The U.S. Federal Reserve was going to eventually taper its stimulus measures once the economy was strong enough, and now that the time is here, low volatility funds can be of benefit.

Forthcoming volatility in the equities market could be ahead, especially with headwinds like inflation looming. Investment banks are already shoring up client portfolios in order to prep for the roller coaster ride.

“Wall Street banks are intensifying preparations for the Federal Reserve’s withdrawal of pandemic stimulus to ensure they are able to handle spikes in market volatility, help clients manage their risks — and score a profit,” Reuters said.

With the official announcement from the Fed, “sales and trading teams are hearing more from clients concerned about the ramifications for their portfolios and the longer-term implications of rising rates and higher inflation, several senior bankers said.”

There are a number of ways to help mute the volatility, especially when it comes to the equities markets. Diversifying risk away by adding other uncorrelated assets can be an option, but there’s an all-encompassing option that investors can get with one exchange traded fund (ETF).

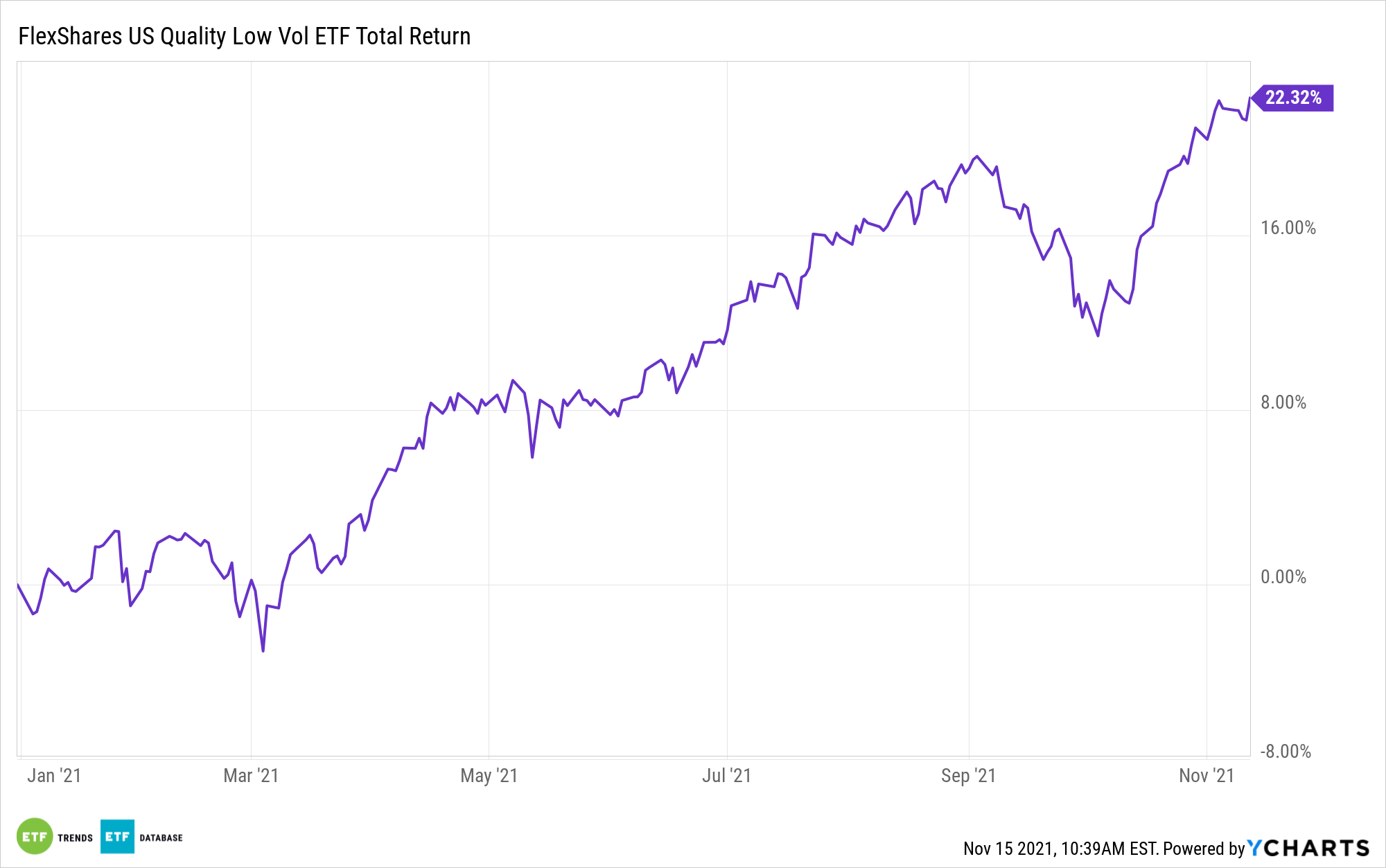

A Low Volatility ETF Option

An option to consider is the FlexShares US Quality Low Volatility Index Fund (QLV). With a 0.22% net expense ratio, the added low volatility feature doesn’t come at a high cost.

QLV tracks a proprietary index of U.S. companies that aims for a portfolio bias toward quality and reduced volatility. The index methodology first assesses financial strength and stability based on quality metrics like profitability, management efficiency, and cash flow. The lowest-scoring companies are excluded.

QLV seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Low Volatility Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to the Northern Trust 1250 Index, a float-adjusted market capitalization-weighted index of U.S. domiciled large- and mid-capitalization companies.

“The FlexShares US Quality Low Volatility Index Fund (QLV) is designed to provide exposure to US-based companies that possess lower overall absolute volatility and that also exhibit financial strength and stability, which we believe are quality characteristics,” a FlexShares Fund Focus said.

For more news, information, and strategy, visit the Multi-Asset Channel.