Covid-19 put the hammer down on emerging markets (EM) just as the group was getting 2020 started on the right foot. However, now could be an opportune time for getting EM exposure as economies try to recover from the pandemic.

Reasons for EM weakness, per a Stock News article, include “overvaluation, weakness in global growth, and the strong dollar. Over the last 4 years, this trend continued as emerging markets were flat, while the S&P 500 is 50% higher.”

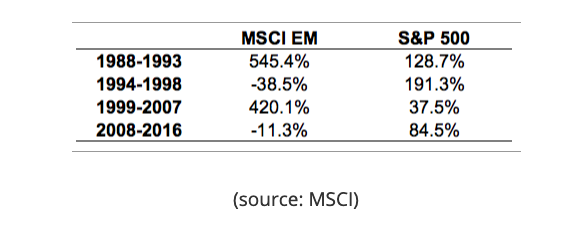

While the EM space has seen better days, historically the group has the ability to outperform given its history versus developed markets. Looking at the chart below, the Stock News article cited the underperformance during the past 12 years, but also its outperformance in previous time periods–namely 1988-1993 and 1999-2007.

What factors can shift the tide for EM moving forward?

“Some reasons that emerging markets have historically outperformed are that they have higher growth rates, younger populations, and are the beneficiaries of globalization,” the article added. “Globalization increased connectivity, and the rise of remote work have transformed the business landscape and opened up all types of opportunities to people all over the world. As a result, people and businesses in emerging markets can compete for work that was once only available in developed markets.”

ETF Emerging Markets Exposure

For broad exposure to emerging markets, ETF investors can take a look at the FlexShares Morningstar Emerging Markets Factor Tilt Index Fund (TLTE). The fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Morningstar® Emerging Markets Factor Tilt IndexSM.

The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to size and value factors relative to the Morningstar Emerging Markets Index, a float-adjusted market-capitalization weighted index of companies incorporated in emerging-market countries. The fund will invest at least 80% of its total assets in the securities of the index and in ADRs and GDRs based on the securities in the index.

Another fund is the FlexShares Emerging Markets Quality Low Volatility Index Fund (QLVE). QLVE seeks investment results that correspond generally to the price and yield performance of the Northern Trust Emerging Markets Quality Low Volatility IndexSM, which is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to a broad universe of securities domiciled in emerging market countries.

For more market trends, visit ETF Trends.