Investors who are considering ways to diversify risk in a volatile market may consider alternative investments like an infrastructure exchange traded fund to adapt to the changing environment.

Alternative assets or sector investments can act as another layer of diversification in a traditional portfolio mix. For instance, an infrastructure ETF such as the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA) offers investors sound fundamentals and above-average dividend yields, making the asset class appealing in the current market environment.

Investors who want to access global infrastructure investments through a liquid vehicle may consider NFRA as an alternative to being forced into long lock-up periods and high initial investments associated with direct infrastructure exposure.

Furthermore, infrastructure exposure could help protect against long-term inflationary risks since most infrastructure operators pass through the cost increases of inflation to users per long-term contracts that typically underpin the infrastructure business models.

“Investors seeking income and portfolio diversification may benefit from infrastructure investments,” according to FlexShares. “Our analysis suggests that infrastructure issuers tend to have predictable cash flow as they provide essential services used in all economic environments. Infrastructure stocks carry both equity and interest rate exposure, but can provide an alternative source of income that may be attractive in a low interest rate environment.”

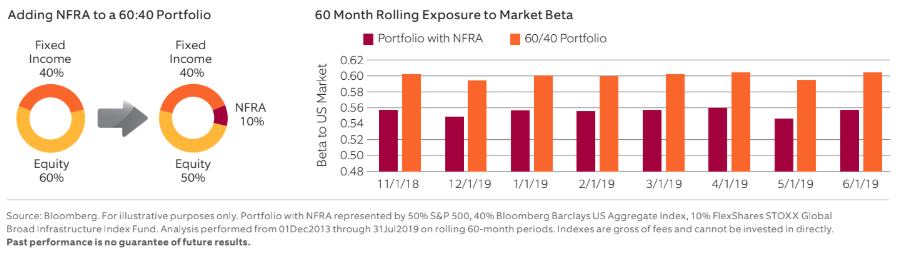

According to FlexShares, a 10% allocation to the FlexShares STOXX Global Broad Infrastructure Index Fund in a traditional 60/40 portfolio with exposure to the S&P 500 Index and Bloomberg Barclays US Aggregate Index could reduce overall portfolio exposure to U.S. equity market beta by an average of 7.4%.

Chart courtesy of FlexShares

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from infrastructure business, providing exposure to not only infrastructure sectors, but non-traditional ones as well.

The FlexShares STOXX Global Broad Infrastructure Index Fund incorporates a bottoms-up portfolio construction methodology that expands on the traditional infrastructure definition, producing a broader inclusion of new and evolving infrastructure sectors like communications and outsourced services. This indexing methodology has helped NFRA avoid large concentrations in other sectors including utilities. Specifically, NFRA includes 30.7% energy, 29.6% communications, 7.4% utilities, 4.3% government outsourcing/social and 26.4% transportation.

For more information on the infrastructure sector, visit our infrastructure category.