The pandemic caused countries and their respective governments to institute travel bans, but as more individuals get vaccinated, more demand for global real estate could result.

More countries are starting to lift these travel bans, which comes at a time when interest rates are still relatively low by historical standards. More foreign investors are looking at real estate in the U.S., which rocketed higher the past year.

“Prospective buyers who have been sitting on the sidelines since the pandemic began last year are setting up appointments with their agents in the U.S. now that the travel ban has been lifted on Monday for 33 countries, including some in the European Union, the United Kingdom, China, Canada, Mexico, Brazil and India,” an article published on WSPA.com by The Real Deal notes.

“Foreign purchases of U.S. homes plummeted from April 2020 to March 2021, according to the National Association of Realtors, down 27 percent to $54.4 billion, compared to the previous year,” the article adds.

While demand is high, inventory is still low. Of course, this only pushes prices higher while bidding wars ensue among prospective foreign buyers.

“I think they’re going to be mostly disappointed with the lack of supply of houses,” said Craig Studnicky, broker and CEO of International Sales Group in South Florida. “There’s just not that much to buy, so they’re going to be highly frustrated with that reality. But there are condos to buy.”

An ETF For Global Real Estate Exposure

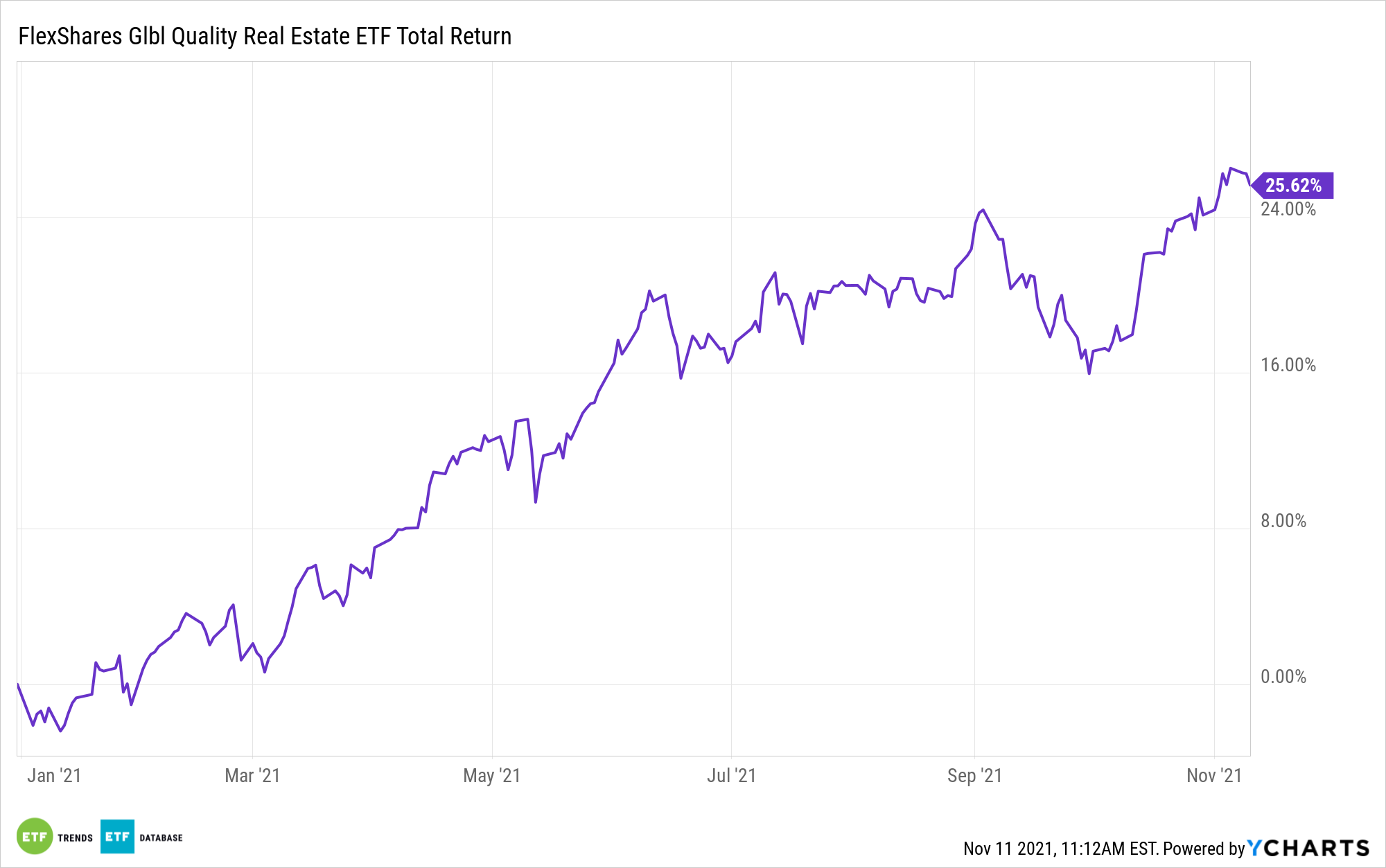

ETF investors looking to get global real estate exposure can do so with the FlexShares Global Quality Real Estate Index Fund (GQRE). The fund comes in with an expense ratio of 0.45%.

Per the fund description, GQRE seeks investment results that generally correspond to the price and yield performance, before fees and expenses, of the Northern Trust Global Quality Real Estate Index. The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to quality, value, and momentum factors relative to the Northern Trust Global Real Estate Index.

While most of its holdings reside in the U.S., investors get that global twist with holdings from other countries. That list includes Japan, Australia, Hong Kong, and Germany.

“Investing in the real estate sector offers the potential to add growth, diversification, income along with potential protection against the risk of long-term inflation to a portfolio,” the FlexShares Fund Focus article says. “We believe that a well-diversified and global approach to real estate investing is a key factor in unlocking the full range of these potential benefits.”

For more news, information, and strategy, visit the Multi-Asset Channel.