It can be easy to get lost in the vast pool of bond-focused exchange-traded funds (ETFs), which makes an actively managed fund like the FlexShares Core Select Bond Fund (BNDC) a must.

Active management helps eliminate the guesswork involved in choosing bond ETFs that suit an investor’s portfolio. As such, BNDC does all the heavy lifting and focuses on investment-grade debt issues to help minimize risk and capture maximum upside.

Using its active management style, BNDC seeks total return and preservation of capital. The fund invests at least 80% of its net assets in U.S. dollar-denominated investment-grade fixed-income securities either directly or indirectly through exchange traded funds and other registered investment companies.

“The ETF is actively managed by institutional fixed-income managers at Northern Trust, the adviser of the FlexShares funds,” a FlexShares Fund Focus noted. “These managers aim to build a diversified bond portfolio through existing ETFs, using both the FlexShares ETF family and ETFs from other providers, to provide exposure across sectors of the fixed income markets.”

“For example, the Fund captures exposure to the major fixed-income asset classes such as Treasuries, corporate bonds, and mortgage-backed securities (MBS), while also choosing ETFs that offer potentially more refined, value-added exposures to a variety of products such as TIPS,” the Fund Focus added.

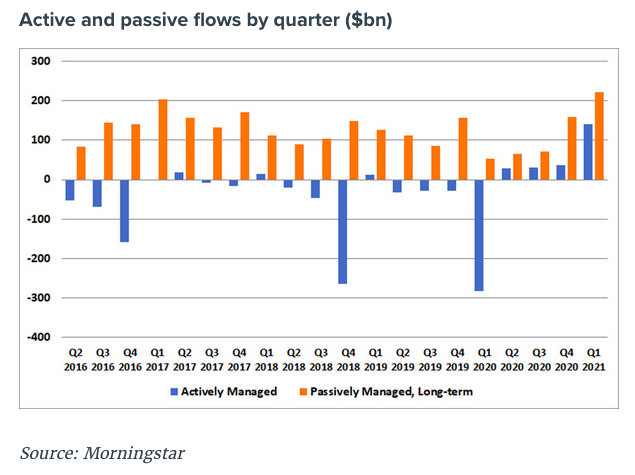

Strong Inflows Activity for Active Funds

It’s been a record year for active funds in 2021 despite the pandemic’s challenges to the markets. Funds are enjoying a healthy inflow of capital from investors, which is something they haven’t experienced for quite some time.

“In the first quarter of 2021, active funds attracted $140bn of new money, their best three-month period for flows since 2013, when they won a record $154.7bn, according to Morningstar,” a Professional Buyer CityWire article noted. “It was also the fourth consecutive quarter in which active funds took in money, the first time they have had such a run since between Q2 2012 and Q1 2013.”

While active funds have been prospering lately, they are still behind in comparison to their passive brethren. Nonetheless, In the grand scheme of things, active funds are enjoying their best year yet.

“Over this most recent run, they have gained a combined $237bn, which still pales in comparison to passive’s $515bn,” the article added further. “However, given active funds had enjoyed inflows in just three quarters in the four years before this run, the turnaround is noteworthy.”

For more news, information, and strategy, visit the Multi-Asset Channel.