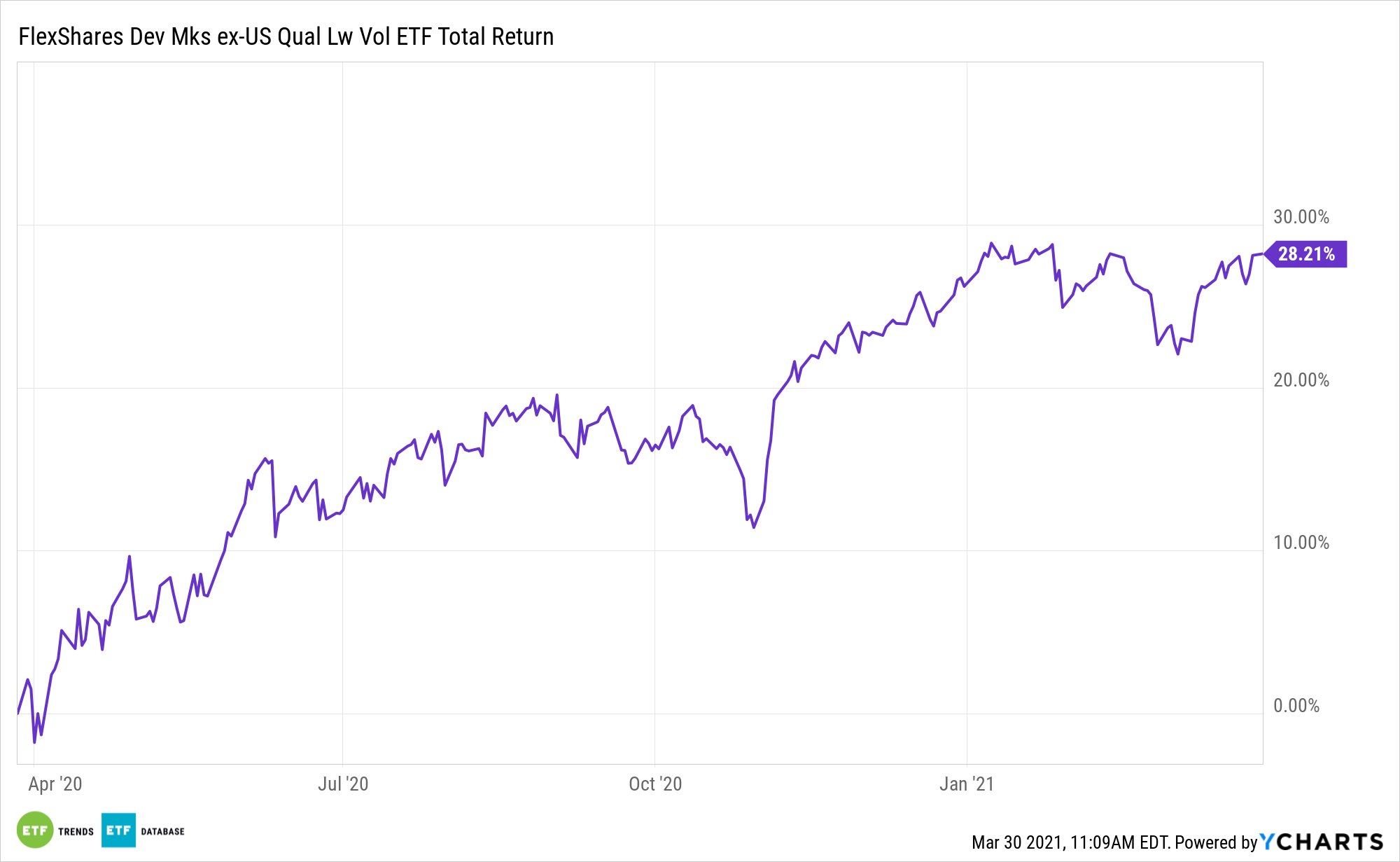

European equities have long vexed U.S. investors, but this time could be different. In fact, it already looks like it will be. Nevertheless, investors seeking some exposure without the full European commitment can turn to the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“Earnings underlying the Euro Stoxx 50 are expected to bounce 33%. The S&P 500 has already climbed to 19.4 times its earnings forecast for 2022, when the pandemic will hopefully have passed. That’s alluring relative to bond yields and badger attacks, but not much else,” reports Jack Hough for Barron’s. “The Euro Stoxx 50, meanwhile, trades at 16.6 times next year’s earnings. J.P. Morgan tracks baskets of stocks tied closely to economic reopening in different regions. The U.S. one has climbed back to its prepandemic level. Europe’s reopening basket is still down about 20%.”

Ample European Allure with ‘QLVD’

European stocks are turning in some impressive performances. U.S. investors can participate in that upside without the full commitment with diversified developed markets ETFs like QLVD.

Value-seeking investors could look to ex-U.S. developing markets like Europe if they want to stay away from the heightened risk posed by investing in emerging markets.

“Even factoring in the U.S. being off to a faster start on vaccines, that makes Europe worth a look. Mutual fund positioning there is relatively low,” according to Barron’s. “That has been a good bet for years, but so far this year, Europe is leading the U.S. in returns. That’s because European stock markets are more tilted toward value hangouts like the banking and energy sectors than the U.S., and less tilted toward growth ones like tech and consumer goods.”

Like other developed markets, many European markets, both in and out of the Eurozone, are home to major equity benchmarks with higher dividend yields than the S&P 500. The yield disparity between European stocks and bonds has been widening as recent global uncertainty pushed investors out of the equities market and into safe-haven fixed income assets.

While a growth pickup would benefit emerging markets, Europe’s health infrastructure and policy response to the coronavirus pandemic has left it better placed in the global economy.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.