By Boox Reserach

- MTUM is an ETF that tracks a basket of U.S. stocks that have exhibited strong momentum through a rules-based strategy.

- Since inception in 2013, MTUM has returned 169.1% compared to 132% for the S&P 500 highlighting an impressive performance history.

- This article explains how the market environment over the past year and lack of exposure to key stocks resulted in the fund underperforming the S&P 500 in 2019.

The iShares Edge MSCI USA Momentum Factor ETF (NYSE: MTUM) offers investors exposure to a basket of U.S. large and mid-cap stocks exhibiting relatively high momentum in their share prices.

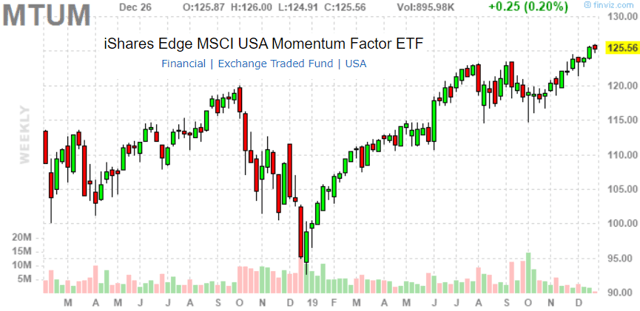

The idea here is simple, with historical market data going back decades, it’s recognized that stock market winners of previous periods tends to continue outperforming going forward. This strategy can also be referred to as trend-following. Indeed, underlying tracking index has a strong return history that has eclipsed the S&P 500 (SPY) with data since 1994. That being said, we note that the MTUM ETF up 27.3% year to date in 2019, has lagged SPY which is up 31.4% on a total return basis. This article explains some of the reasons for the recent underperformance and implications going forward.

(source: Finviz.com)

Momentum Factor Strategy Background Considering MTUM’s inception date of April, 2013 represents a limited history, we take a look at the underlying ‘MSCI USA Momentum’ tracking index with data going back to 1994. Favorably, the tracking index has offered long-term excess returns relative to the ‘MSCI USA’ benchmark which is a passive broad-market index comparable to the S&P 500. The momentum value strategy methodology essentially rotates into winners of previous periods based on a 12-month and 6-month look back. As per MSCI. A momentum value is determined for each stock in the MSCI parent index by combining the stock’s recent 12-month and 6-month local price performance. This momentum value is then risk-adjusted to determine the stock’s momentum score.