The U.S. consumer continues to surprise as strong summer spending carries on well into the fall. However, an undercurrent of growing debt threatens to erode that strength, creating potential cause for concern looking ahead. Advisors and investors looking to hedge for uncertainty should consider the NEOS Enhanced Income Cash Alternative ETF (CSHI) for its noteworthy yields.

Consumer spending has proven resilient this year. The personal consumption expenditure (PCE) price index increased 0.4% in September month over month and 3.4% year over year. Travel remains a key contributor, reported the U.S. Bureau of Economic Analysis.

Increasing costs driven by persistent inflation looks to be undercutting spending power for consumers, however. CNBC reported the average balance for credit cards surpassed $6,000, a decade-high and 15% increase over last year. Total credit card debt for U.S. residents now tops $1.08 trillion.

“These are consumers who are struggling to afford their everyday expenses,” Charlie Wise, senior vice president of global research and consulting at TransUnion, told CNBC. “They’re trying to keep the house of cards from collapsing.”

It’s all part of the larger picture of conflicting and complex data points regarding U.S. consumer and economic health. Investor and market uncertainty remain hallmarks of this year, and could carry on into the new year.

Find Opportunity in CSHI as US Consumer Concerns Grow

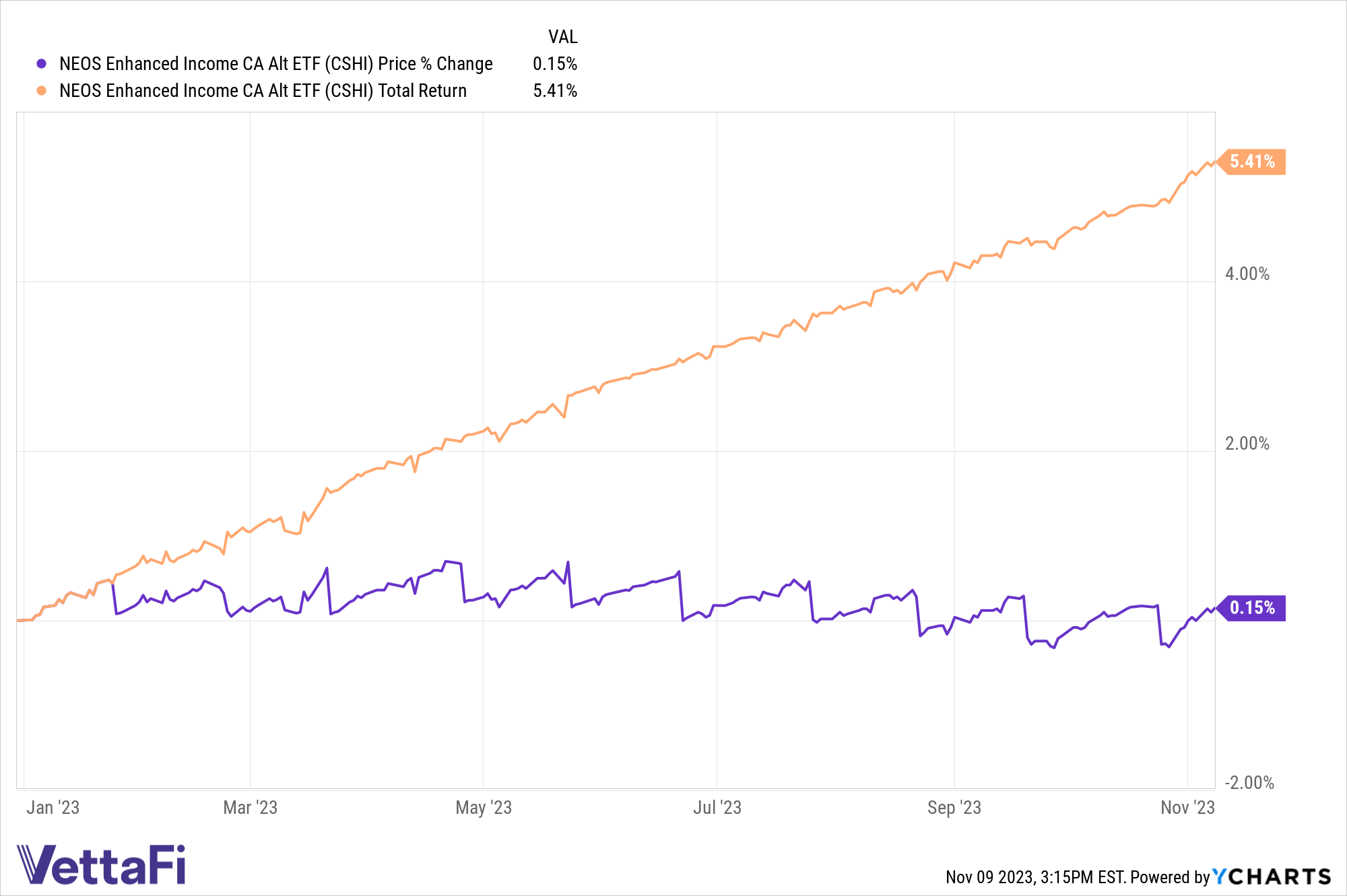

Investors seeking to make the most out of their cash allocations as they wait out uncertain markets should consider the NEOS Enhanced Income Cash Alternative ETF (CSHI). The fund seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding.

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. The fund currently has a distribution yield of 6.15% and a 30-day SEC yield of 5.00% as of 10/31/2023.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at FMV.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis visit the Tax-Efficient Income Channel.