Inflation remains a controversial topic, but there are strong indications that it’s likely to rise over the next several years.

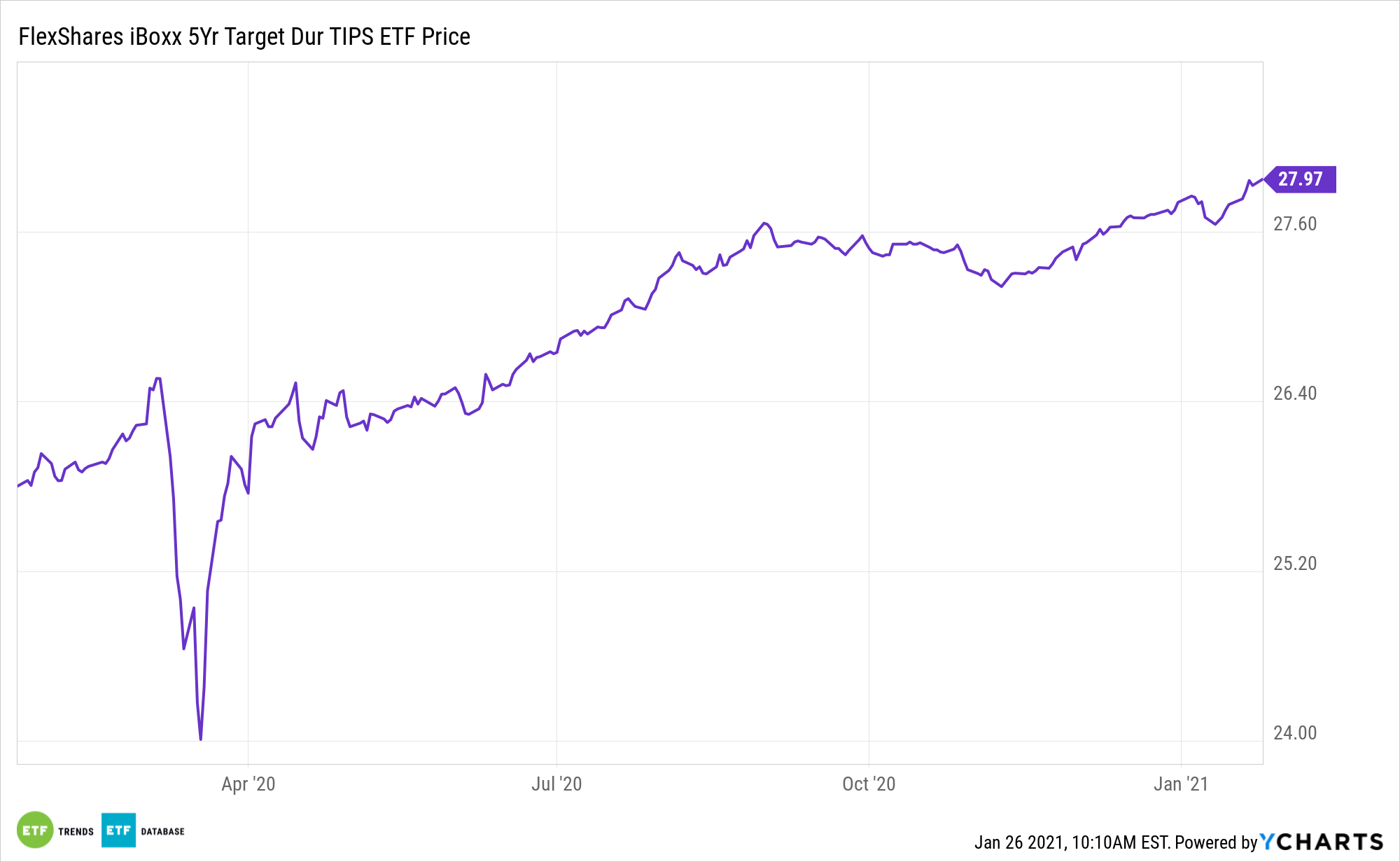

That would be good news for the FlexShares iBoxx 5Yr Target Duration TIPS ETF (NYSEArca: TDTF) and the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEArca: TDTT). TDTF tracks the iBoxx 5-Year Target Duration TIPS Index.

“The outlook for the US economy will remain challenging over the next several months as the COVID-19 pandemic continues to rage across the country,” notes Moody’s Investors Service. “However, the pace of economic recovery likely will strengthen in the second half of 2021 once pandemic concerns begin to recede. Recently, the expectation of an earlier and stronger recovery has fueled US reflation trades, as market expectations of inflation have steadily climbed over the last few weeks from March lows.”

TDTF, TDTT Ready for Action

Treasury Inflation-Protected Securities (TIPS) are popular among fixed income investors looking to protect against the scourge of inflation. ETFs can make it easier to access TIPS.

By many accounts, official inflation remains muted, but that ignores an array of price increases across everyday categories. It also ignores other ample signs of rising inflation.

“Several factors are bolstering expectations for strengthening inflation, along with a rapid recovery in US economic activity in the second half of the year: the rollout of coronavirus vaccines, easy credit conditions, and the prospect of additional fiscal support and enhanced pandemic management put forward by the new US administration and backed by the Democratic majorities in both chambers of Congress,” writes Moody’s.

Investors will typically look at TIPS ahead of an inflationary period since buying TIPS after inflation has gone up would mean the security has already priced in the inflation. Investors do not want to overpay for the TIPS exposure.

“In contrast to previous recessions during which median wage growth declined, the data show that median wage growth has held up over the last eight months at around 3.5% on an annual basis, similar to 2019 levels,” notes Moody’s. “If the US can avoid a further broad-based deterioration in the economy and the labor market while pandemic woes persist, wages and the purchasing power of many households likely will remain intact, supporting a recovery in household demand.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.