Amid an impressive earnings boom, these should be go-go days for European equities. Price action says otherwise, indicating investors mulling exposure across the Atlantic might want to do so in non-dedicated form.

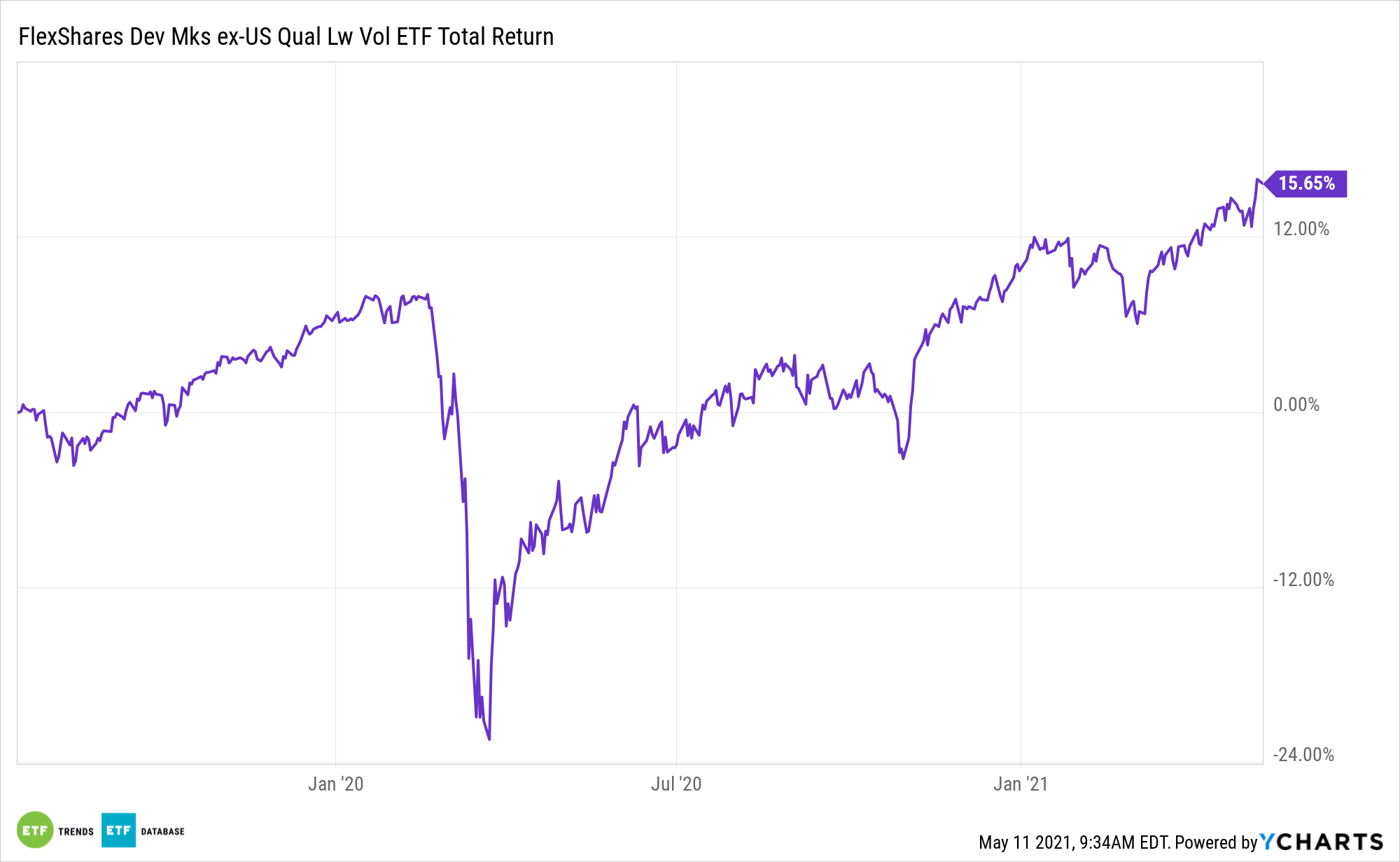

The FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD) is a practical idea for investors looking to dip their toes into the waters of European equities without the all-in commitment of a dedicated Europe fund.

Data confirm European earnings are strong, highlighting a source of allure with QLVD.

“So far in earnings season, 60% of companies in the MSCI Europe index have beaten earnings per share (EPS) estimates by 5% or more, with 19% missing estimates—the best ever rate since Morgan Stanley began gathering data in 2007. Financials and consumer discretionary companies posted the broadest beats so far in earnings season, they added,” reports Callum Keown for Barron’s.

QLVD: Just Right for European Exposure?

QLVD follows the Northern Trust Developed Markets ex US Quality Low Volatility Index and allocates over 43% of its weight to six European countries, including the U.K., Switzerland, and Germany.

Relevant to Europe by way of the QLVD thesis is the recent uptick in quality in earnings on the continent.

“The earnings beats were also ‘high quality in nature’, citing significant recent upgrades earlier this year across the board, and underpinned confidence in a strong rebound in 2021,” Barron’s reports, citing Morgan Stanley.

Quality is a point of emphasis for QLVD, which offers investors more than just a basic low volatility strategy.

“Low-volatility strategies can be a helpful defensive strategy for investors who want to reduce potential portfolio declines during market downturns, while still capturing some of the gains that come during positive markets,” according to the issuer. “We believe that the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (QLVD), which incorporates our research-driven findings about the role of quality in a stock’s potential volatility, can help investors meet their risk management and capital appreciation goals.”

QLVD’s quality inclusion is important for another reason: European companies that are missing earnings estimates are being punished.

“However, share price action in the aftermath of earnings has been negatively skewed. Companies whose earnings have missed expectations have seen their stocks underperform by an average of 1.5% on the day of results, while those beating estimates have only outperformed by 0.2%,” concludes Barron’s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.