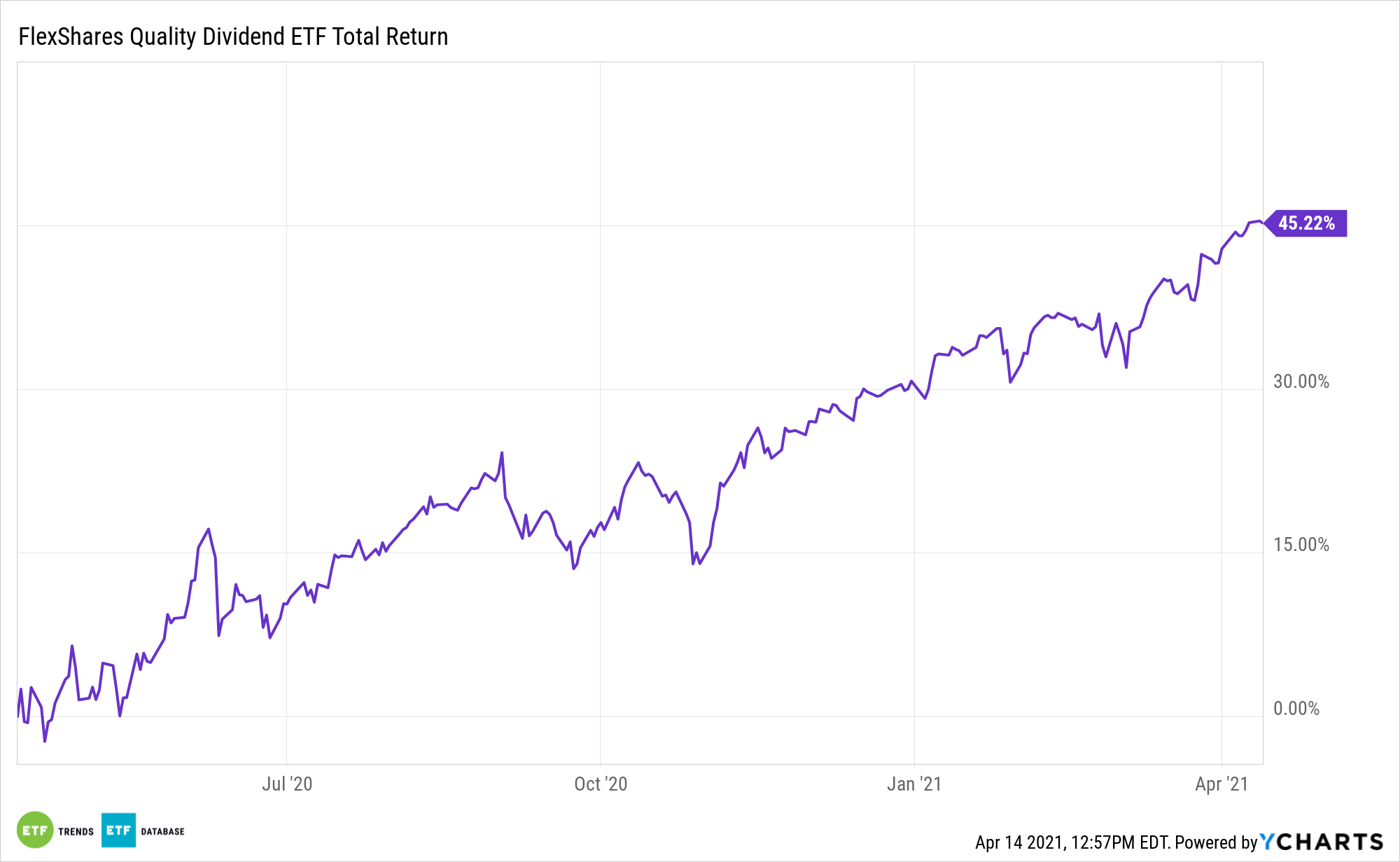

Dividend growth is back in a big way. Investors have good cause to revisit quality payout growth with the FlexShares Quality Dividend Index Fund (NYSEArca: QDF).

QDF’s underlying benchmark targets management efficiency or quantitative evaluation of a firm’s deployment of capital and its financing decisions. By using a management efficiency screen, the index can screen out firms that aggressively pursue capital expenditures and additional financing, which typically lose flexibility in both advantageous and challenging partitions of the market cycle.

“On a per share basis, S&P 500 Q1 2021 dividend payments for the S&P 500 increased 0.2% to $14.68 from Q4 2020’s $14.64 and were down 4.2% from the Q1 2020 record $15.32 payment,” according to S&P Dow Jones Indices. On an aggregate basis, index components paid $123.9 billion in dividends in the quarter, up from $121.6 billion in Q4 2020.”

The QDF Thesis

QDF’s methodology goes beyond prosaic measures such as dividend increase streaks. In fact, it can be argued that the FlexShares fund is far more stringent when it comes to sourcing reliable dividend growth. The ETF emphasizes the quality factor, of which a company’s ability to generate free cash and dividend growth and stability are integral tenants. Another element that has been critical to QDF’s success is the emphasis on management efficiency and a company’s ability to generate cash. Company stocks that issue high dividend yields can be masking their distressed books. Consequently, these quality dividend ETFs try to limit the impact of these value traps by requiring a history of sustainable dividend growth.

Many of last year’s dividend offenders are resuming payouts – another sign of growth that supports the case for QDF.

“Companies that suspended their dividends have started to pay again, while others who decreased their dividends or left them unchanged in 2020 have resumed increasing payments,” said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. “The dollar amount of dividend increases in U.S. common stocks in Q1 2021 was the largest since Q1 of 2012 as reductions significantly declined in the quarter.”

QDF is also relevant because of emerging inflationary pressures.

Dividend growth as a means of trumping inflation could and arguably should serve to highlight the advantages of the ETFs that focus on dividend growth stocks. That group is comprised of well-established ETFs that emphasize dividend increase streaks as well as unique funds that look for sectors chock-full of stocks that have the potential to be future sources of dividend growth.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.