With President Biden’s massive infrastructure pitch looming, investors can prepare for an uptick in government spending in a variety of ways. The FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA) is one of the best ideas.

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from the infrastructure business, providing exposure to both traditional and non-traditional infrastructure sectors.

“Biden is expected to unveil the first of a two-part spending proposal Wednesday, focused on infrastructure upgrades. That topic has been a major theme of Biden’s campaign and early presidency and the ‘Build Back Better’ approach,” reports Jesse Pound for CNBC.

The infrastructure category has historically offered higher dividend yields than global fixed income and global equities, along with greater predictability of long-term cash flows. NFRA may be able to capture the growing demands of economic development that are driving more funding into transport, power, and other systems.

NFRA Reclaims the Spotlight

Infrastructure exposure can also help protect against long-term inflationary risks since most infrastructure operators pass through the cost increases of inflation to users through the long-term contracts that typically underpin the infrastructure business models.

“One key to building out U.S. infrastructure will be increasing the production of semiconductors domestically, as a global shortage and tensions with China have made policymakers wary of relying on international production,” according to CNBC.

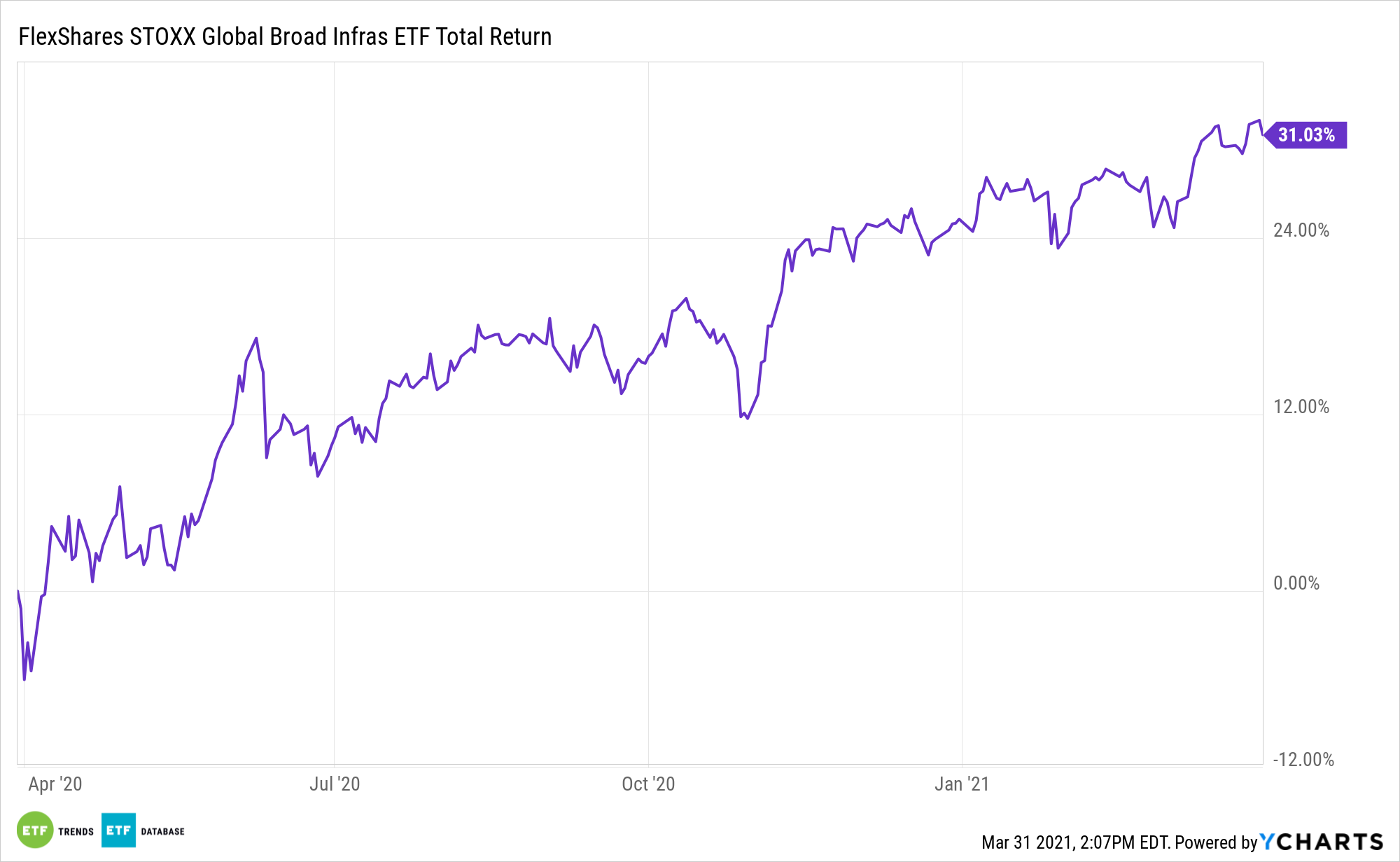

Data confirm there are good reasons for investors to consider infrastructure over the coming months.

NFRA’s index focuses on long-lived assets in industries with very high barriers to entry, with at least 50% of their revenue from key sectors with a 3-month average daily trending volume of at least $1 million. The portfolio is weighted based on a free-float market cap with certain constraints to limit exposure in any one security, sub-sector, or country. The fund is rebalanced annually.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.