Options income strategies continue to garner inflows this year as investors seek to enhance their core allocations in uncertain markets. The NEOS S&P 500 High Income ETF (SPYI) is a fund that advisors and investors don’t want to miss, given its outperformance in the category.

The near- to midterm outlook for interest rates and inflation looks more hopeful but remains uncertain. Though inflation cooled more than expected in October, Fed minutes revealed the regulatory body remains aggressively positioned.

In a time when each new piece of economic data often results in strong market swings, uncertainty is a significant risk. In such an environment, options-based income strategies have proven enormously popular. Funds like the JPMorgan Equity Premium Income ETF (JEPI) raked in nearly $12 billion in net flows YTD.

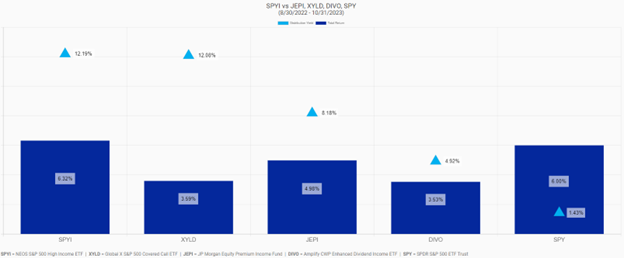

The NEOS S&P 500 High Income ETF (SPYI) is a fund advisors and investors don’t want to sleep on. It continues to offer significant distribution yields and total returns this year. Since launch in August 2022, the ETF outperforms some of its largest peers in the category.

Image source: NEOS

See also: “Flows Pick Up Pace Into SPYI as Investors Look to Next Year“

Don’t Sleep on SPYI for Broad Equity Income

SPYI capitalizes on core equity allocations while also providing a tax-efficient income stream for portfolios.

The fund seeks to provide higher income through call options the fund writes and earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long-term and 40% short-term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.