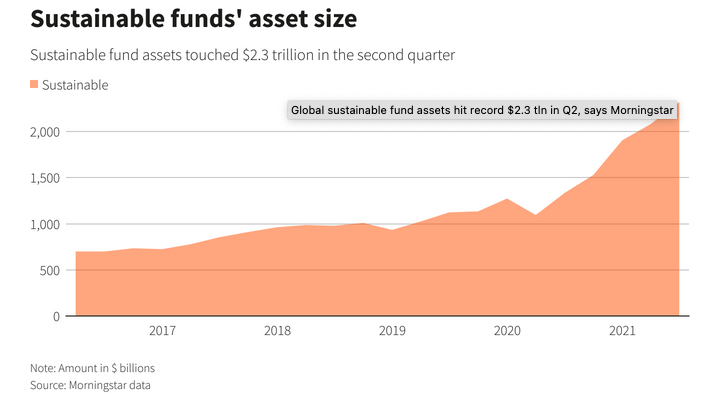

Environmental, social, and governance (ESG) continues to shine, despite a minor setback in the second quarter, as sustainable fund assets hit record highs.

“Global sustainable mutual fund assets hit a fresh record high in the second quarter, led by flows into equities, although the pace of net inflows slowed from the prior quarter, data from Morningstar showed,” a Reuters article explained. “Funds focused on environmental, social and governance (ESG)-related issues saw their combined assets climb to $2.3 trillion for their fifth consecutive quarter of growth, up 12% from the end of March.”

However, net inflows were down in Q2 by 24%. Despite this, the growth trajectory for sustainable fund assets looks strong, according to Morningstar.

“An increase in the number of sustainable products across the globe, market appreciation, and positive inflows continued to drive global sustainable fund assets upward,” said Morningstar. “Inflows in the second quarter have faltered, but asset growth remain strong.”

A notable statistic in the Morningstar report was the fall in fixed income sustainable funds. Net inflows dropped 41% as investors opted for shorter duration debt.

“Overall, fixed income funds registered an increase in inflows over the period as investors poured money into duration-shortening strategies to protect portfolios against the risk of rising interest rates in the face of creeping inflationary pressures,” Hortense Bioy, global director of Sustainability Research, told Reuters. “A lack of options in the ESG fixed income space – and the focus on corporate bonds – means that ESG funds didn’t benefit from that trend.”

An ETF Capturing ESG’s Global Impact

One way to capture the global impact of ESG is via the FlexShares STOXX Global ESG Impact Index Fund (ESGG). Per the fund description, ESGG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® Global ESG Select KPIs Index.

The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® Global 1800 Index, a float-adjusted market-capitalization weighted index of companies incorporated in the U.S. or in developed international markets. The fund uses the index as its starting point and then sifts through companies, weeding them out based on the following criteria:

- Companies that do not adhere to the U.N. Global Compact principles

- Companies involved in controversial weapons

- Coal miners

For more news, information, and strategy, visit the Multi-Asset Channel.