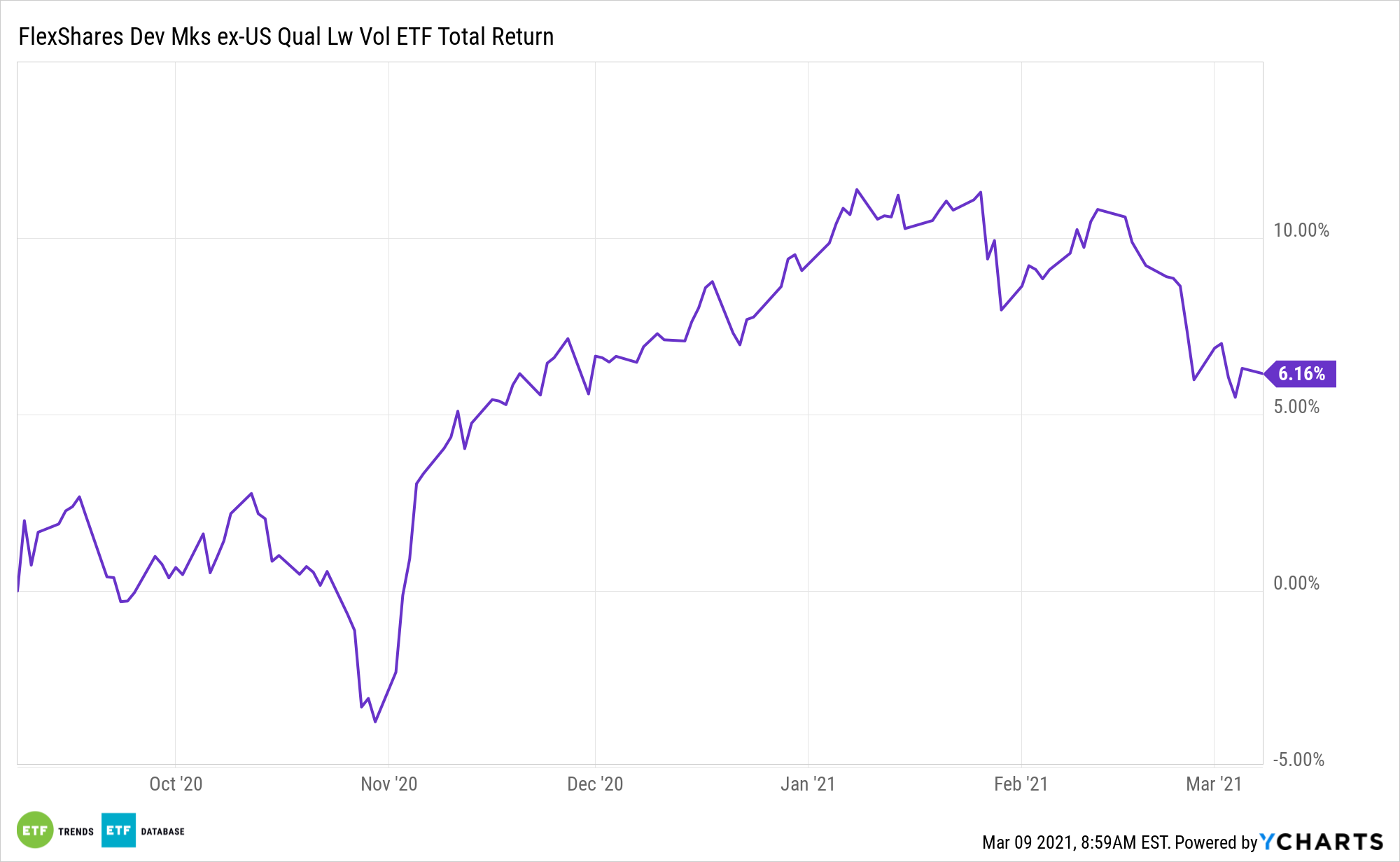

The cyclical value resurgence is highlighting opportunities with British and European equities, a scenario that investors can participate in with reduced volatility with the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“UK and euro area stocks lagged the global market in 2020. UK stocks, skewed toward sectors that typically fare poorly during cyclical downturns and weighed down by Brexit uncertainties, were the worst performer among developed market (DM) peers. With the risk of a no-deal Brexit lifted and the UK leading the vaccine rollout among DMs, we see a broad activity restart in the summer,” according to BlackRock research.

The fate of British stocks is relevant in the QLVD conversation because the country is one of the ETF’s largest geographic exposures. With Brexit nearing conclusion, there’s growing clarity that could benefit U.K. equities and QLVD.

European Allure with QLVD

European stocks are turning in some impressive performances. U.S. investors can participate in that upside without the full commitment with diversified developed markets ETFs like QLVD.

Value-seeking investors could look to ex-U.S. developing markets like Japan if they want to stay away from the heightened risk posed by investing in emerging markets.

“We expect a vaccine-led reopening to enable activity to return to pre-Covid levels by late 2021 or early 2022 in the euro area and the UK, with a well of pent-up demand fueling spending, especially in services,” notes BlackRock. “Activity data last week were stronger than expected, suggesting services have not been as severely hit as by the initial lockdowns as in 2020. We see ongoing fiscal support for the most affected households and sectors, and expect central banks to keep financial conditions easy. We expect the ECB to likely reiterate such a commitment at this week’s policy meeting, pushing back against higher bond yields.”

Importantly, the case for QLVD is supported by improving European earnings expectations.

“Recent earnings suggest an improving outlook for European and UK companies. More European companies have beat earnings expectations in the fourth quarter of 2020 than ever – albeit versus moderate expectations – accompanied by an improving margin picture. Cyclical exposures such as materials and energy have posted the strongest upward earnings revisions, lending additional support,” concludes BlackRock.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.