Yields on Treasury inflation-protected securities (TIPs) recently turned positive, confirming that inflation is something advisors and investors need to prepare for.

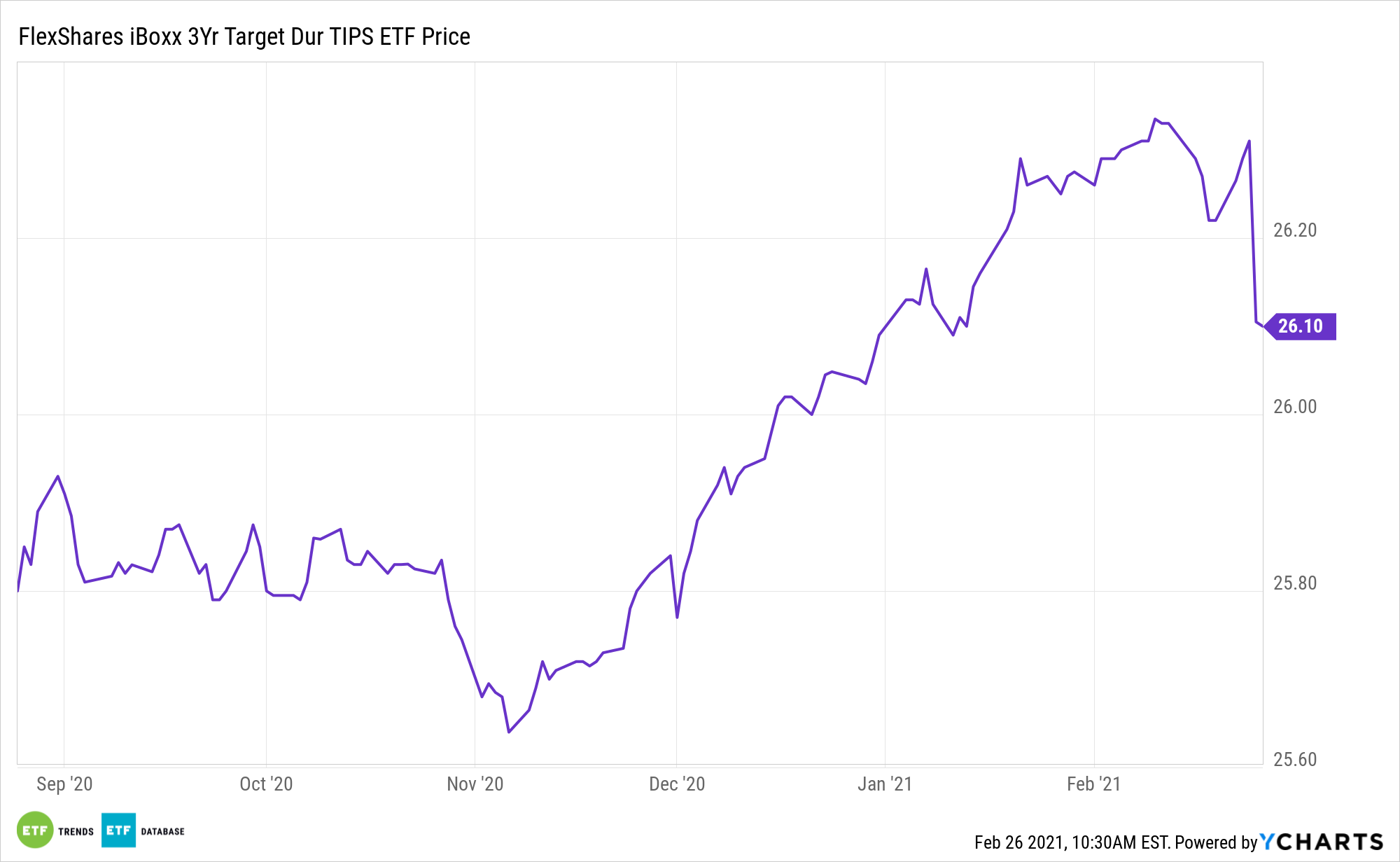

Preparation comes packaged into the FlexShares iBoxx 5Yr Target Duration TIPS ETF (NYSEArca: TDTF) and the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEArca: TDTT). TDTF tracks the iBoxx 5-Year Target Duration TIPS Index.

“The fiscal policy outlook is very consequential for investors. The consensus view is that the low interest rate regime is here to stay. This is the core justification for current asset valuations and strategic asset allocations. But whether it persists will depend crucially on the interplay between interest rates, inflation and debt,” according to BlackRock research.

Loose monetary policy coupled with President Joe Biden’s proposed $1.9 trillion package for pandemic relief have caused some to warn of a coming surge in inflation.

Time for TIPS?

Some market participants are concerned that the Fed may have to change its interest rate policy sooner than expected. These doubts certainly contributed to Wednesday’s equity pullback. Inflation fears are further reflected by a sharp rise in benchmark Treasury yields, which may be partially attributed to expectations for greater inflation.

“In the U.S., the 2020 fiscal response amounted to $3.3 trillion. Current Covid support approved in late 2020 and proposed spending by the new U.S. administration could add up to another $2.8 trillion to the fiscal bill as of February 2021. And even more is likely on the way in coming years,” notes BlackRock.

TDTT would be particularly useful in an environment where inflation data exceeds forecasts, meaning investors should monitor the breakeven inflation rate.

Treasury Inflation-Protected Securities (TIPS) are popular among fixed-income investors looking to protect against the scourge of inflation. ETFs make it easier to access TIPS.

Investors will typically look at TIPS ahead of an inflationary period since buying TIPS after inflation has gone up means that the security has already priced in the inflation and investors may be overpaying for their exposure.

“We estimate the cumulative activity shortfall in the U.S. and Europe will be a fraction – a quarter roughly – of the global financial crisis (GFC), yet the discretionary fiscal response now is a multiple of the response then – roughly four times. And the objective of policy today is not to stimulate – there is no point stimulating activity that’s been purposefully halted – but to provide a bridge to a post-Covid world. We see a large part of activity restarting on its own once the pandemic is under control even without fiscal support,” concludes BlackRock.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.