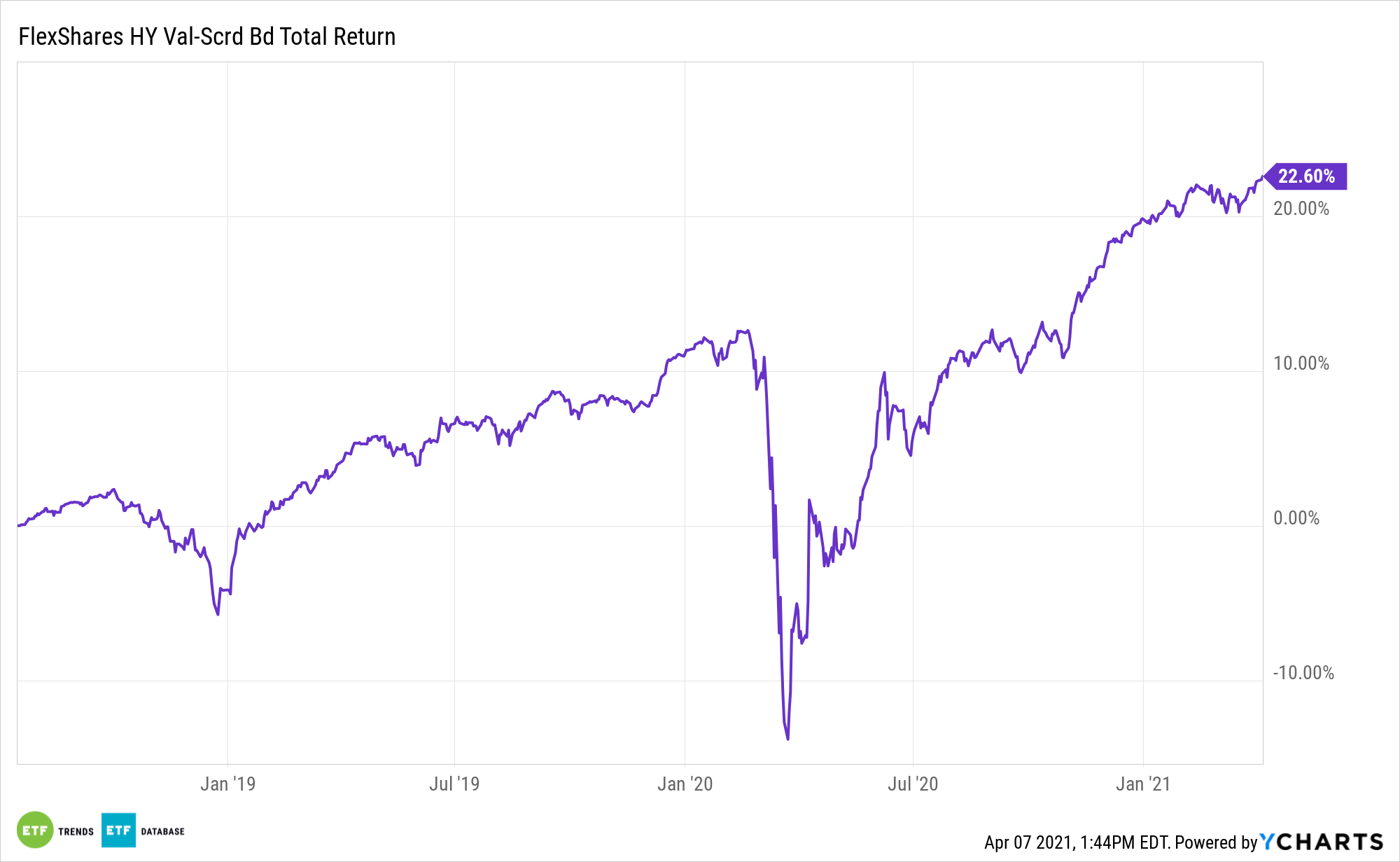

High-yield corporate bonds aren’t necessarily inexpensive these days, but in a low Treasury yield environment, junk bonds can be useful for income investors. One noteworthy play is the FlexShares High Yield Value-Scored Bond Index Fund (NYSEArca: HYGV).

HYGV’s index tracks the performance of a broad universe of U.S. dollar-denominated high-yield corporate debt, while seeking a higher total return than the overall high yield corporate bond market (as represented by the Northern Trust High Yield US Corporate Bond IndexSM). The index uses a rules-based methodology to select and weight high yield bonds according to a proprietary value score that measures the relative attractiveness of each security’s valuation compared to market price.

As the high yield market grows increasingly expensive, HYGV’s 0.37% expense ratio is looking attractive.

Goldman Sachs “highlighted signs the high-yield market is looking pricey. First, the market’s rising tide is lifting all junk-rated boats: The gap between valuations on different bonds has narrowed, meaning there are fewer deals for professional bond pickers. For example, only about 10% of bonds in the high-yield market are trading with yields of more than 5 percentage points above Treasuries, compared with 25% in November,” reports Alexandra Scaggs for Barron’s.

With HYGV, Quality Is Always On the Menu

With its unique scoring methodology, HYGV offers investors a potentially better mousetrap for junk bonds, especially for those seeking long-term, yield-bearing allocations.

Through the use of proprietary value scores calculated by fund’s index provider, NTI, HYGV seeks to hold bonds that are currently trading at market prices below the levels implied by their fundamentals. The goal is for HYGV to provide greater capital appreciation and higher potential income, even as the portfolio’s duration and sector exposures are adjusted at index reconstitutions so that they match the parent index.

“The relative scarcity of places to put cash creates a headwind for Goldman Sachs’ bullish view on the high-yield market, wrote strategist Michael Puempel,” adds Barron’s. “But while the scarcity of good bargains may be a sign that high-yield valuations are stretched, it doesn’t mean that junk bonds can’t continue to outperform higher-rated markets, such as Treasuries and investment-grade bonds. Treasuries have marked steep losses this year as their yields have climbed, and few on Wall Street expect yields to stop climbing until the 10-year yield reaches 2%”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.