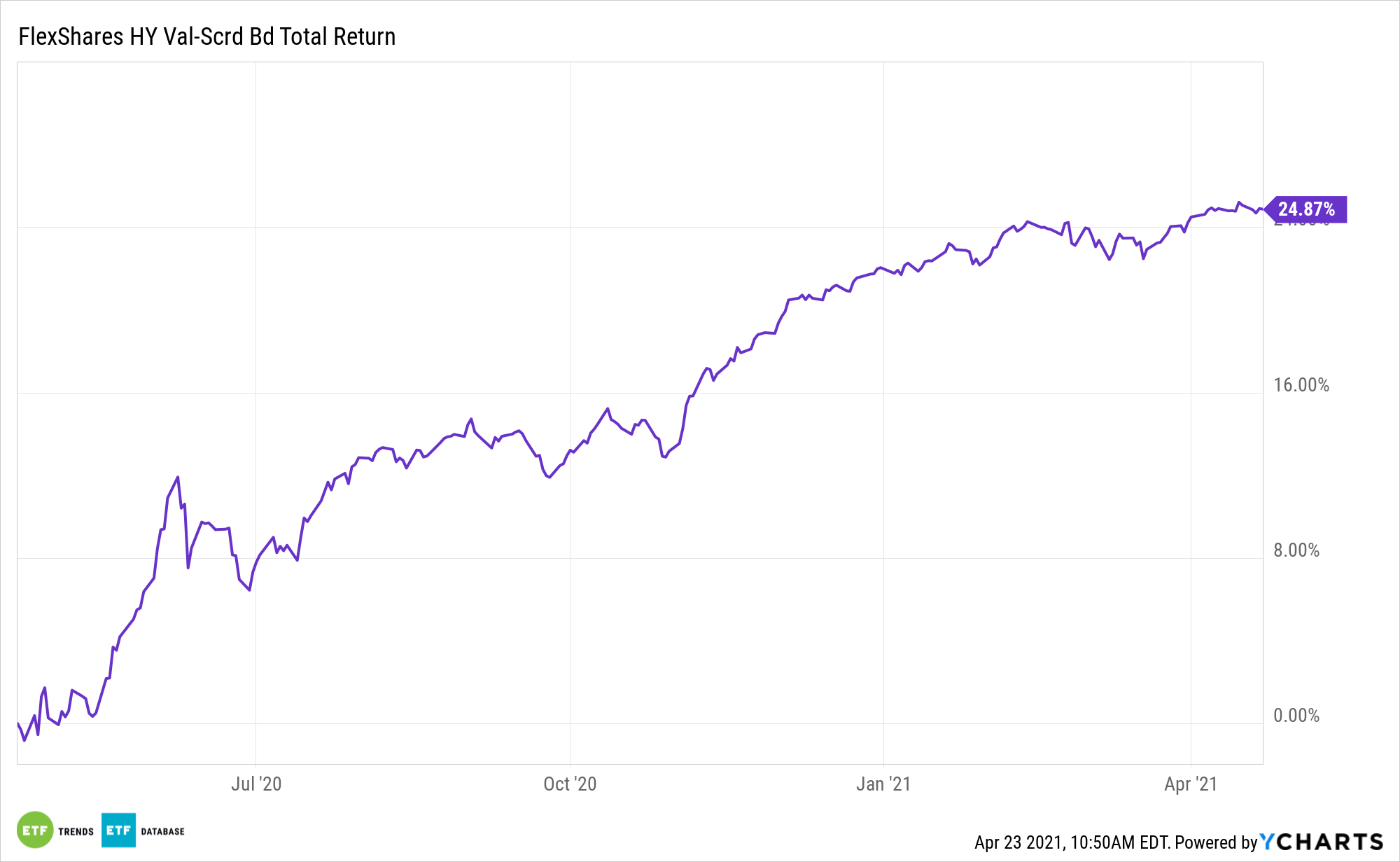

A spate of fresh high-yield corporate debt supply is coming to market, but that’s not weighing on the FlexShares High Yield Value-Scored Bond Index Fund (NYSEArca: HYGV).

HYGV’s index tracks the performance of a broad universe of U.S. dollar-denominated high-yield corporate debt, while seeking a higher total return than the overall high yield corporate bond market (as represented by the Northern Trust High Yield US Corporate Bond IndexSM). The index uses a rules-based methodology to select and weight high-yield bonds according to a proprietary value score that measures the relative attractiveness of each security’s valuation compared to market price.

Robust issuance can be seen as a sign of similarly strong demand – the latter of which is supportive of funds such as HYGV.

“High-yield corporate bond issuance had a strong start to the year, due to growing expectations for the U.S. economy to take off coupled with tight credit spreads and less perceived credit risk,” said Moody’s Investors Service. “US$-denominated high-yield bond issuance totaled $76 billion in the March compared with the $55 billion in February and $83 billion in January. Issuance in March was 70% above its prior five-year average, but this includes last March when the pandemic caused high-yield issuance essentially to dry up. If we adjust for the pandemic, March was still very strong; high-yield issuance was 67% above is average between 2015 and 2019.”

Breaking Down ‘HYGV’

Another point in favor of HYGV over the near-term is that market observers see minimal chance of credit spreads reversing.

“The narrowing in high-yield option adjusted spreads has provided a big boost to issuance over the past few months,” notes Moody’s. “Currently, the high-yield corporate bond spread is 296 basis points, compared with its historical average of 540 bp. Considering the potential strength of the U.S. economy this year and next, spreads should remain tight.”

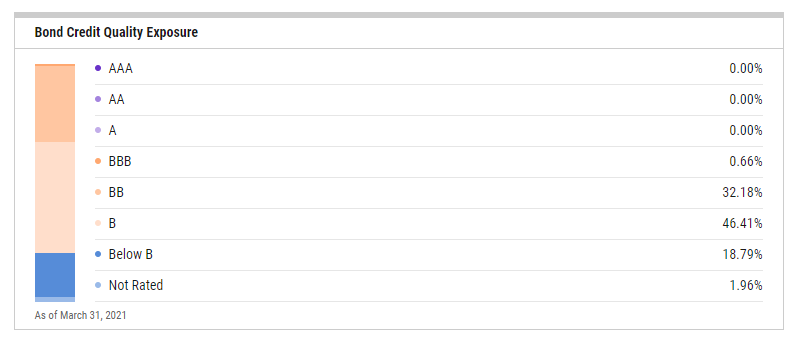

HYGV allocates about 78% of its weight to bonds rated BB and B on the S&P scale. GDP growth could be another factor working in favor of the fund this year.

“We have been consistently revising our forecast higher for GDP this year because of changes to our fiscal policy assumptions,” continues Moody’s. “We now look for real GDP to rise 6.4% this year, compared with the 5.7% in the March and 4.9% in the February baselines. The higher corporate tax rate will bite a little bit into the economy next year, but its drag is in basis points, not percentage points. We revised the forecast higher for GDP growth in both 2024 and 2025 because of the proposed federal infrastructure package.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.