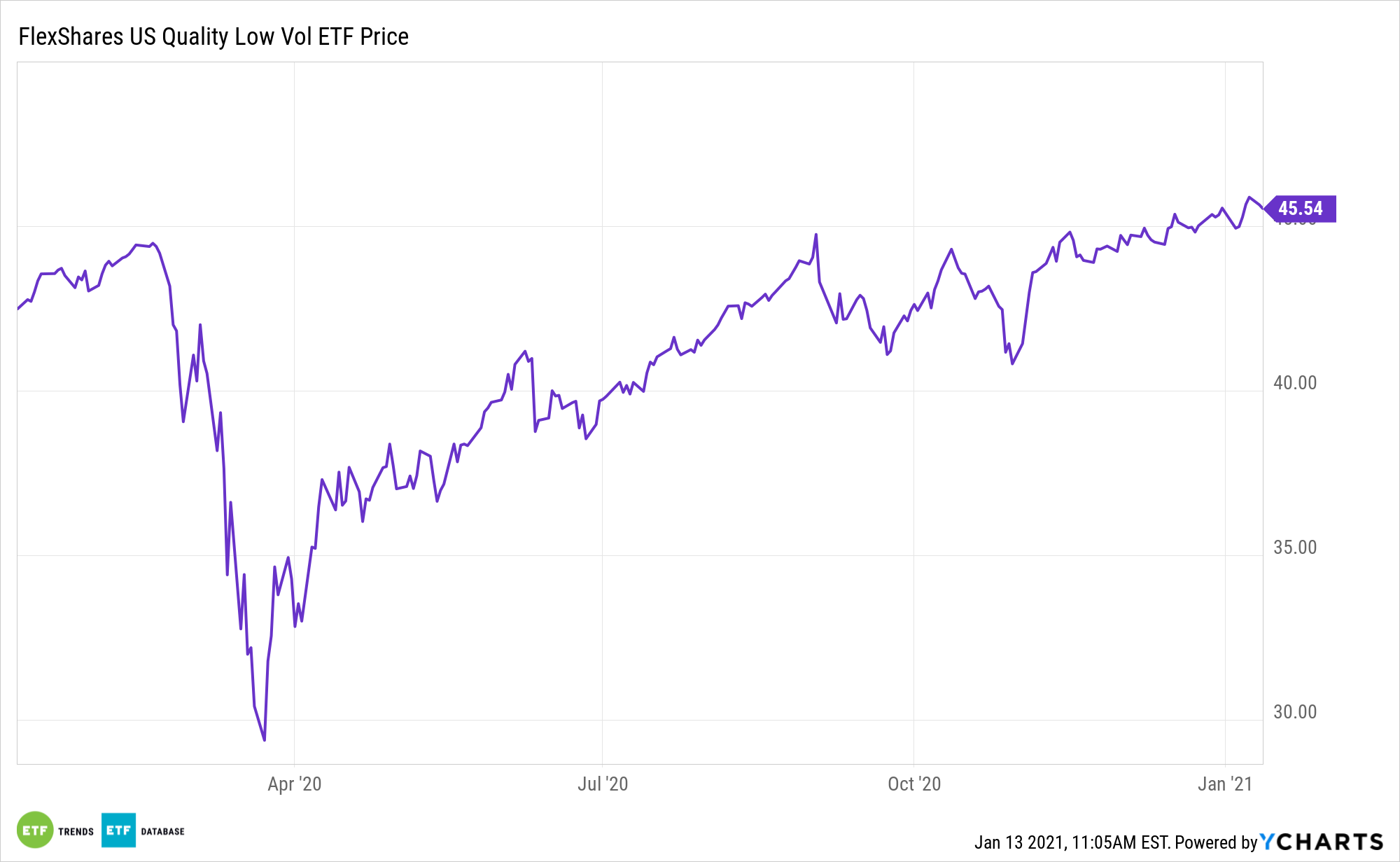

One of the hallmarks of the quality factor is a strong balance sheet. Investors that follow suit tend to be rewarded over the long haul. When it comes to quality access, the FlexShares US Quality Low Volatility Index Fund (NYSE: QLV) puts investors in the driver’s seat.

QLV follows the Northern Trust US Quality Low Volatility Index. The ETF’s benchmark employs a quality screen to provide exposure to high-quality companies with lower absolute risk, thereby limiting potential future volatility. The quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“The bottom line is that, while investors want to be positioned for the Democrat stimulus beneficiaries, it might be better to play capex-spending recipients and those who can ‘manage’ the balance sheet since this tends to be a ‘longer cycle’,” writes Max Adams for Business Insider.

A multi-factor strategic beta approach can help investors better diversify risk. Like traditional asset diversification, factor diversification can help produce more consistent outcomes. For instance, the value factor was the worst performing factor in the first half of 2020, but was also the best performing factor of the second half of 2019. A multi-factor approach helps investors smooth out their rides.

QLV’s Stricter Quality Controls Go Beyond Many Competitors

QLV incorporates strict sector controls to help prevent the index from deviating too significantly from the broader US-equity market. The fund constructs the final constituents list with consideration to the exposure of the low volatility factor.

“A big difference between the recession in 2020 and prior economic downturns is heightened levels of cash for both businesses and individuals,” adds Business Insider. “S&P 500 companies ended last year with a record amount of cash as a percentage of total assets, and US companies raised the largest amount of cash from bond and equity markets.”

The fund integrates rigorous fundamental analysis through a quality screen of US-based companies that can be viewed as a potential means to mitigate future volatility. FlexShares believes this is different than other low volatility funds that may utilize only historical return and/or correlation data in hopes that the lower volatility will carry forward.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.