When it comes to environmental, social, and governance (ESG) funds such as the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG), investors tend to focus on the environmental portion of the equation.

That’s understandable as climate change and environmental issues command considerable mainstream media attention, but the “S” and “G” are still important.

“Social and environmental issues are often intertwined, as evidence is growing that climate change will have a disproportionate impact on low-income communities and developing countries,” according to Morningstar research. “Reduced reliance on fossil fuels will harm job security and income for workers in fossil-fuel industries unless mitigating policies are put in place.”

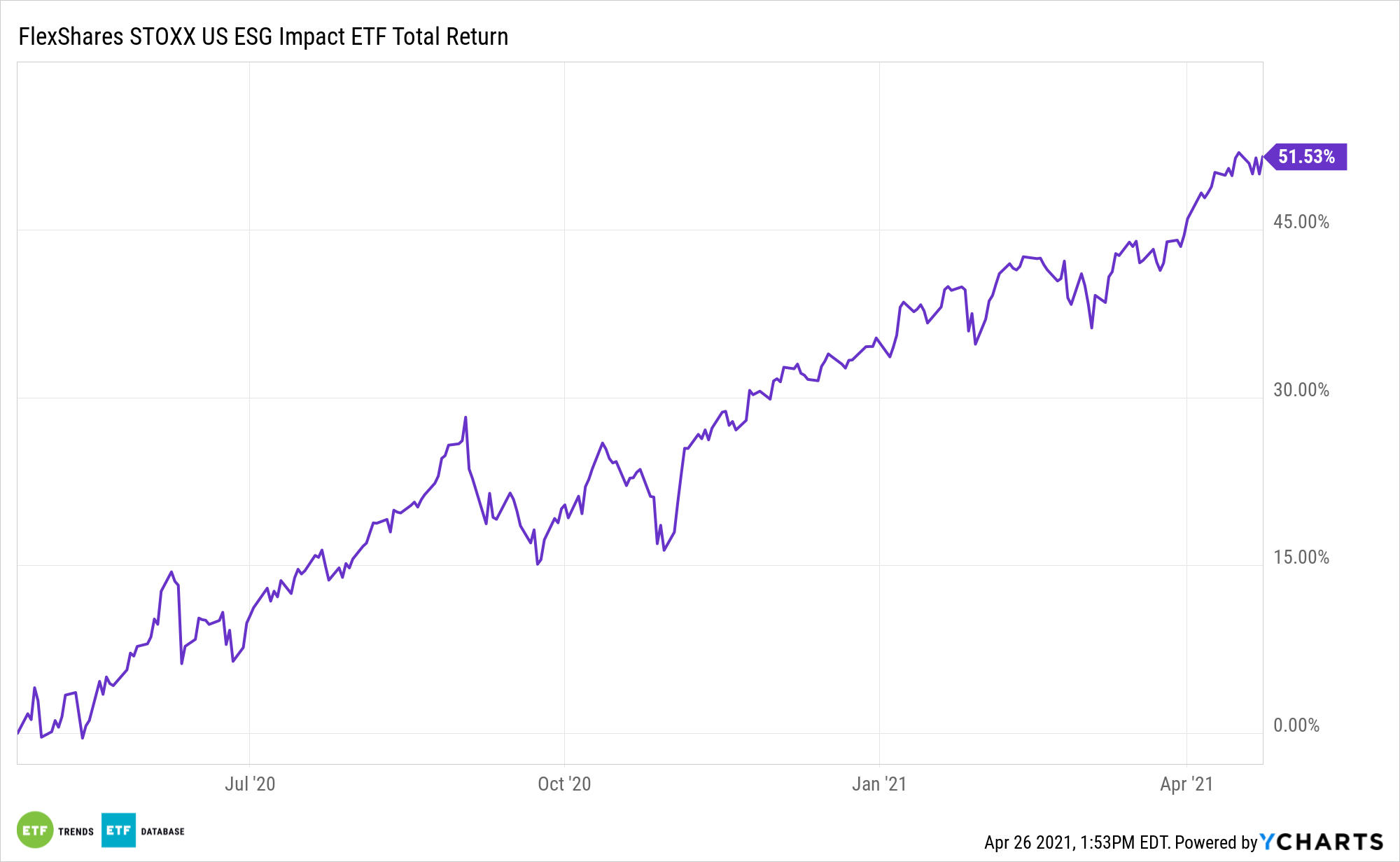

The FlexShares ESG ETF seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

Sizing Up S&G Opportunities

For investors considering ESG, ESGG, and other funds in the category, the time is right to finally prioritize social and governance issues at the corporate level and beyond.

“The renewed reckoning over American racism, past and present, prompted in part by George Floyd’s murder, is also driving a deeper company and investor focus on racial justice,” notes Morningstar. “In June 2020, 128 investment organizations and individuals signed a public statement in which they pledged to integrate racial justice into their investment decision-making and engagement strategies, and to embed a racial equity and justice lens within their organizations.”

Putting a premium on social and governance causes also benefits corporations, their employees, and investors over the long haul, confirming there are tangible rewards for “doing good.”

“Good corporate governance practices also play a significant role in determining how corporations act on key issues of interest to sustainable investors and society. These include issues such as director independence, diversity of board members, responsiveness to shareholders, executive pay, and anti-corruption,” continues Morningstar. “Sustainable investors have been increasingly concerned about the role of corporate leadership in broader society–particularly their political spending and lobbying activities, based on the number of shareholder proposals filed in advance of U.S. corporations’ annual meetings.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.