As China stocks continue to fall, investors may want to ensure their emerging markets exposure diversifies away from the country.

China stocks have been pressured by a weakening yuan and waning investor optimism toward the world’s second-largest economy. In the weeks following the authorities’ stimulus policy and promise to energize the economy, China’s economy has shown clear signs of a slowdown.

As investors look to avoid the fallout, its essential that investors understand how exposed their portfolios are to China.

It’s important to note that investors can underweight China but retain their emerging markets exposure. A fund like the Hartford Multifactor Emerging Markets ETF (ROAM) underweights mega-cap tech and Chinacompared to category peers such as the iShares MSCI Emerging Markets ETF (EEM), the Vanguard FTSE Emerging Markets ETF (VWO), the SPDR Portfolio Emerging Markets ETF (SPEM), and the Schwab Emerging Markets Equity ETF (SCHE).

How Underweighting China Impacts Performance

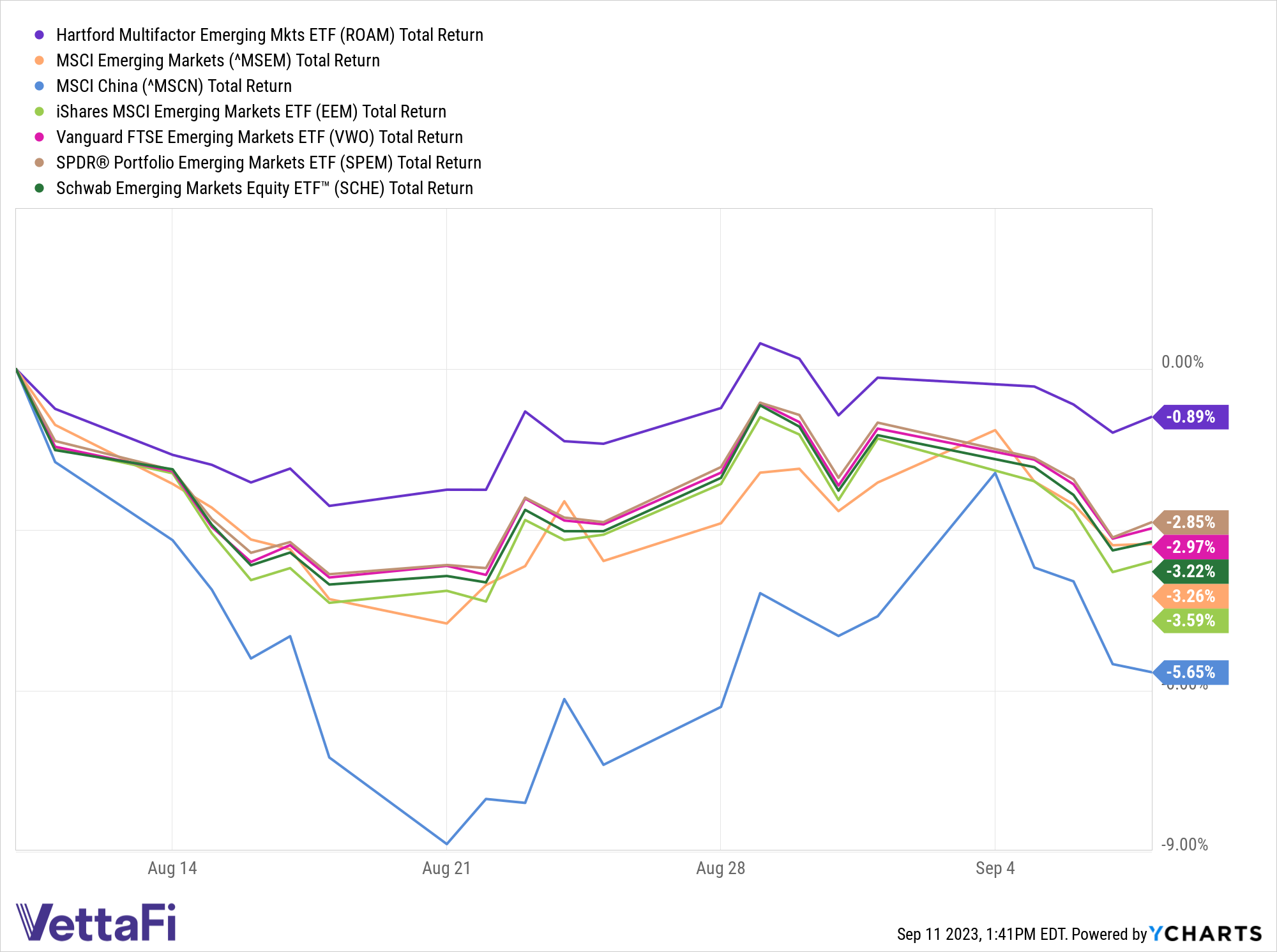

ROAM’s underweight to China has led the fund to outperform its peers in the past month as China stocks have struggled. While the MSCI China index is down 5.7% in the past one-month period, ROAM has stayed fairly flat, declining just 0.9%.

See more: “ROAM Outperforms EEM by 7.4% YTD, Limits Losses”

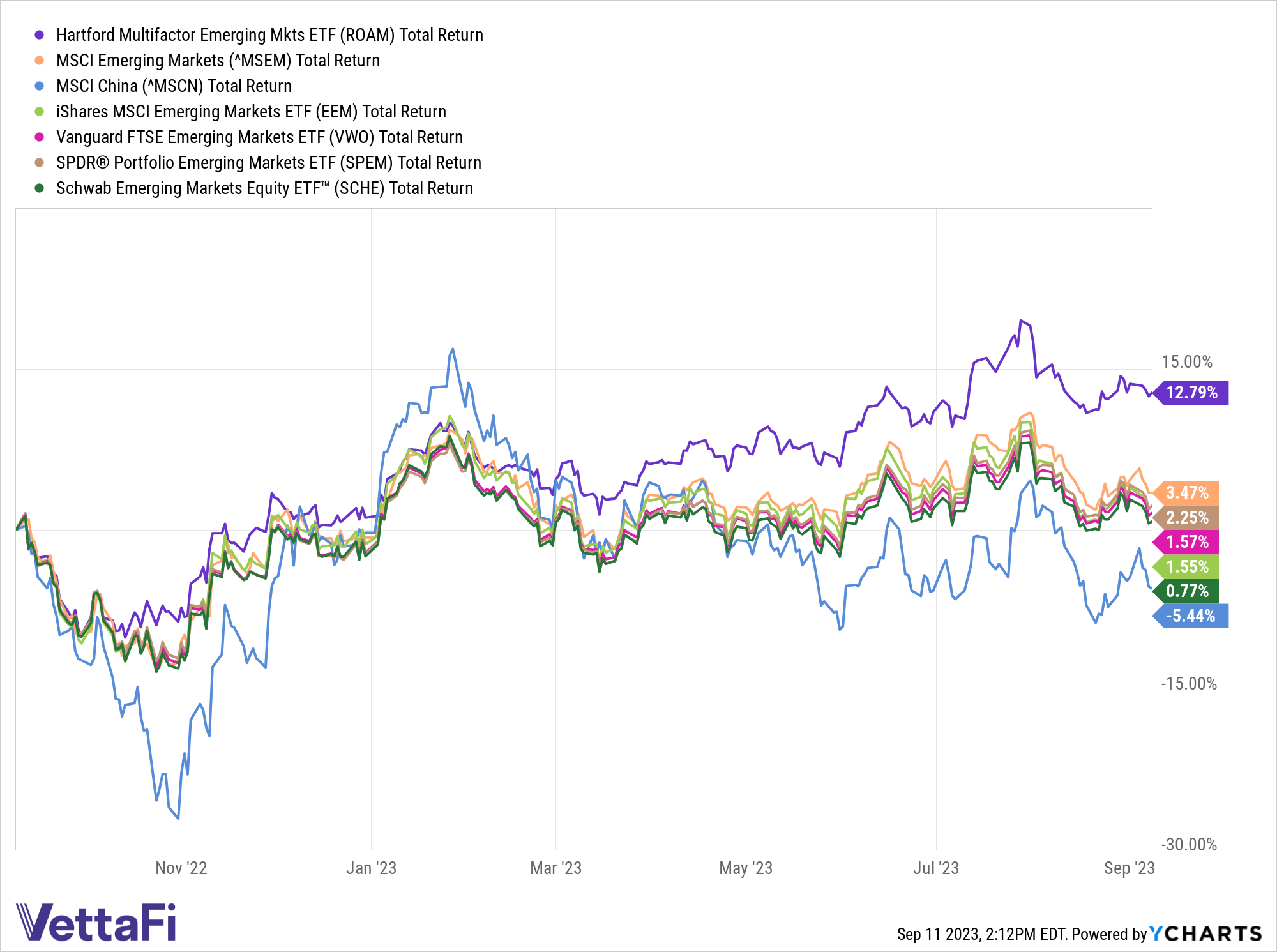

It may seem like the simplest way to avoid China stocks’ losses is to divest from emerging markets entirely. However, investors would miss out on some compelling gains and diversification benefits.

Broad emerging markets ETFs are struggling over the past month. However, looking at the past year highlights the value emerging markets exposure underweight China can add to portfolios.

ROAM has climbed 12.8% in the past one-year period, while enhancing portfolios’ total returns and diversification. Notably, during the same period, the MSCI China index has dropped 5.4%.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.