The world’s economy will top $100 trillion in 2022 according to British consultancy Cebr, which opens up opportunities for getting international exposure, especially when it comes to obtaining more yield through dividends.

“The important issue for the 2020s is how the world economies cope with inflation, which has now reached 6.8% in the U.S.,” said Cebr deputy chairman Douglas McWilliams. “We hope that a relatively modest adjustment to the tiller will bring the non-transitory elements under control. If not, then the world will need to brace itself for a recession in 2023 or 2024.”

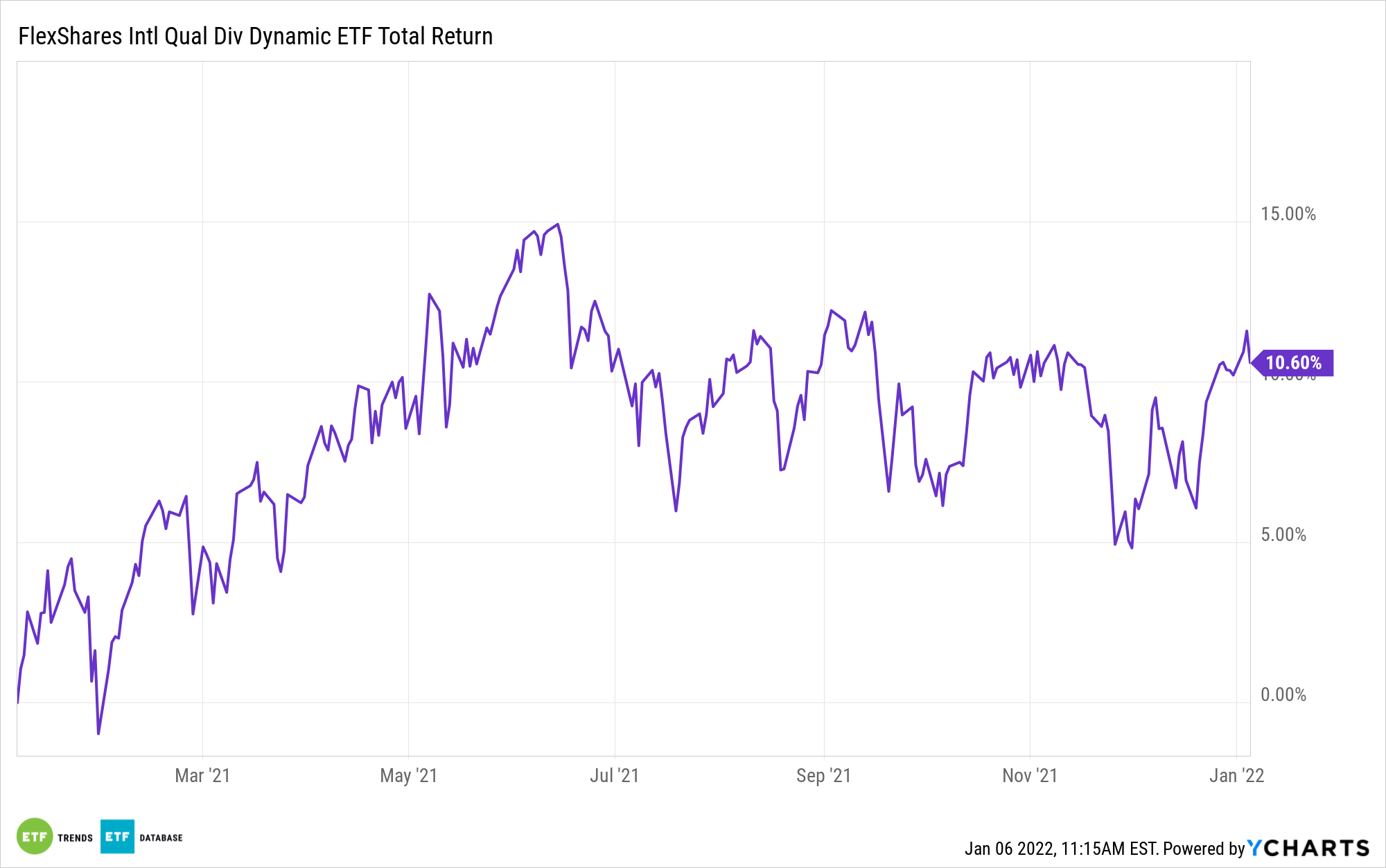

One way for investors to get quality dividend exposure is the FlexShares International Quality Dividend Dynamic Index Fund (IQDY), which seeks investment results that correspond generally to the price and yield performance of the Northern Trust International Quality Dividend Dynamic Index. The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust International Large Cap Index.

The DQS approach to underlying index construction recognizes the real-world goals behind international dividend investing strategies — namely, to generate sustainable income from a portfolio, to help improve diversification, and to harness the long-term return potential of international dividend-paying stocks. Additionally, IQDY also reduces risk by not over-concentrating holdings in one or a few holdings, with the largest holding at just over 2% of the fund’s assets.

Mitigating International Investing Risk

Investing overseas has its own set of nuances. As such, a risk mitigation strategy is necessary, which ETF investors get in IQDY by looking for not just high dividend yields, but solid fundamentals.

“While international dividend investing is for some investors a well-established equity investment strategy, blindly pursuing international stocks with the highest dividend yields may be dangerous in the long run,” a FlexShares Fund Focus says. “High dividend yields may mask underlying problems—such as weak stock prices due to poor financial performance—that could result in lower future dividend payments.”

“The FlexShares International Quality Dividend Dynamic Index Fund (IQDY) helps investors avoid common risks of dividend investing by selecting stocks with both high dividend yields and strong underlying fundamentals while attempting to utilize an aggressive slant,” the Fund Focus adds. “We believe this quality-focused approach offers a method for pursuing an international dividend investing strategy that emphasizes sustainable dividend yields to help meet investors’ goals for income, diversification and total return.”

For more news, information, and strategy, visit the Multi-Asset Channel.