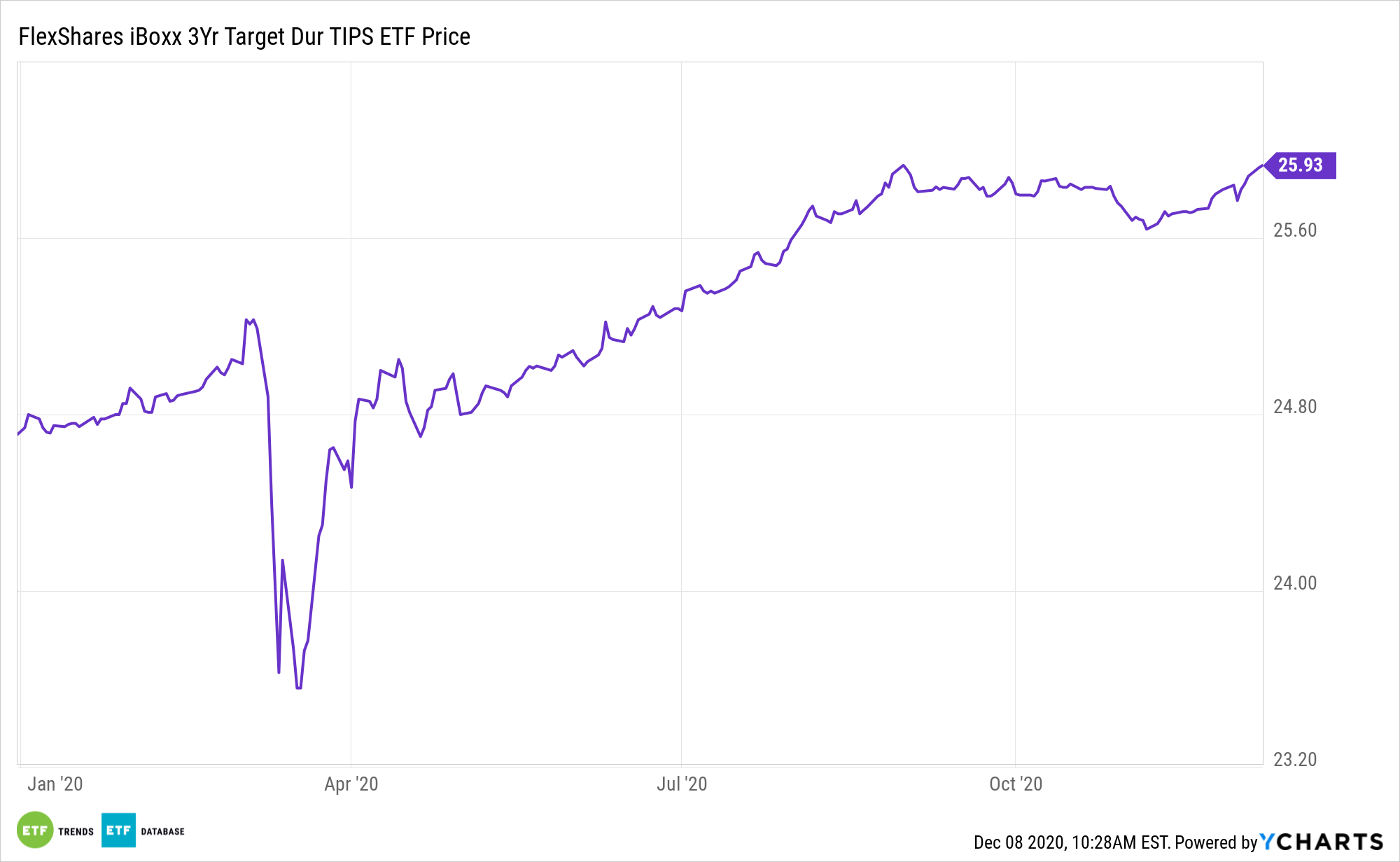

Investors are acknowledging the specter of inflation, a scenario that brings ETFs like the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEArca: TDTT) into the spotlight.

TDTT is particularly useful in an environment where inflation data exceeds forecasts, meaning investors should monitor the breakeven inflation rate.

Treasury Inflation-Protected Securities (TIPS) are popular among fixed-income investors looking to protect against the scourge of inflation. ETFs make it easier to access TIPS.

“The recent rebound in investors’ inflation expectations—which have also boosted long-term Treasury yields—could persist because of the improved outlook for economic growth, Wall Street strategists say,” reports Alexandra Scaggs for Barron’s.

Investigating Inflation with TDTT

Can inflation be added to the list of certainties other than death and taxes? In the case of inflation, investors can at least minimize its effects using exchange-traded funds that incorporate an inflation-hedging strategy via Treasury Inflation-Protected Securities (TIPS).

Investors now argue that the Federal Reserve’s rate cuts this year have bolstered the outlook on inflation, with some even contending that inflation may rise fast enough to force the Fed to hike rates.

“The prospect of effective Covid-19 vaccines has helped investors see an end to the pandemic. And government stimulus is looking more likely, strategists say, which should support Americans’ spending and income through lockdowns this winter,” reports Barron’s. “The bond market has confirmed that investors expect stronger inflation in coming years as well. There has been a multiweek rebound in ‘break-even rates,’ or the gauges of compensation that Treasury-market investors demand in response for the risk of inflation over different time periods.”

Treasury Inflation-Protected Securities (TIPS) are popular among fixed-income investors. The Federal Reserve paints a compelling picture for those considering TDTT.

Investors will typically look at TIPS ahead of an inflationary period since buying TIPS after inflation has gone up means that the security has already priced in the inflation and investors could be overpaying for TIPS exposure. TDTT, conversely, has 20 holdings and a weighted average maturity of 3.92 years.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.