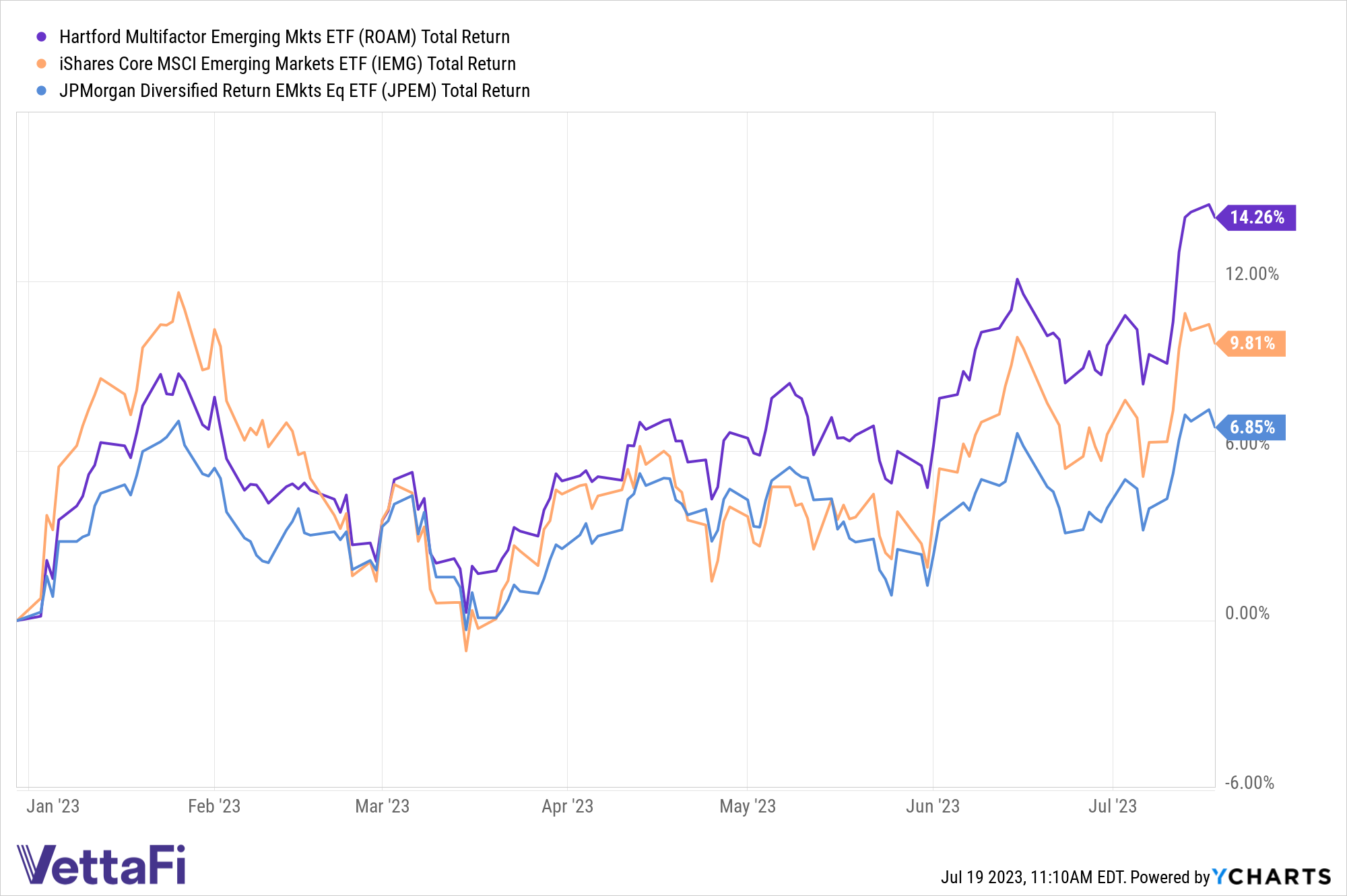

For example, the Hartford Multifactor Emerging Markets ETF (ROAM) has demonstrated strong performance this year. ROAM has outpaced the benchmark as well as its passive multifactor category peers. ROAM is up 14.3% year-to-date, while the iShares Core MSCI Emerging Markets ETF (IEMG) is up 9.8%. Meanwhile, the JPMorgan Diversified Return Emerging Markets Equity ETF (JPEM) has returned just 6.9%.

ROAM’s methodology targets the value, momentum, and quality factors for a 15% volatility reduction over a full market cycle. Presumably, it’s the highlighting of those specific factors that has led to the fund’s outperformance.

Better Options for Non-Correlated Returns

Gordon: Those are noteworthy returns in a challenging market environment. However, in an environment fraught with a number of risk factors, factor investing is the equivalent of making a bet on a specific type of market risk. When that risk flips, it can cause serious pain for investors.

Given the prolonged market and investor uncertainty of the last 18 months and the continued uncertainty regarding the Fed path and inflation looking ahead, these seem like subpar times to be making any kinds of risky bets. There are other strategies that could prove better hedges against uncertainty and risk than multifactor investing in today’s environment.

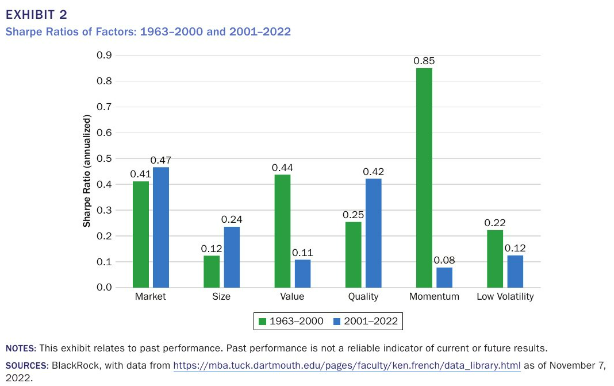

Individual factors are risky and can be extremely painful for portfolios. The momentum factor crashes spectacularly on a semi-regular basis. Further, value factor investing generated annual returns of 1.5% between 2001 and August 2022, according to BlackRock research.

Image source: BlackRock. Click to enlarge.

Multifactor investing works to diversify these risks, sure. However, it comes with both a sharp learning curve and a need for constant due diligence. What’s more, these strategies carry fairly significant tracking errors (up to -21% over a nearly 30-year period, as measured by Nicolas Rabener, managing director of FactorResearch).

Investors looking for diversification opportunities would do better to look to other avenues for non-correlated returns. For advisors and investors that do not mind complexity and due diligence, managed futures strategies are worth consideration. They offer low and often negative correlation to stocks and bonds. They’re also known for their ability to respond rapidly to changing market trends. Funds like the iMGP DBi Managed Futures Strategy ETF (DBMF) and the KFA Mount Lucas Index Strategy ETF (KMLM) are strong contenders within the class.

For those investors looking to keep things simple but with an eye towards concentration risk within equities, the Invesco S&P 500 Equal Weight ETF (RSP) is a fund to consider.

Elle, it’s been really great chatting factors and multifactor ETFs. While the funds you mentioned offer noteworthy short-term returns, overall this investment strategy carries too much enhanced risk and potential pain for portfolios for my taste.

Caruso: Karrie, you make some good points, and I agree that targeting single factors often leads to undesired qualities. For example, you cited RSP. However, targeting the small size factor also introduces greater volatility and tilts away from quality. Multifactor ETFs using an integrated approach have demonstrated their ability to enhance returns and mitigate volatility and other risks. I think this is a huge opportunity for investors and is worth consideration. Plus, unlike managed futures ETFs that charge high expense ratios, multifactor ETFs cost around as much as other equity funds, allowing them to be a core holding in portfolios.

For more news, information, and analysis, visit the Multifactor Channel.