Key Takeaways

The record setting year of the ETF keeps getting stronger. U.S.-listed ETFs gathered $900 billion of new money with two weeks of trading left in the year, continuing to obliterate the prior record of $504 billion set in 2020.

The record setting year of the ETF keeps getting stronger. U.S.-listed ETFs gathered $900 billion of new money with two weeks of trading left in the year, continuing to obliterate the prior record of $504 billion set in 2020.- Asset managers have broadened their suite of actively managed and thematic ETFs that can round out an investors’ portfolio often built with broad market index offerings.

- BlackRock U.S. Carbon Transition Readiness ETF (LCTU) and Global X Wind Energy ETF (WNDY) are among the hundreds of ETFs that began trading in 2021 and the pair are rated favorably by CFRA.

Fundamental Context

ETF supply, not just demand, has accelerated in 2021. Year-to-date through December 17, investors poured $904 billion into U.S.-listed ETFs, further extending the record for ETF flows of $504 billion set just in 2020. With more than $100 billion in new money gathered since the end of November, it has become exciting to watch just how close the ETF industry could get to hitting the $1 trillion net inflows mark.

After last year’s then-record-setting cash haul, asset managers have already launched a whopping 439 new products year-to-date through December 14. This is 30% more than the number of products currently trading that came to market in 2020, and more than the number that launched in 2018 (213) and 2019 (206) combined, net of closures.

In addition to surging demand, we think recent changes to regulations that made it easier to launch an ETF product and investors’ growing comfort with thematic and/or actively managed ETFs have also likely helped encourage asset managers to roll out new offerings.

Figure 1: Inception date of ETFs currently trading

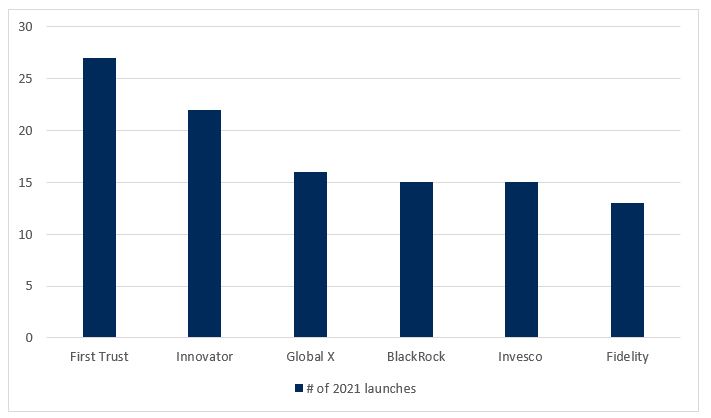

First Trust (27) and Innovator ETFs (22) have brought the highest number of new products to market in 2021. Both firms have had success in recent years with defined outcome ETFs that offer capped upside returns of a broad market index, such as the S&P 500, in exchange for downside protection using options. In 2021, they expanded their suite of offerings with actively managed ETFs such as FT Cboe Vest U.S. Equity Buffer ETF – April (FAPR) and Innovator Defined Wealth Shield (BALT). In addition, First Trust expanded its actively managed fixed income lineup this year with First Trust TCW Emerging Markets Debt ETF (EFIX).

As demand for thematic ETFs has accelerated, Global X deepened its lineup. Global X has had success in 2021 with products, such as Global X U.S. Infrastructure Development ETF (PAVE), which provide cross-sector exposure to long-term trends. This year, the firm launched 16 new ETFs, many tied to distinct long-term themes, such as Global X Wind Energy ETF. In addition, the asset manager expanded its own suite of products that seek to buffer against market selloffs with funds like Global X Nasdaq 100 Tail Risk (QTR).

Meanwhile, BlackRock (BLK), Invesco (IVZ), and Fidelity each launched a double-digit number of new products in 2021 according to CFRA’s ETF data. These large asset managers built out their ESG offerings, such as BlackRock U.S. Carbon Transition Readiness, Fidelity Sustainability U.S. Equity ETF (FSST), and Invesco ESG NASDAQ-100 ETF (QQMG), in response to the growing demand for equities products that offer a more environmentally and/or socially responsible approach.

Figure 2: # of 2021 ETF launches

Conclusion

In a recent video, CFRA’s Head of ETF Data and Analytics and I broke down the record year for U.S. listed ETFs, including a discussion of the drivers of the supply and demand. We are keenly focused on new product launches, as we provide a forward-looking star rating on over 2,100 ETFs based in part on what is inside, including several hundred ETFs that came to market this year. Look for the video on the MarketScope Advisor platform or visit https://www.youtube.com/watch?v=32lp6nRXe78

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.