At the factor level, two prominent themes are in place through less than five months into 2021. First, it’s clear value stocks are regaining long lost market leadership. Second, dividend growth is on pace for an impressive year, bringing relief to investors in a low-yield climate.

The FlexShares Quality Dividend Defensive Index Fund (NYSEArca: QDEF) is an exchange traded fund that provides investors exposure to both the value and dividend resurgences. Owing to the value factor’s tendency to outperform following recessions, QDEF is a relevant consideration for income investors today.

“Value stocks, as measured by the Russell 1000 Value Index, lagged in the throes of the crisis but have outperformed their growth counterparts by more than 15% since the announcement of the first effective vaccine in November of 2020,” according to BlackRock research.

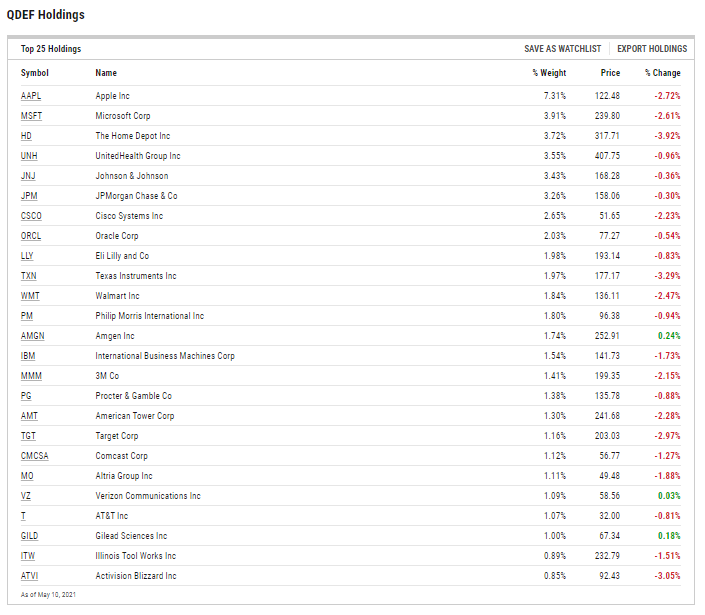

QDEF devotes 35.63% of its weight to value stocks, more than triple its exposure to names with the growth designation.

Picking Apart the Case for ‘QDEF’

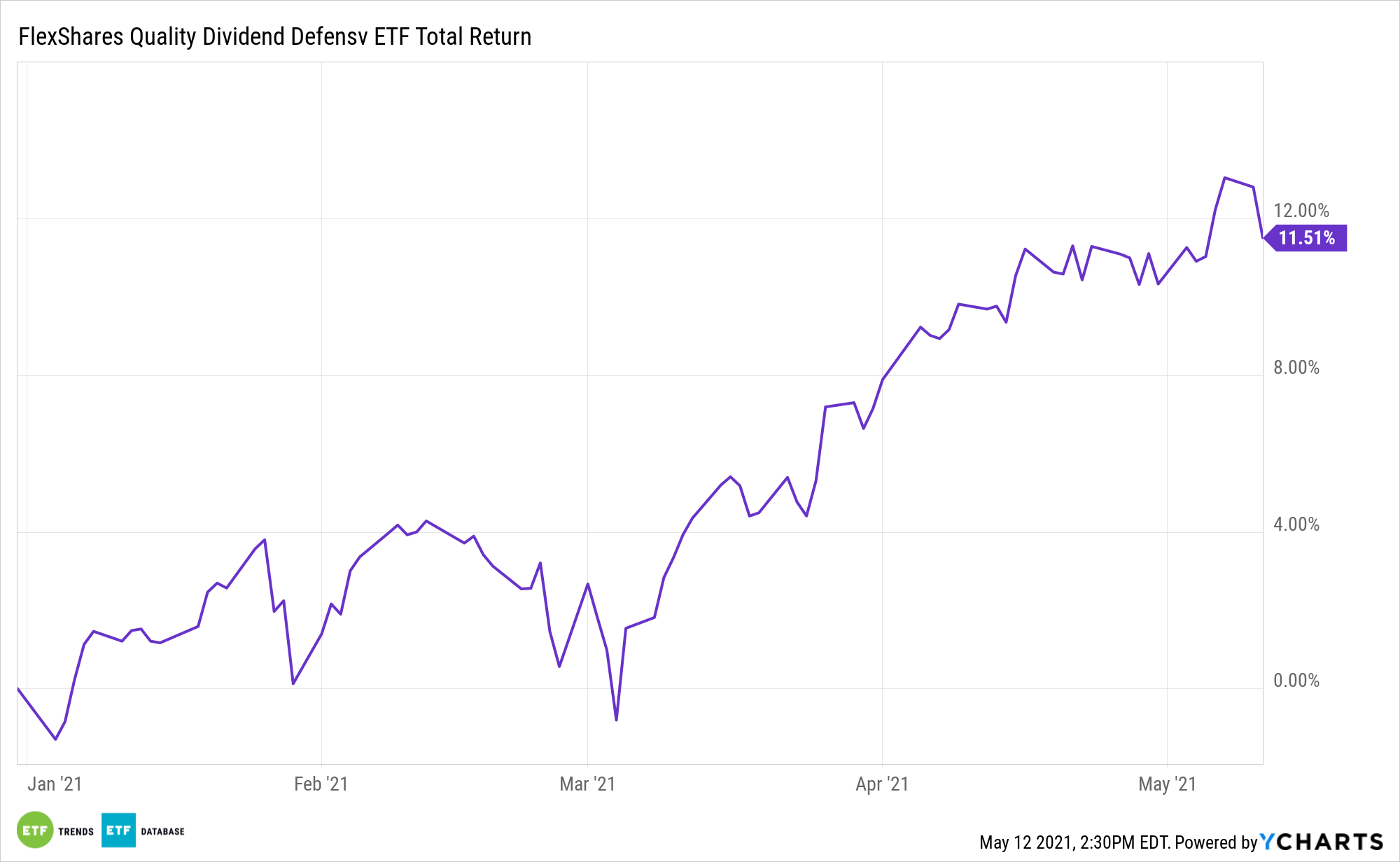

QDEF is up an impressive 12.34% year-to-date – undoubtedly a nice run for an ETF that’s positioned as a defensive offering. However, that performance shouldn’t imply QDEF’s upside from here is limited. Some key factors indicate the opposite may be true.

“While the disparity in valuation has narrowed from a historic wide back in November, it was still far from ‘normal’ at March 31 – at nearly two standard deviations wider than the average observed since 1979,” notes BlackRock.

One way of looking at that is that value has long way to go to shed the “cheap” label. Additionally, the current environment is supportive of dividend strategies.

“Michael Fredericks, Head of Income Investing for BlackRock’s Multi-Asset Strategies and Solutions team, shares his equity counterpart’s affinity for dividend stocks, and sees a particular opportunity after the valuations of high-dividend stocks were beaten down last year,” according to the asset manager. “He cites the potential for company dividends to grow across time as a benefit versus bond coupons, which are very low and fixed to maturity.”

High dividend ideas are undoubtedly compelling with interest rates low, but QDEF is more of a play on dividend durability and growth, which investors should prioritize. The fund allocates 40% of its weight to technology and healthcare stocks – two of the best payout growth sectors in recent years.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.